Klarna is one of the most popular Buy Now, Pay Later (BNPL) platforms in the USA and other parts of the world. The app offers users the flexibility to split payments into manageable installments while shopping online or in-store.

With over 150 million active users and 500,000+ global retail partners, Klarna has redefined modern digital payments and consumer financing.

The trend of the Buy Now Pay Later (BNPL) model is rapidly gaining traction. According to Statista, the global BNPL market is projected to reach $565.8 billion by 2026, growing at a CAGR of 13.23%.

Some reasons for this exponential surge are increasing e-commerce activities, demand for flexible payment options, and more and more millennial and Gen Z consumers preferring alternative credit solutions over traditional loans or credit cards.

For entrepreneurs, the BNPL trend presents a golden opportunity. By developing a BNPL app like Klarna, you will not only tap into a growing fintech niche but also open doors to additional revenue by monetizing the app.

So, if you are planning to enter the BNPL space, this blog is a must-read. In this blog, we have provided you with a step-by-step process to develop a BNPL app like Klarna, key features, technology stack, monetization strategies, and more. So, without further ado, let’s start.

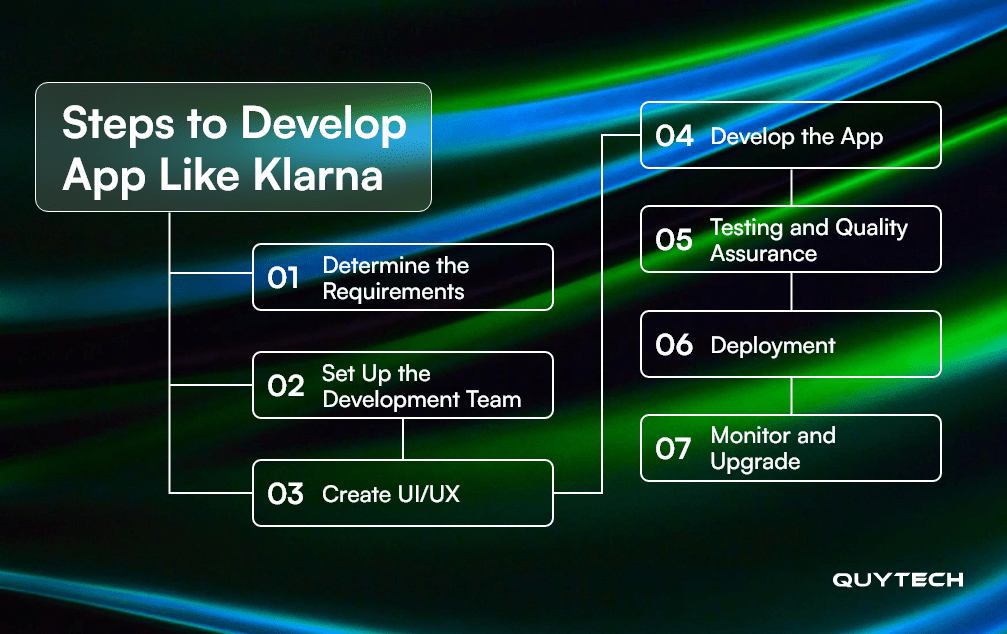

Step-by-Step Process to Develop a Buy Now Pay Later App like Klarna

The following is the comprehensive process to build a custom Buy Now Pay Later (BNPL) app similar to Klarna.

- Determine the Requirements

Begin your Klarna clone BNPL app development by identifying your target audience, business goals, and core features to integrate into your mobile app.

Also, research the market to understand what users are expecting from Buy Now Pay Later apps.

Study the competitors like Klarna, AfterPay, Affirm, Zip, and others to analyze their strengths and weak points. Based on your analysis, set your unique value proposition.

- Set Up the Development Team

Developing a BNPL app like Klarna requires a deep understanding of laws and regulations, the finance industry, mobile app development, emerging technologies, SDKs, and more.

Hence, it is recommended that you hire mobile app developers who are experienced in developing Buy Now Pay Later apps.

Moreover, instead of hiring app developers in-house, you can outsource your project to a leading mobile app development company that has a proven portfolio of fintech and BNPL apps. Work with legal experts also to understand industry regulations and compliance requirements.

- Create UI/UX

After setting up your development team, start designing the UI/UX for your BNPL app like Klarna. Engage your designers to create interfaces that are not only visually appealing but also functional and intuitive.

While designing UI/UX, focus on frictionless onboarding, clear navigation, transparency in credit terms, and trust-building elements.

You can use wireframes and prototypes to validate the user flow and incorporate feedback from test users to optimize usability and engagement.

- Develop the App

At this stage, begin the coding of both frontend and backend modules using the selected tech stack and programming languages.

Also, you must integrate APIs and third-party tools to enable various functionalities, such as payment gateways, real-time credit scoring, KYC/AML systems, user dashboards, and merchant portals.

Moreover, integrate cutting-edge technologies such as artificial intelligence for fraud detection, credit risk analysis, and personalization, and blockchain to enhance the apps’ transparency and security.

- Testing and Quality Assurance

Post-development, conduct rigorous testing to ensure that your BNPL app, like Klarna, functions seamlessly under all conditions. In testing, you will check your app’s functionalities, performance, usability, security, and compliance.

Moreover, run manual and automated testing across devices and OS versions to ensure that it is completely bug-free and ready to launch.

- Deployment

Once the app passes QA, deploy it to production environments. You need to configure cloud infrastructure, databases, and CI/CD pipelines for scalability and performance.

Submit your Klarna-like Buy Now Pay Later app to the Google Play Store and App Store, following their respective guidelines.

Moreover, ensure that all regulatory and data protection measures are implemented before the app becomes publicly accessible.

- Monitor and Upgrade

After the launch, monitor your app’s performance and user activities using different key performance indicators and analytics tools.

Also, gather user feedback and based on it, upgrade your Buy Now Pay Later App like Klarna.

Continuously identify and fix vulnerabilities, improve its features, and release new versions to enhance functionality, adapt to regulatory changes, and maintain competitiveness in the evolving Buy Now Pay Later landscape.

Industry Standards and Compliance You Should Adhere to Develop BNPL Apps

It is crucial that a Buy Now Pay Later (BNPL) app complies with the financial regulations and industry standards. You must ensure this to avoid legal pitfalls and win users’ trust. So, here are the critical areas on which you must focus while developing your Klarna clone AI-powered BNPL app.

- KYC (Know Your Customer) & AML (Anti-Money Laundering)

While developing a BNPL app like Klarna, you must implement KYC (know your customer) and AML (anti-money laundering) procedures to verify user identities, prevent financial fraud, and ensure that your platform cannot be used for illicit activities.

- PCI-DSS Compliance

If your Buy Now Pay Later app processes card payments, then it must follow PCI-DSS standards to securely store, process, and transmit cardholder data. In these standards, you must add encryption, tokenization, and regular security audits to avoid breaches and penalties.

- Data Privacy Laws

When building your AI BNPL app like Klarna, you must comply with data privacy regulations like GDPR (Europe) or CCPA (California). You should take consent from users before collecting their data, enable data access requests, and protect users’ data by implementing encryption, anonymization, and secure storage protocols.

- Fair Lending Regulations

As you are developing a BNPL app with AI capabilities for making credit decisions, you must comply with fair lending laws such as the ECOA, ensuring that loan approvals or denials are unbiased, explainable, and do not discriminate based on gender, race, or other protected attributes.

- Financial Licensing Requirements

Depending on your region, you may need a lending or financial services license to operate legally. So, it is recommended that you work with legal experts to meet all jurisdiction-specific licensing and financial compliance requirements.

- Audit Trails & Reporting

To ensure regulatory transparency, you need to maintain detailed logs of transactions, user activities, and automated decisions. This will enable auditors to conduct smooth audits, support internal governance, and ensure that your BNPL app, like Klarna, meets the reporting standards required by authorities.

Also Read: How to Develop an App Like MoneyLion

Top Features to Integrate into BNLP App like Klarna

The following are the top features that you must add to your Buy Now Pay Later mobile app, like Klarna.

- User Registration & Onboarding

This is a basic feature for the Klarna alternative BNPL app that enables quick sign-up with email, phone number, or social login, followed by KYC verification. A smooth onboarding experience builds user trust and ensures regulatory compliance from the start.

- AI-Powered Credit Assessment

A BNPL-centric app feature that uses machine learning algorithms to evaluate users’ creditworthiness in real time. By integrating this feature, your app can provide instant approvals without affecting credit scores and ensure responsible lending based on user behavior and data.

- Multiple Payment Options

Different and flexible payment plans like pay in 30 days, 4 equal installments, or custom schedules so that users can pay the installment as per their convenience. Also, this feature allows users to link credit/debit cards, digital wallets, direct bank accounts, and crypto wallets for ease of use.

- Merchant Integration Panel

This feature allows businesses to easily integrate their BNPL solution via APIs or plugins and provide them with dashboards to track transactions, manage customers, and offer promotions through the platform.

- Personalized Dashboards

Smart dashboard that allows users to view purchases, payment schedules, credit limits, and spending insights. This BNPL app feature enhances transparency and promotes responsible financial behavior.

- Push Notifications & Reminders

With this feature, you can automate timely alerts for upcoming payments, due dates, promotional offers, or failed transactions. This helps reduce missed payments and increases user engagement.

- AI-Powered Fraud Detection & Risk Management

AI-driven fraud detection and risk management features to monitor activities, detect, and block suspicious activities in real-time. With this feature integration into your BNPL app, you can mitigate fraud and risk and ensure users’ trust.

- In-App Customer Support

A generative AI-powered chatbot integrated into the BNPL app that can offer live chat, address FAQs, and provide real-time assistance for users’ issues. This feature helps in improving trust and ensures user satisfaction during financial transactions.

- Rewards & Cashback System

This feature of BNPL apps like the Klarna app encourages user retention and repeat purchases by offering loyalty points, cashback, or referral bonuses.

- Compliance and Data Security

Various security protocols, such as end-to-end encryption, secure APIs, and two-factor authentication, that are compliant with PCI-DSS, GDPR, and other regional financial regulations, to protect user data and financial activities.

You Might be Interested In: Steps to Develop a Personal Finance Coach App Like Cleo AI

Technology Stack for Building a BNPL App Similar to Klarna

The following is the technology stack that you can use to develop a Klarna clone mobile application.

| Component | Tools and Technologies |

| Frontend Development | Flutter / React Native / Swift (iOS) / Kotlin (Android) |

| Backend Development | Node.js / Django / Spring Boot / Ruby on Rails |

| Database | PostgreSQL / MySQL / MongoDB |

| Authentication | OAuth 2.0 / Firebase Auth / Auth0 |

| Payment Gateway | Stripe / Adyen / PayPal / Braintree |

| Credit Scoring | Experian / Equifax API / Custom ML Model |

| Loan Management | Custom-built engine / Fintech SDKs (e.g., Mambu, Synapse) |

| Push Notifications | Firebase Cloud Messaging (FCM) / OneSignal |

| Cloud Hosting | AWS (EC2, S3, RDS) / Google Cloud / Azure |

| CI/CD | GitHub Actions / GitLab CI / Jenkins |

| Monitoring & Logs | Datadog / Sentry / New Relic / ELK Stack |

| Security & Compliance | SSL/TLS, PCI-DSS, SOC2, GDPR compliance |

| Fraud Detection | Sift / Riskified / Custom ML-based fraud engine |

| Analytics | Mixpanel / Firebase Analytics / Amplitude |

| KYC/AML Verification | Jumio / Onfido / Trulioo |

| APIs for Integrations | REST / GraphQL / Webhooks |

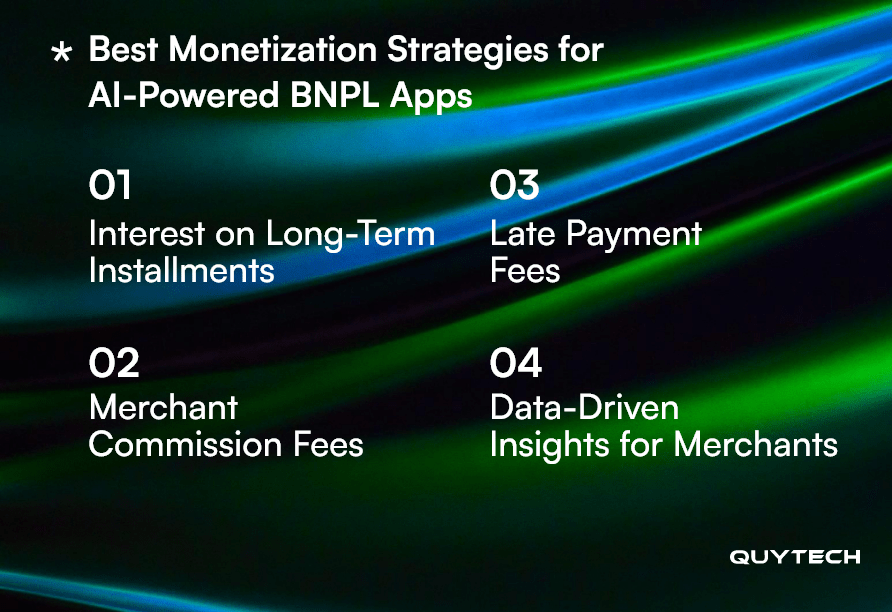

Best Monetization Strategies for AI-Powered BNPL Apps

Here are some proven monetization strategies for an AI BNPL app like Klarna to ensure long-term profitability.

- Interest on Long-Term Installments

The first monetization strategy for Buy Now Pay Later apps is charging interest on the long-term EMIs. You can offer your users flexible repayment plans with different repayment tenures and apply competitive interest rates on them.

- Merchant Commission Fees

You can also charge partner merchants a commission fee to generate revenue from your BNPL app, like Klarna. You can charge a small percentage, like between 1-3%, or other, of each transaction that is processed through your app.

- Late Payment Fees

To generate income from the Buy Now Pay Later app, you can also choose to impose nominal late fees on overdue payments from users or customers. Because of late payment fees, it will also encourage users to make timely repayments.

- Data-Driven Insights for Merchants

Lastly, you can generate revenue by providing anonymized consumer behavior analytics and sales insights to the merchants. These insights can be useful for merchants to refine their product strategies and increase their ROI.

Also Read: Top Monetization Strategies for iOS Apps

Challenges of Developing AI-Powered Buy Now Pay Later Apps

When developing a custom BNPL app, you’re likely to encounter a few technical and strategic challenges. To help you navigate them effectively, we’ve outlined the key obstacles along with practical solutions to overcome each one.

- Regulatory Compliance and Data Privacy

When developing a BNPL app like Klarna, you must ensure that it complies with financial regulations like PCI-DSS, GDPR, and KYC/AML laws.

So, partner with legal experts during the development process. Also, you can use secure cloud services that come with built-in compliance systems.

- Scalability & Performance

Your BNPL app, similar to Klarna, must be able to handle a growing user base, data volume, and transaction load without downtime.

Hence, during development, you can use microservices architecture and cloud-native technologies to ensure a scalable performance.

Moreover, you must also employ load balancing, caching, and auto-scaling to ensure your app’s uptime and responsiveness.

- Seamless AI Integration

While developing a Klarna clone Buy Now Pay Later mobile app, you must ensure to integrate AI models into the app without affecting performance.

You can use APIs or dedicated AI services for the AI model deployment into your mobile app.

Also, you must offload heavy processing to the backend to keep the mobile app lightweight.

- Real-Time Credit Risk Assessment

In a BNPL app, you must accurately assess your users’ creditworthiness in real time by analyzing their past credit history.

To do this, you must integrate custom AI/ML models that can analyze alternative data, for example, purchase history, device data, and behavior patterns, to generate real-time credit scores with minimal friction.

- User Trust and Transparency

Users may be hesitant to use your AI-powered BNPL like Klarna, as they may have transparency and trust issues.

So, it becomes crucial that you clearly communicate your terms and conditions, disclose affiliations with financial institutions, ensure regulatory compliance, and implement robust security and privacy measures to win the trust of users for your BNPL mobile app.

You Might Be Interested In: How to Develop an App Like MoneyLion

Conclusion

These days, the demand for Buy Now Pay Later apps like Klarna is at an all-time high. These apps allow users to pay for what they shop for, later in time, in installments, based on the EMI plan they have chosen.

To develop an AI-powered Buy Now Pay Later app like Klarna, you can follow the step-by-step guide given in this blog.

We have also mentioned the top features that you must add to your app, monetization strategies so that you can generate revenue, and most importantly, crucial industry standards and compliance requirements to avoid any kind of legal issues and win users’ trust.

If you ain’t able to develop the app yourself and seek professional help, then reach out to Quytech, the best fintech mobile app development company that has developed numerous Buy Now Pay Later apps and other fintech solutions for clients all over the world.

Frequently Asked Questions

Buy Now Pay Later, also known as BNPL, is a type of shopping app that allows users to shop and make purchases instantly, and pay over time in interest-free or low-interest installments. It could be Pay in 4, Pay in 30 Days, or longer-term EMI plans.

E-commerce stores, fintech startups, retail chains, digital marketplaces, and others can develop Buy Now Pay Later apps similar to Klarna to give flexible payment options to their customers.

Yes, you can use APIs or plugins to integrate Buy Now Pay Later (BNPL) into your e-commerce store.

A basic BNPL app may cost $25,000–$60,000+ and take approximately 4–6 months to develop. On the other hand, an advanced and feature-rich AI-powered BNPL app can take 9–12 months or more, with costs scaling accordingly.

Artificial intelligence (AI) in BNPL apps alternative to Klarna, is used for enhanced credit risk assessment, automates fraud detection, offers personalization to users, and improves user experience with intelligent customer support and purchase predictions.

The license requirement depends on your location or region. In some countries, it is compulsory, and in others, it is optional. However, keep in mind to comply with your BNPL app with lending, KYC, AML, and data protection regulations.

Yes, being the top mobile app development company, Quytech is an expert in developing secure, scalable, and custom BNPL apps for startups, integrating AI, payment gateways, KYC, loan management features, and more.

Contact our team of experts at Quytech and share your requirements. Then, we will plan, design, and develop your BNPL app like Klarna after analyzing your goals and requirements.