In 2024, thousands of people in the UK and Canada were tricked into investing in a fake cryptocurrency scheme called AdmiralsFX. Fraudsters used deepfake videos of celebrities to promote the scam and make it look legitimate. Unfortunately, over £27 million (around $35 million) was stolen from people who thought they were making a safe investment.

This fraud made it clear that traditional rule-based fraud detection system no longer works. Businesses, mainly with high transaction volumes, need to implement AI fraud detection in digital transactions to prevent and detect fraud. AI-powered fraud detection can help businesses secure transactions to prevent financial losses, reputational damage, and shaken customer trust.

But what AI in fraud detection is, how does AI detect fraud in digital payments, what type of fraud it detects, why it is critical, what the benefits of implementing it are, and applications of AI transaction fraud detection across industries- this blog thoroughly explains everything.

Read on to know more!

Highlights

- Conventional fraud detection methods are rule-based; AI for payment fraud prevention

- utilizes machine learning, deep learning, and anomaly detection to continuously learn and adapt to new fraud patterns.

- Benefits of AI fraud detection for banks and fintechs, and other similar firms dealing with high volumes of transactions are real-time monitoring of transactions to identify and prevent fraud attempts.

- Industries such as banking, e-commerce, retail, fintech, and insurance are the major ones to benefit from AI-driven fraud prevention. They can build customer trust and brand reputation while avoiding or reducing financial losses.

- Implementing AI for fraud detection is a stepwise process that begins with assessing fraud risks and ends with ensuring the technology is integrated in a way that complies with regulators.

- Increasing adoption of Generative AI, LLMs, and Blockchain in fraud detection systems could be the future trends in fraud detection and prevention in digital transactions.

What is AI Fraud Detection in Digital Transactions

AI for payment fraud prevention and detection simply means using AI, ML, and advanced analytics to identify and prevent fraud in digital transactions. Conventional fraud detection methods are rule-based and follow a set of defined patterns, but the implementation of AI in fraud detection automatically and continuously learns from historical data, real-time data, and transaction behaviors to immediately identify even highly difficult-to-spot fraud attempts.

The major benefits of AI fraud detection for banks and fintechs are that these organizations can keep an eagle eye on irregularities in digital payments by processing the payment or transaction data in real-time. They can do this level of monitoring without any manual intervention.

Artificial intelligence uses techniques like pattern recognition, anomaly detection, and risk scoring to find what’s different or unusual from the normal behavior or pattern. We all remember that whenever we log in to our online banking accounts from a different device, it immediately sends an alert or requires additional verification. This is done to prevent any fraud.

Similarly, the AI-powered fraud detection system raises an alarm in case of sudden high-value transactions or more than usual attempts to make a digital payment. AI fraud detection enables banking, retail, e-commerce, fintech, and insurance organizations to integrate new and highly advanced fraud techniques, minimize false positives, and offer real-time fraud prevention.

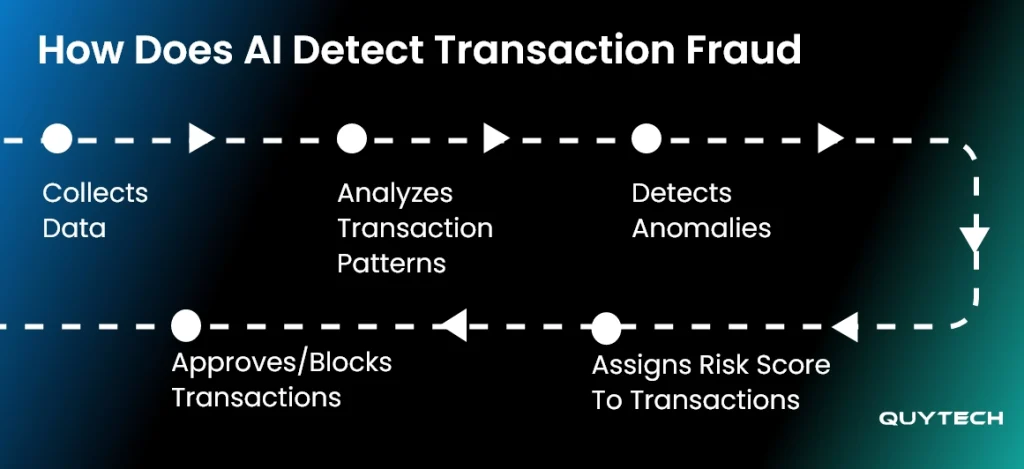

How Does AI Detect Transaction Fraud: Stepwise Working

Let’s understand how AI fraud detection in digital transactions works:

Collects Data -> Analyzes Transaction Patterns -> Detects Anomalies -> Assigns Risk Score to Transactions -> Approves/Blocks Transactions

Digital Transactions Fraud- Key Statistics

Check out these surprising statistics to know the growing number of digital transaction frauds worldwide:

- Synthetic identity fraud led to a financial loss of over $10 billion last year.

- 1 in every 120 online transactions globally is at risk of fraud.

- The online payment fraud market reached approximately $50 billion in 2024, and this number is growing at an unprecedented rate.

- The e-commerce industry witnessed a 26% increase every year in transaction fraud.

How Does AI Detect Fraud in Digital Payments: Key Use Cases

Just like organizations are using advanced ways to detect and prevent fraud, fraudsters are also continuously finding new and quick ways to commit fraud in transactions. To combat this situation and transaction-related fraud, the only way out is to ensure you have real-time fraud detection systems in place.

But before doing so, it is crucial to understand:

How does AI detect fraud in digital payments?

This section is dedicated to that only, let’s find out:

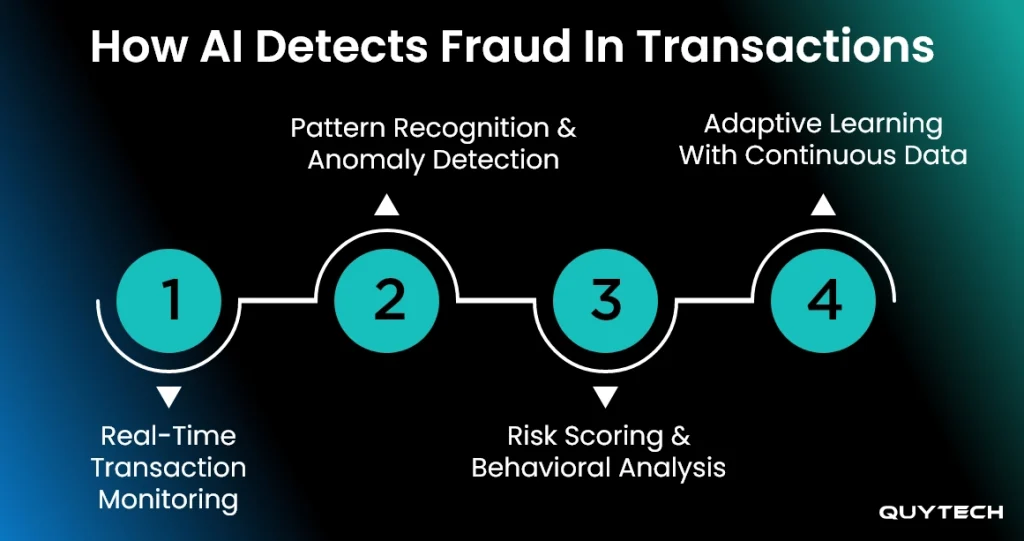

- Real-time Transaction Monitoring

Real-time transaction monitoring is a must for businesses where hundreds of transactions are done every second. And implementing AI for transaction monitoring leaves no room for mistakes or suspicious transactions to go unnoticed.

AI fraud monitoring in real-time continuously looks for unusual patterns and immediately raises an alert upon detecting suspicious activity or transaction to prevent or minimize financial loss.

- Pattern Recognition and Anomaly Detection

Machine learning algorithms run in the background to enable fraud detection systems to detect irregularities in transaction behavior. The system compares the transaction with historical data to find out these irregularities and quickly triggers an alert.

AI anomaly detection is the technology that identifies these anomalies or deviations that could turn into fraud. These irregularities could be unusual spending patterns, making transactions at odd times, or from inconsistent geolocations.

- Risk Scoring and Behavioral Analysis

Artificial intelligence technology gives a risk score to every transaction by considering parameters like the user’s transaction history, the type of device that is generally used to make transactions, the location of the user, and the frequency of transactions.

Whenever the system for AI fraud detection in digital transactions finds a different behavior than this, it triggers an alert and even takes actions like blocking the transaction or requiring additional verifications.

- Adaptive Learning with Continuous Data

Rule-based fraud detection systems follow the same rules always and forever, unless changed manually, even when the transaction data evolves or new types of transaction fraud are happening.

AI automatically and continuously trains and updates its models and algorithms to ensure adaptive learning for detecting new fraud techniques or attempts.

Types of Transaction Fraud that AI can Detect and Prevent

Fraudsters or cyber criminals use different techniques to commit transaction fraud. By implementing AI, these frauds can sometimes be prevented or detected in time to avoid financial loss.

Credit Card Fraud

Fraudsters can steal or clone credit card details, stored in an e-commerce platform or provided during insurance policy purchase, to make unauthorized purchases.

AI in credit card fraud detection identifies unusual spending patterns and immediately blocks the card if it finds unusual card usage or large payment transactions.

Identity Theft

Stealing personal information, such as social security numbers, addresses, and login credentials, falls under identity theft. By stealing such information, impostors can make fraudulent transactions.

AI in identity theft detection verifies digital identities with behavioral biometrics and anomaly detection to prevent this fraud.

Account Takeover

It is one of the most common types of transaction fraud, where hackers or cybercriminals get unauthorized access to a user’s online banking account and make purchases.

AI for account takeover fraud detection automatically tracks abnormal login patterns and device usage to mark suspicious activities.

Chargeback Fraud

In this type of fraud, a customer makes a purchase and raises a dispute with their bank to get a refund.

AI analyzes transaction histories to find and prevent false chargeback claims

Apart from these, phishing and social engineering fraud, wire transfer fraud, and synthetic identity fraud are some other common types of transaction fraud that can be detected and prevented with AI implementation.

Deepfake Fraud

Deepfake videos and images are the newest types of fraud that cybercriminals are using. They use these images and videos to impersonate trusted individuals or authorities and authorize fraudulent payments.

AI-powered deepfake detection tools can analyze inconsistencies in facial expressions and voice to flag deepfake videos.

Voice Scams

Fraudsters these days use voice cloning to mimic the speech of family members or colleagues and trick victims into sending money or sharing sensitive data.

AI for payment fraud prevention leverages speech pattern analysis technology to identify cloned voices and prevent such fraud.

Phishing and Social Engineering Fraud

This is one of the most common types of transaction fraud where cybercriminals trick people into revealing confidential information by sending them fake emails or via phone calls or SMS that ask them to click on any link, download malicious software, or provide login credentials.

AI in phishing and social engineering fraud detection detects suspicious patterns and scans attachments to give a green signal for their download. This can help identify anomalies in senders’ behavior and prevent data leaks and unauthorized transactions.

Wire Transfer Fraud

Cybercriminals conduct this fraud by pretending to be a legitimate business person and asking personnel and other people to make unauthorized money transfers. They use email spoofing or the BEC (Business Email Compromise) technique for it.

AI for payment fraud prevention can automate detecting unusual transfers by keeping a tab on the transaction histories, validating sender identities.

Technologies and AI Methods Used in Transaction Fraud Detection

To accurately detect suspicious transactions, AI uses top-notch methods to detect and prevent transaction fraud in real-time. These methods and techniques are:

Graph Machine Learning (Graph ML)

Fraudulent transactions usually have hidden links between accounts, devices, and locations. Graph ML techniques can uncover these connections to highlight fraud networks. They can detect collusion rings and money mule accounts while flagging unusual transaction patterns in a network.

Biometric Authentication

This is one of the widely used techniques for AI fraud detection in digital transactions. Biometrics is done via facial recognition, fingerprint scans, and behavioral biometrics. These authentication methods make sure only authorized or legitimate users can access their accounts. Biometric authentication saves users and institutions from identity theft and account takeover.

Device Fingerprinting

Another amazing technique that is doing wonders for AI for payment fraud prevention and detection is AI-driven device fingerprinting. It enables creating a unique ID for each device based on various factors, including browser settings, IP addresses, and hardware details. With device fingerprinting, it is easier to recognize unauthorized login attempts and suspicious devices.

Behavioral Analytics

Using behavioral analytics in systems built for AI fraud detection in digital transactions thoroughly analyzes the way users interact with applications and websites. The techniques can even monitor mouse movements and login times to find out if the person is an authorized user or a fraudster. It also helps with detecting anomalies in real time.

Natural Language Processing (NLP)

Natural language processing techniques play a crucial role when it comes to implementing AI for payment fraud prevention. It enables real-time scanning of phishing emails, fake websites, and voice scams. NLP can even identify suspicious language patterns in communication to block fraud attempts before any fraud happens with a person.

Applications of Real-Time Fraud Detection Across Industries

When we talk about the word fraud or transaction word, the first industry we feel that might get impacted is banking. We may also think that the benefits of AI fraud detection for banks and fintechs are immense, while for others, they are limited.

However, AI in fraud detection is not limited to the banking sector; it applies in every industry where digital transactions dominate. But how does AI detect fraud in digital payments?

Artificial intelligence integration for fraud detection empowers them to detect and prevent transaction-related fraud and build a positive brand reputation and trust. Let’s dig deeper to know further:

- Banking

Banks have always been on the hit list of the fraudsters looking to commence transaction-related fraud. They receive constant threats and face fraud attempts, every now and then. Using AI in banking fraud detection can help banks to avoid or detect:

- Credit card fraud

- Identity theft

- Money laundering

- Account takeovers

Similar Read: Suspicious Behavior Detection Systems in Banks: Complete Development Guide

- E-Commerce and Retail

Hundreds of users place orders and make payments on online marketplaces every day. Therefore, the chances of transaction fraud are quite high there. AI-powered fraud detection software analyzes transaction patterns, customer behavior, and unusual account activities to avoid digital payment fraud, such as:

- Payment fraud

- Fake user accounts

- Promo codes misuse

- Chargebacks

Also Read: Role of Artificial Intelligence (AI) in eCommerce

- Insurance

The insurance sector is one of the main targets of fraudsters attempting to commit transaction-related fraud. AI insurance fraud detection systems help insurance industries deal with false claims, inflated damages, and staged accidents. They can help with:

- Verifying claims

- Detecting anomalies in customer history

- Assessing fraud probability

Read More: The Role of AI in Insurance: Notable Use Cases and Industry Changes

- Fintech and Digital Payments

AI in fintech fraud detection plays a pivotal role, especially now when digital wallets, mobile wallets, Buy Now Pay Later, and peer-to-peer transfers are increasingly being used. With AI-powered real-time fraud detection, fintech and digital payment service companies can ensure:

- Real-time transactions monitoring

- Verify identities

- Reduce the chances of scams

Read More: AI in Fintech: Critical Roles, Benefits, and Use Cases

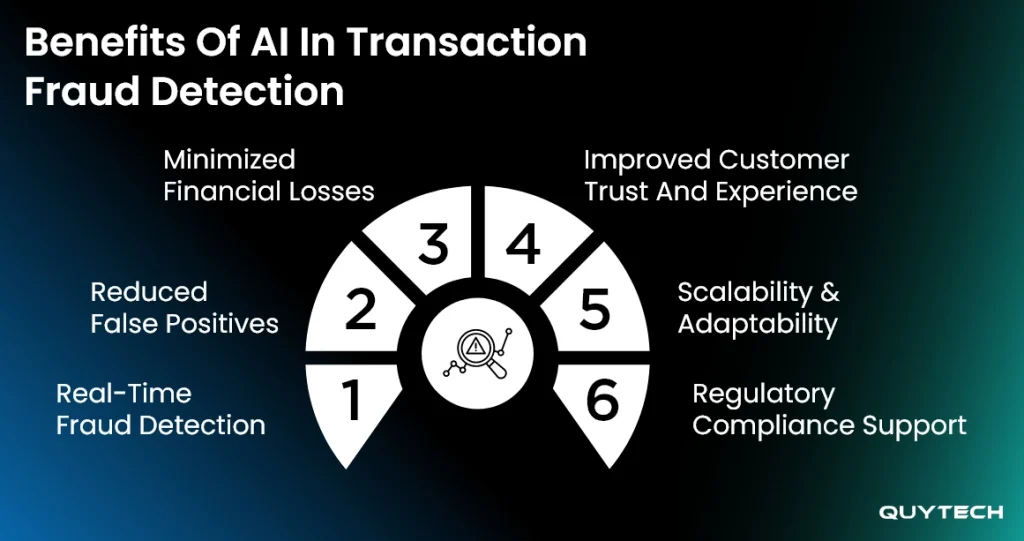

Benefits of AI for Payment Fraud Prevention and Detection

Artificial intelligence in transaction-related fraud detection helps fintech, e-commerce, banking, and other organizations to reduce false positives, ensure secure transactions, minimize financial losses, and offer numerous other benefits that are as follows:

- Real-Time Fraud Detection

The benefit of AI in fraud detection is real-time monitoring of transactions right when they occur. This is one of the major benefits of AI fraud detection for banks and fintechs. Even a single irregularity or unusual activity or behavior makes the AI-powered transaction fraud system to trigger an alert to stop or minimize financial loss.

- Reduced False Positives

Uninterrupted monitoring and exceptional capabilities to continuously learn from historical data enable AI-powered systems to detect anomalies with great accuracy. This reduces false positives that may impact customer experience.

- Minimized Financial Losses

Detecting fraud in time or, even, on time helps businesses to prevent further losses. E-commerce businesses can prevent chargebacks, insurance companies can avoid insurance fraud, and banks can avoid the theft of funds.

- Improved Customer Trust and Experience

Building customer trust and delivering a secure and seamless transaction or digital payment experience is a must for any organization. AI-powered transaction fraud detection helps organizations to achieve these goals.

- Scalability and Adaptability

The ability to seamlessly scale to handle increasing transaction volume makes AI fraud detection solutions a perfect choice for banks, fintechs, and e-commerce companies. Apart from scalability, their continuous adaptability to new fraud techniques makes them a must-have.

- Regulatory Compliance Support

AI enables businesses to ensure adherence to industry standards and regulations, including Anti-Money Laundering and Know Your Customer, which is crucial for any business. An AI fraud detection compliance system doesn’t require any manual intervention.

AI Fraud Detection in Digital Transactions: Key Techniques and Technologies Used

How does AI detect fraud in digital payments? Does AI work alone, or are other technologies involved too?

Supervised Learning

In this technique, AI models are trained on legitimate as well as fraudulent transaction datasets to make them understand what’s normal and what’s not.

Unsupervised Learning

This ML technique enables the AI fraud detection system to identify unusual patterns in data without prior labelling. This is useful in finding unusual behavior in digital payments, peer-to-peer transfers, and e-commerce transactions.

Deep Learning

Deep learning and neural networks are used to analyze datasets, even the complex ones, to find correlations between the data and detect synthetic patterns, identities, and multi-step fraud chains.

Natural Language Processing

NLP techniques analyze unstructured data, collected from emails, chats, and insurance claim forms, to find fraudulent activities. Based on the results obtained with text-based fraud detection AI, insurance companies can identify fraudsters.

You may want to explore further: AI and Machine Learning in Fraud Detection- How Does it Work?

AI for Payment Fraud Prevention and Detection: Real-World Examples

Let’s check out the real-world examples of AI fraud detection in digital transactions to know how the world’s leading companies are utilizing this technology to ensure end-to-end security of transactions.

JPMorgan Chase

JPMorgan Chase has implemented an AI fraud detection system that can analyze millions of daily transactions against fraud. The system utilizes ML and anomaly detection to monitor fraudulent credit card transactions, wire transfers, and suspicious account activities.

PayPal

PayPal is another leading global payment platform that relies heavily on AI and deep learning to ensure secure transactions and prevent fraud. The system it has implemented utilizes neural networks, which are trained on historical transaction data and consider real-time data, to flag irregularities and suspicious activities like unauthorized transfers and account takeovers.

Visa

Visa is a global card-payment organization that processes over 500 million transactions per day. To prevent fraud and detect it in time, Visa uses an AI-driven system- Visa Advanced authorization. This system monitors every transaction in real-time and uses predictive analytics and risk scoring to predict the chances of fraud.

Also Read: How AI is Used for Fraud Detection and Prevention in Retail

Transaction Fraud Detection Using AI: Future Trends

With the growing popularity and adoption of AI-powered fraud detection systems to secure digital transactions and payments, the future of such systems seems quite promising.

If you are planning to implement AI-powered fraud detection and protection systems in your organization, it is critical that you know about the trends that will shape their future. From Generative AI, blockchain, and predictive fraud intelligence to even smarter real-time monitoring, there are a lot of trends to look out for.

- The Rise of Generative AI

Growing use of generative AI in transaction fraud detection is one of the trends that we may expect in the future. The technology plays an important role in fraud simulation and detection. We may witness the use of Gen AI to create synthetic fraud scenarios, using which businesses can test their fraud detection models.

- Blend of AI + Blockchain

In the upcoming times, we may see AI and blockchain together being used for fraud detection. This will ensure the transparency and immutability of transactions to spot suspicious activities immediately.

- Predictive Fraud Intelligence with LLMs

The third major trend that we may also witness in the future is the use of predictive fraud intelligence along with LLMs by analyzing massive amounts of structured and unstructured data to identify fraud risks before they actually occur.

- Smarter Real-Time Monitoring

In 2026 and beyond, we may see the implementation of more AI fraud detection tools, powered by deep learning, graph analytics, and anomaly detection, to improve precision and reduce false positives.

Partner with Quytech to Implement AI for Transaction Fraud Detection

Building a highly secure and next-level AI-powered fraud detection system or implementing AI for transaction fraud detection is no easy feat. It requires in-depth expertise and hands-on experience in AI, ML, deep learning, predictive analytics, and various other technologies.

Moreover, you should also have knowledge of how the whole risk analysis process works. Besides, there are a number of other factors that need to be considered for integrating AI to detect transaction fraud.

Therefore, it is a wise decision to partner with a highly experienced AI development company, like Quytech, with prior experience in building AI-powered fraud detection systems. We have over 14 years of experience in building powerful fraud detection systems for banking, fintech, e-commerce, insurance, and other similar industries. Here is how we work:

- Fraud Risks and Data Availability Assessment

Every business is different; therefore, the first step we take is to identify the unique transaction fraud-related challenges you are facing. We determine whether it is credit card fraud, money laundering, chargebacks, or digital wallet scams that you need to prevent with an AI implementation or an AI-powered fraud detection system. After this, we check the data availability and analyze transaction patterns to build an effective implementation strategy.

- AI Fraud Detection Models Selection

Based on the thorough analysis, our experts choose the right AI, machine learning, deep learning, and anomaly detection models and techniques. The selection of the right techniques determines the accuracy in risk scoring and real-time fraud detection & prevention. Our team then develops and trains models on your custom datasets, including historical and real-time data.

- AI Integration with Existing Infrastructure

We integrate the trained AI models and developed AI detection tools with your banking systems, payment gateways, and other platforms to initiate real-time fraud monitoring. Our team makes sure this process is done with minimal disruption.

- Continuous Monitoring and Model Updates

AI-powered Fraud detection models need continuous monitoring and updates on new transactions for accurate outputs and to minimize false positives. We, at Quytech, ensure the same.

What differentiates Quytech is our:

- Proven expertise in AI fraud detection in digital transactions solution development.

- Experience in working with banking, insurance, fintech, and e-commerce companies.

- Focus on customization and scalability.

- End-to-end implementation of AI fraud detection in your payment gateways, wallets, and other systems.

Explore More: Fraud Detection System Development: A Comprehensive Guide

Final Thoughts

With the total transaction value in the digital payment market projected to reach US$20.09 trillion by the end of this year, one can have an idea of the transaction-related fraud. To prevent and timely detect these fraud, it is crucial for banking, fintech, retail, insurance, and e-commerce organizations to implement AI fraud detection in digital transactions.

AI, together with ML, deep learning, analytics, and other technologies, can analyze both historical and real-time transaction data to identify the risk of payment fraud, identity theft, and other financial fraud. It reduces the risk of financial losses.

Integrating AI for payment fraud prevention and detection might seem quite easy to many. However, it requires a great technical expertise and knowledge of assessing financial risk. Therefore, companies looking to leverage AI and similar technologies for transaction-related fraud detection must partner with an experienced technology company to build an AI-powered fraud detection system from scratch or integrate the technology into their current infrastructure.

Frequently Asked Questions

AI helps detect fraud in banking transactions by monitoring transaction patterns in real time to identify suspicious transactions and transfers, unusual spending patterns, and multiple failed login attempts.

AI, alone, cannot completely eliminate financial fraud. However, it can reduce it significantly. The technology, together with anomaly detection, predictive analytics, and behavioral analysis, can help businesses prevent transaction-related fraud activities.

As mentioned in the blog, supervised learning models, unsupervised learning models, deep learning and neural networks, and graph analytics are a few AI models that can facilitate seamless fraud detection.

AI in fraud detection costs depend on the size and type of the business, transaction volume, tech stack required, and a few other factors. Remember, it is a one-time investment that can help your business save millions and build trust with your customers.

Industries with high digital transaction volume can benefit from AI-driven fraud detection. These industries could be banking and financial services, e-commerce and retail, insurance, and fintech and digital payment service providers.

While implementing AI in fraud detection, companies may encounter challenges associated with data privacy and security, regulatory concerns, false positives, and customer experience issues, and the cost of implementing and training AI models for real-time transactions monitoring and fraud detection.