Are you in the insurance business that is looking to stay ahead of the curve and meet the evolving needs of your customers? Wondering how you can leverage the power of mobile technology to enhance your services? Look no further than insurance mobile app development.

In today’s digital age, where smartphones have become an integral part of our lives, mobile applications have revolutionized various industries, and insurance is no exception. Insurance mobile apps offer convenience, accessibility, and personalized experiences for policyholders and act as a crucial tool for insurance companies to thrive in a competitive market.

This blog serves as a comprehensive guide for businesses in the insurance industry, navigating the world of insurance mobile app development. We will also explore the benefits and features that these apps bring, along with a detailed step-by-step guide involved in creating a successful insurance mobile app.

Join us as we embark on this journey, empowering your business to leverage mobile app development and meet the demands of the modern insurance landscape.

Market Stats of Insurance Apps

Let’s first go through some of the market research on insurance apps.

- As per the reports, the global market size of the insurance sector has reached US $1.164 trillion by 2023.

- According to Grand View Research, the global market of Insurance Apps is expected to grow at a CAGR of 52.7% from 2023 to 2030.

- It is stated that 83% of users believe that the insurance industry and customer expectations will be reshaped by the technology.

As these figures predict the increasing demand for insurance apps in coming years, it is time you should plan to develop a dynamic and robust insurance app for your business.

Why Your Insurance Business Needs a Mobile App

While planning for an insurance mobile app, various questions come to mind for business owners. One such question is ‘Why does your insurance business need a mobile app?’.

Let’s go through some of those reasons:

- Digital Presence

As we all know, people today want to manage everything in their day-to-day lives digitally. Providing a platform where they can easily enroll for insurance, claim their insurance, and check the updates of their policies will definitely help increase your business productivity.

- Customer Engagement

Developing an app can increase customer engagement in various ways. An insurance app sends push notification that gives regular updates of policies to their customer, renewals updates, new product info, and claim status to the user. With an app, people can view your different products at their fingertips and invest in them anytime and anywhere.

- Streamlined Processes

Insurance processes are generally complex and time-consuming. Brokers and insurers take a lot of time to process user’s insurance requests. With an app, users can apply for any insurance policy in just a few minutes, and check their status when required.

- Competitive Edge

By creating a mobile app, you can lead the market with a distinct edge. It keeps your users updated with the latest products, access to policy information and claims processing, fostering loyalty and staying competitive in a digital-driven market. It also streamlines administrative processes, reducing operational costs and improving overall efficiency for the insurance business.

- Data Collection & Analysis

An insurance app is a valuable resource for insurance businesses to gather user data and process them according to their requirements. Business can examine their data to create futuristic strategies and provide more accurate services according to their requirements.

- Cost Efficiency

By digitizing operations and automating manual tasks, an insurance mobile app minimizes reliance on physical offices and paperwork, yielding substantial cost savings and operational efficiency enhancements for your business.

There are some of the reasons why your insurance business needs a mobile app. Let’s move on to the insurance app development process in the next section.

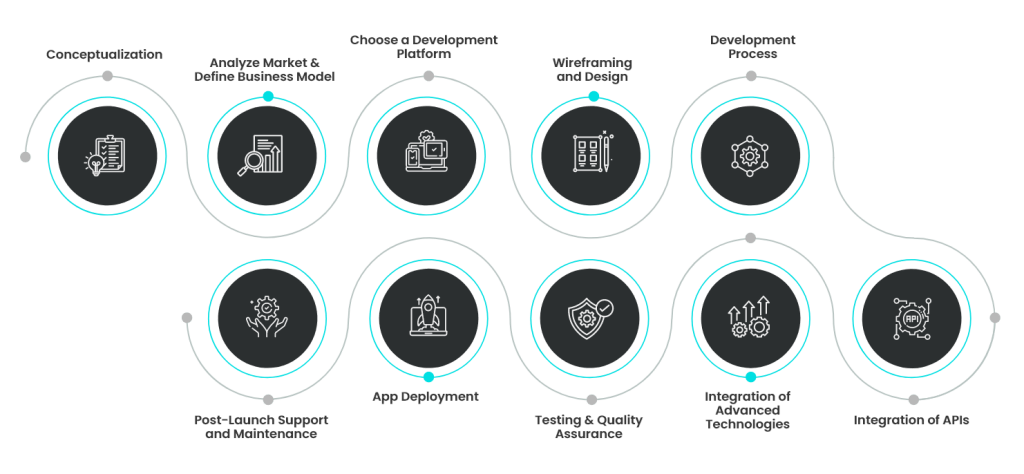

Step-by-Step Insurance App Development Process

Developing an insurance app is a daunting task, but with the right approach, you can develop an app in a few simple steps. Here, we have broken down the entire insurance app development process into simple steps to assist you in developing a sophisticated insurance app.

1. Conceptualization

To develop a dynamic insurance app, start by brainstorming and planning. During this phase, delve into strategies for developing the app, outlining its goals, purpose, and objectives. Identify your potential target audience and understand your current users to ensure the app caters to a wide range of users. Conduct surveys to learn about their preferences and expectations for a digital insurance platform.

Additionally, carefully design the features and functionalities your app should include. It is crucial for an insurance app to seamlessly handle the tasks typically carried out by brokers or insurers. This ensures users can access all the relevant information they need in one place, tailored to the type of insurance they desire.

2. Analyze the Market and Define the Business Model

After conceptualizing your business objective and goals, the next step is to analyze the market and competitors and define the business model according to your requirements.

You can go through the competitor’s app to check the best points of their app that you can consider and the ones that are not liked by the user.

According to the market research you have conducted, you can design the business model of your app in the following ways:

- Insurance App for Agents

Insurance agents use the app to represent their insurance products to their customers and increase their sales at a faster speed.

- Insurance App for Customers

This app is used by customers to check their policies, claim insurance, update policies, and others. Developing an intriguing and easy-to-navigate insurance app for customers can help them purchase insurance products efficiently and increase your business ROI.

- P2P Insurance App

Peer-to-peer (P2P) app for insurance is a type of insurance arrangement where a group of individuals with similar needs and interests pool their resources to insure each other. Instead of relying on a traditional insurance company, members of the group contribute money to a common fund that is used to cover potential risks and claims within the group.

3. Choose a Development Platform

After analyzing the market and defining the business model, now is the time to choose the development platform for your insurance app. Choose the app platform wisely based on the number of users you want to target.

To develop a platform-oriented or native app, i.e., analyze the number of users of various platforms, such as Android, iOS, and more. The success of your insurance app also depends on the number of users using that particular platform.

To reach wider target audience, you can develop a hybrid or cross-platform app. These apps can be easily used on various platforms whether Android, iOS, or more.

4. Wireframing and Design

Wireframing and designing the UI/UX of an insurance app involves a meticulous process to create a seamless and intuitive user experience. Beginning with thorough research and defining objectives, the design process moves on to mapping user flows.

The wireframing stage focuses on creating low-fidelity representations of the app’s structure and layout, emphasizing key screens for tasks such as policy management and claims submission. The UI/UX design phase then transforms these wireframes into visually appealing interfaces, considering factors like user engagement, accessibility, and efficient information presentation.

Striking a balance between aesthetics and functionality is crucial in crafting an insurance app that not only meets the users’ needs but also provides a user-friendly and trustworthy experience.

5. Developing the MVP of the Insurance App

The Minimum Viable Product (MVP) development of an insurance app involves prioritizing essential features to deliver a functional version quickly while gathering valuable user feedback.

Initially, the focus is on core functionalities such as user registration, policy creation, and basic claims submission. The MVP aims to provide users with a simplified yet functional experience, allowing for the testing of fundamental processes and identifying potential improvements.

This iterative approach enables developers to validate the app’s viability in the market, understand user preferences, and make informed decisions for subsequent feature enhancements.

The MVP development strategy in the insurance app context accelerates the time-to-market, minimizes development costs, and ensures that the app meets the basic needs of users before incorporating more advanced features based on feedback and evolving requirements.

6. Integration of APIs

After developing the final product of your app, now is the time to integrate various APIs into your insurance app. These are various APIs that you can integrate into your insurance apps:

- Payment Gateways

APIs like Stripe, or PayPal facilitate secure online payments for policy premiums.

- Geolocation

Services like Google Maps API can be used for location-based services, helping users in providing accurate addresses and for risk assessment.

- Identity Verification

APIs like Jumio or Trulioo can be integrated to verify user identities, reducing the risk of fraud during onboarding.

- Insurance Comparison

APIs from insurance aggregators like QuoteWizard or Insurify can be integrated to provide users with policy comparisons and help them choose the best-suited coverage.

- Communication

Integrating communication APIs like Twilio for SMS or SendGrid for email can enhance communication between the insurance company and users, providing updates, alerts, and notifications.

- CRM

Integrating Customer Relationship Management (CRM) APIs like Salesforce or HubSpot can help in managing and analyzing customer interactions, improving customer service.

- Document Management

APIs such as DocuSign or Adobe Sign can be integrated for secure and efficient digital document signing and management.

- Claim Processing

Solutions like Snapsheet or ClaimVantage offer APIs that streamline and automate the claims processing workflow.

- Data Analytics

Integrating APIs like Google Analytics or Mixpanel can gather insights on user behavior within the app, aiding in data-driven decision-making.

These are some of the APIs that you must integrate into your insurance app to ensure the smooth working of the various processes.

7. Integration of Advanced Technologies

After integrating different APIs into your insurance app, now you can move on to integrating your app, its features, and functionalities with various advanced technologies. The technologies that you can integrate into your insurance app are as follows:

- Artificial Intelligence

Integrate artificial intelligence to seamlessly operate various processes and other functionalities of your app.

- Blockchain

For enhanced security and transparency, blockchain APIs like Chainlink can be integrated for smart contracts or secure data storage.

- Predictive Analytics

Utilizes historical data to foresee potential risks, enabling the insurance app to anticipate and mitigate future claims, enhancing risk assessment accuracy.

- Machine Learning

Employs algorithms to analyze vast datasets, enabling the insurance app to dynamically adapt and improve decision-making processes, enhancing underwriting and fraud detection.

- Natural Language Processing

Natural language processing enables the insurance app to understand and respond to user queries and policy documents, enhancing customer interactions and automating claims processing through language comprehension.

- Generative AI

Generative AI enhances customer experience by creating personalized policy recommendations and automating content generation, streamlining communication, and making policy creation more efficient.

- Cloud Storage

Facilitates seamless access, storage, and retrieval of vast amounts of insurance data, enabling the app to scale efficiently and ensuring secure and reliable data management for analytics and real-time decision-making.

These are some of the advanced technologies that can help you make your app more robust and secure.

8. Testing and Quality Assurance

The testing and quality assurance process of an insurance app is a comprehensive and iterative approach to ensure the app’s functionality, security, and user experience meet high standards.

The process involves multiple stages, including unit testing, integration testing, and system testing, to identify and rectify any software defects or inconsistencies. Security testing is crucial to safeguard sensitive user data, and performance testing ensures the app operates smoothly under various conditions.

User acceptance testing (UAT) involves real users simulating scenarios to validate that the app meets their needs and expectations. Continuous testing throughout the development lifecycle is key, and automated testing tools may be employed to enhance efficiency. Rigorous quality assurance measures not only ensure a bug-free and stable application but also contribute to user trust and satisfaction in the context of handling sensitive insurance-related information.

9. App Deployment

The deployment process of an insurance app involves various thorough testing processes of the app to deploy it on a live or productive platform.

You need to check the various permissions that you must have to deploy your app on any app store, for example, Google App Store, Apple Play Store, or more.

Deployment tools are then used to automate the release process, ensuring a smooth and consistent transition. Database migrations and configurations are managed to maintain data integrity, and necessary server infrastructure is set up or updated.

Once the app is deployed, monitoring tools are often utilized to track performance, identify potential issues, and ensure the overall health of the system.

10. Post-Launch Support and Maintenance

Deploying an app on the App Store is just the beginning. Once your app is live on the App Store or Play Store, you need to take care of several things, such as its updates, maintenance, resolving bugs from time to time, and even more.

Another essential aspect of app maintenance is tracking its performance, gathering user feedback, and working on it. User feedback can help you keep track of app performance and their likes and dislikes about the app. Based on the majority of reviews, you can make changes to particular features and functionalities.

These are the aligned steps for developing an insurance app for your business. You can go through each step as mentioned and develop an engaging and compelling insurance mobile app.

Types of Insurance Apps

Before developing an insurance app, you should be aware of the different types of insurance apps and which type of insurance app you want to develop. Let’s go through different types of insurance apps that you can consider.

1. Life Insurance App

A life insurance app is one of the most crucial types of insurance that most people look for. This type of app offers various kinds of life insurance to users, such as term life insurance, group life insurance, permanent life insurance, mortgage life insurance, universal life insurance, variable life insurance, and more.

With the help of such apps, users can get a faster estimation of life insurance coverage, receive updates on policies, fill in and track claims.

2. Health Insurance App

A health insurance app is another type of insurance app that you can develop to attract a wider target audience to your app. According to a report by Business of Apps, the revenue of the healthcare sector is anticipated to grow to US $35.7 billion by 2030, which is why it is a good time to invest in health insurance apps.

The health insurance app contains medicare, HMO, EPO, health insurance, health savings insurance, short-term coverage, government health platform, and more.

Using a health insurance app, users can analyze all the details of health insurance in one place, and determine various aspects of it.

3. Vehicle Insurance App

A vehicle insurance app is one of helps users explore various vehicle insurance plans. A vehicle insurance app helps people purchase insurance for any vehicle. Users can click the images of their vehicle and upload them on the portal. With the help of AI, the insurance app analyzes its condition and determines the exact insurance cost of that vehicle.

A vehicle insurance app includes classic car insurance, comprehensive insurance, roadside assistance, bodily injury, full coverage, liability insurance, guaranteed auto protection, and more.

4. Business or Corporate Insurance App

Business insurance app allows businesses of small, medium, and large scales to take insurance for their companies. This type of insurance protects businesses from a variety of potential risks and uncertainties.

Business insurance is typically intended to safeguard your company’s finances, as well as protect employees, property and liability insurance, and more.

A business insurance app also allows you to go through general liability insurance, commercial property insurance, business income insurance, and more.

5. Travel Insurance App

Travel insurance is another type of insurance offered by various insurance apps. A travel insurance app also includes trip cancellation, travel medical emergencies, accidental death and dismemberment, baggage loss, cancel for any reason, and more.

Users can experience seamless travel insurance with pay-per-day policies through dedicated mobile apps, effortlessly securing coverage when journeying across borders. If you’re considering venturing into insurance mobile app development, this type offers a compelling choice.

6. Property Insurance App

Property insurance plays a crucial role in real estate insurance. This type of investment app helps people to easily apply for insurance as well as investments for their properties. With this, you can insure your home, commercial property, or other valuable assets. A range of risks can be financially protected by property insurance.

Property insurance involves homeowners insurance, flood insurance, personal property, liability coverage, living expenses, and more.

These are some types of insurance apps that you can choose from to build your insurance app.

Must-Have Features of a Successful Insurance App

Insurance apps are packed with various dynamic features. Let’s check some of those features in brief.

Basic Features of an Insurance Mobile App

| Policy Access | Users can view and manage their insurance policies, including coverage details and renewal dates. |

| Claim Submission | Enables users to submit insurance claims digitally, streamlining the claims process and reducing paperwork. |

| Document Upload & Storage | Allows users to upload and store important documents related to their insurance policies within the app. |

| Profile Management | It lets users update personal information, contact details, and beneficiaries associated with their insurance policies. |

| Policy Information | Provides comprehensive information about the terms and conditions, coverage details, and exclusions of the insurance policies. |

| Virtual Insurance Cards | Provides digital versions of insurance cards for quick and convenient access. |

Advanced Features of an Insurance Mobile App

| Premium Payments | Facilitates online payments for insurance premiums, providing a convenient and secure transaction platform with blockchain technology. |

| Notifications and Alerts | Sends AI-enabled push notifications or alerts to users for policy updates, payment reminders, or important information. |

| Renewal Reminders | Sends automated timely reminders to users about upcoming policy renewals to ensure continuous coverage. |

| Secure Authentication | Implements secure login methods, such as passwords or biometrics, to protect user data and ensure privacy. |

| IoT Home Sensors | Connect with IoT sensors to detect and prevent potential home insurance risks, such as water leaks or fire incidents. |

| Mobile Biometrics | Incorporates biometric authentication for secure access to sensitive information within the app. |

| Data Analytics | Utilizes predictive analytics to predict and prevent potential risks, optimizing underwriting processes. |

| Chatbot Functionality | Integrates AI-enabled chatbots for instant customer assistance and query resolution. |

| Enhance Data Security | Implements blockchain technology to enhance data security and streamline verification processes. |

| Property Assessments | Utilizes Augmented Reality for virtual property assessments in home insurance claims. |

| Customer Support | Includes an AI-enabled customer support feature for users to contact the insurance company, ask questions, and seek assistance 24/7 hours. |

These are some of the basic and advanced features of an insurance mobile app that you can consider using in your app.

Challenges in the Insurance Industry and How Technology Can Resolve Them

There are various challenges in the insurance industry for both businesses and users. With the help of technology, businesses can resolve these challenges and improve their productivity. Let’s have a quick sneak peek at them.

1. Insurance Fraud / Lack of Transparency

Challenge: Insurance Fraud can seen commonly when you go offline to buy insurance policies. Brokers often sell the wrong insurance policies to users, don’t share complete policy details or something about hidden charges.

Solution: With the help of an insurance app, everything is transparent. Users can buy the products they are searching for. Also, they can check complete policy details and choose any policy that suits their requirements. Integrating AI in insurance apps, empowers users to compare various insurance policies and enroll with the best one.

2. Data Breach Threat

Challenge: Insurance apps are full of data from various users. Cyber attackers or hackers are in search of just a loophole to steal the confidential data of these insurance apps.

Solution: By enabling blockchains into your insurance, you can keep your insurance app secure and robust. This can protect insurance businesses from huge losses and results in enhanced security of data.

3. Lower Revenue Generation

Challenge: For an insurance policy, brokers have to reach out to clients at various times to sell an insurance policy, which is a time-consuming process.

Solution: With an insurance app, insurance brokers can integrate the process by generating video meetings, streamlining the process, and verifying the document, which will result in increased revenue generation.

4. Inoperable System

Challenge: Various times when users buy an insurance policy or insurance claim online, they have to wait in queues, face the server or inoperable system issues, and others.

Solution: Developing an insurance mobile app with the cloud server, can resolve such issues. With such an app, you can buy policies online without waiting in long queues and even facing server issues.

Popular Insurance Apps

Now, let’s study some of the popular insurance apps that are serving the market with their effective app solutions.

1. The General Auto Insurance

The General Auto Insurance app provides users with a seamless experience for managing their auto insurance policies. Users can easily access their policy details, make payments, and even file claims directly through the app. The interface is user-friendly, offering quick navigation and real-time updates on policy information. The app also features tools for obtaining insurance quotes, making it convenient for users to explore coverage options.

Total Downloads: 1.5 million

Rating: 4.75 based on 30 thousand reviews

Also check: How to Develop a Payment App Like PayPal

2. State Farm

State Farm’s app stands out for its comprehensive features, allowing users to handle various property insurance needs in one place. Policyholders can view and manage policies, file claims, and connect with agents effortlessly. The app’s integration of banking services, like managing accounts and credit cards, adds extra convenience.

Total Downloads: 12 million

Rating: 4.66 based on 200 thousand reviews

3. New York Life

New York Life’s app focuses on providing policyholders with easy access to their life insurance information. Users can review policy details, pay premiums, and access beneficiary information. The app also offers financial calculators and tools for planning, helping users make informed decisions about their coverage.

Total Downloads: NA

Rating: 3.7

4. United Health Group

United Health Group’s app is tailored for health insurance management. Users can check coverage details, review claims, and locate healthcare providers within the network. The app includes health and wellness features, such as tracking fitness activities and accessing personalized health tips. This holistic approach makes it a valuable tool for those with United Health Group insurance.

Total Downloads: 400k

Rating: 4.66 based on 200 thousand reviews

5. Travelers

Travelers Insurance app streamlines business and property insurance management. Users can easily access policy information, report claims, and receive real-time updates. The app’s unique feature is the Risk Tool, providing personalized insights to help users understand and mitigate risks at home. This proactive approach sets the Travelers app apart, making it a valuable resource for policyholders.

Total Downloads: 400k

Rating: 4.7 based on 26000 reviews

6. Allianz Travel Insurance

Allianz Travel Insurance’s app is designed for those who love to travel. It allows users to purchase travel insurance, access policy details, and file claims seamlessly. The app also provides travel assistance services, including emergency contacts and medical assistance information. With features like trip tracking and real-time flight updates, Allianz’s app ensures travelers have peace of mind throughout their journeys.

Total Downloads: 100k+

Rating: 3.5

Conclusion

The landscape of insurance is undergoing a digital revolution, and the strategic implementation of mobile apps is at its forefront. Insurance businesses that are into insurance mobile app development have the opportunity to revolutionize customer experiences, streamline operations, and stay ahead in a competitive market.

As the demand for user-friendly and feature-rich insurance apps continues to grow, your business also requires an app that can connect you with a wider target audience and enhance customer experience.

To develop an engaging and intriguing insurance app, you can connect with the top insurance app development company. Quytech is the leading name in the field of the fintech app development company that has developed various apps for the insurance industry. Our developers have over 25 years of experience developing insurance apps with cutting-edge technologies, such as AI, AR, Blockchain, IoT, predictive analysis, and more.

Visit our portfolio for detailed insight into our work.