Insurance claim processes have been a nightmare for not just customers but also for insurers. Long waits, document collections, and multiple approval stages are no easy feat. This is where Artificial Intelligence and ML come into play.

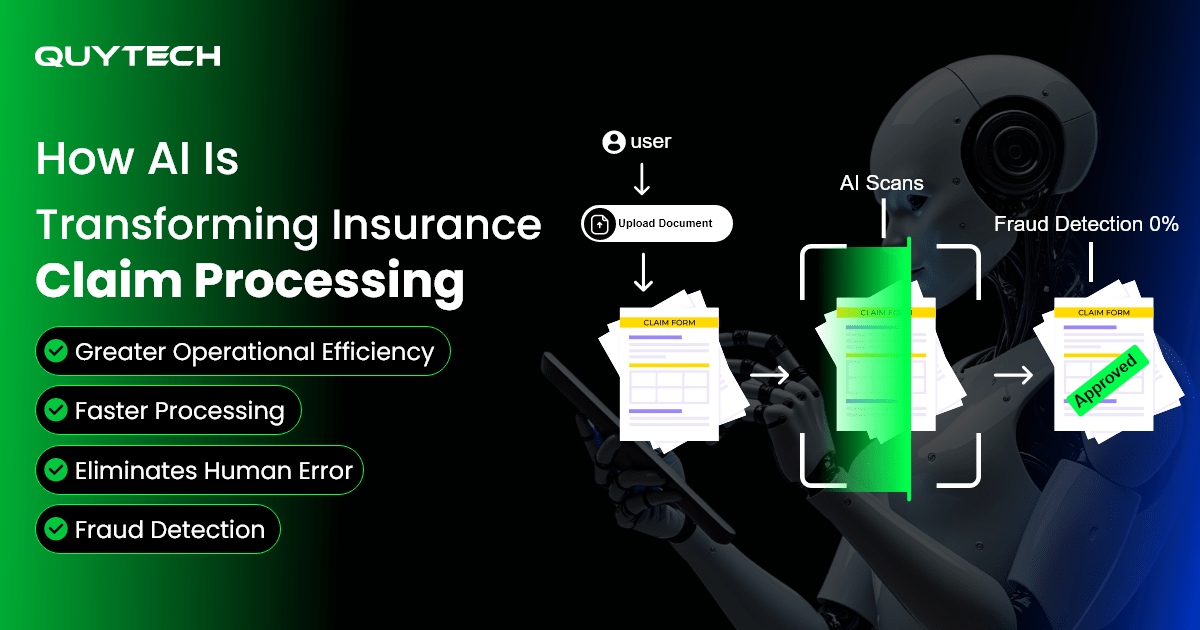

AI in insurance claim processing simplifies tedious, time-consuming procedures to help insurance companies flag fraud and add speed to the overall process with the help of automation.

Curious about how AI in insurance claim processing works? Read this blog and get answers to all your curiosities.

Key Takeaways

- AI in insurance claim processing drives automation, informed decision-making, faster resolution, and fraudulent activity detection.

- AI-based claim processing utilizes advanced technologies like machine learning, natural language processing, robotic process automation, and predictive analytics.

- The AI-powered system built for claim processing works by analyzing filed claims, verifying validity, reviewing policy, approving the claim settlement, and initiating the payment.

- It brings in benefits like operational efficiency, faster processing, reduced human error, improved decision-making, and fraud detection.

- The challenges that insurance companies may face in implementing AI in insurance claim processing are a lack of data availability, legacy system integration, resistance to change, and cybersecurity risks.

AI-Based Claim Processing: How it Works? (How it helps)

Before exploring how AI in insurance claim processing works, let’s get a basic understanding of what AI-based claim processing actually means.

AI in insurance claim processing stands for automation, enhanced decision-making, and autonomy. It transforms the traditional paper-based and manually handled claim processing system to provide precise and quick resolutions.

Let’s now understand how AI in claim processing works:

- Firstly, the customer submits their claim digitally. This can be done via web, chatbots, or mobile applications. The customer can also attach medical bills, images, documents, etc.

- Once the customer uploads the above-mentioned data, AI reads this data with the help of NLP and extracts details for further procedures.

- After this, the machine learning models run a quick check to verify the documents submitted. They compare the claim filed with past claims to spot anomalies.

- Once the claim filed passes this step, the AI starts matching it with the policy of the customer. It checks whether the claim filed is covered under the policy or not.

- After the policy matching process, the claim is forwarded for approval. Simple ones get approved instantly, while complex claims might require human approval.

- Once approved, the payments are initiated and the claims are settled.

You Might Also Like: The Role of AI in Insurance: Top Use Cases & Future

How AI/ML is Transforming Insurance Claim Processing

Artificial intelligence and machine learning have brought a huge transformation in the insurance claim processes. The same procedures that once took weeks are now addressed within hours. Fascinating, isn’t it? Let’s dive deeper and understand how AI/ML is transforming insurance claim processing:

Role of Machine Learning

Machine learning is an AI technology that learns over time. It does so by learning about the customers from every interaction it has.

- Machine learning plays its role in insurance claim processing by predicting risks.

- It analyzes the historical data of customers to depict past claim patterns and flags possible fraud.

- Machine learning is capable of analyzing the customer’s data within minutes. This enhances customers’ experience by giving speedy resolution.

Role of Chatbots

Chatbots are artificial intelligence-driven agents that interact with customers. They interact through calls and texts.

- The chatbots provide insurance claim support 24/7 without any interruption.

- They help in speeding up the filing process.

- Chatbots go through the customer’s information to verify their documents and prevent insurance fraud.

- They automate the routine tasks. This reduces the workload and allows the workers to focus on higher-level tasks.

Key Benefits of Using AI in Insurance Claim Processing

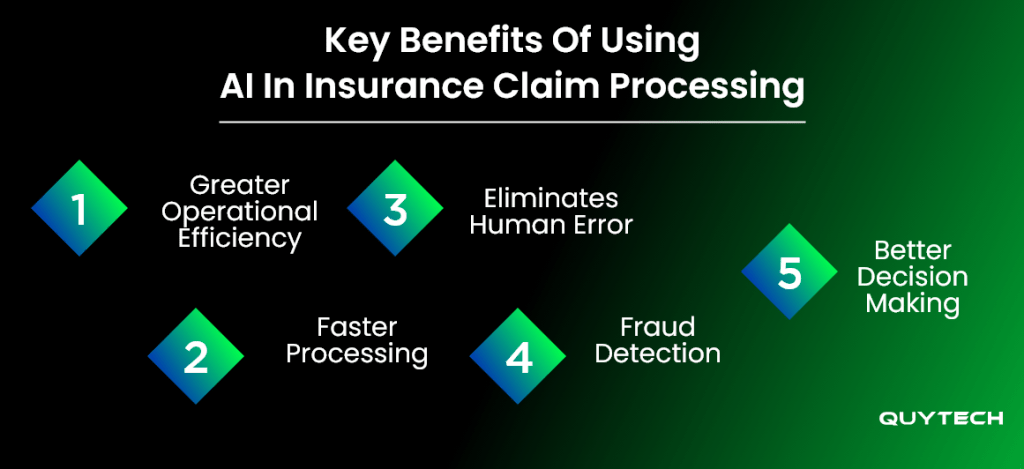

Let’s now explore some benefits that artificial intelligence brings to claim processing:

Greater Operational Efficiency

The operational efficiency gets a lot better with AI. Artificial intelligence automates routine tasks and reduces the workload of employees. This enables them to focus on the complex ones. AI tools for insurance claim processing reduce operational costs and utilize resources efficiently.

Faster Processing

Another advantage of AI in insurance claim processing is its speed. Traditional claim processing used to take weeks and months. But with AI, it can be done in real-time. Artificial intelligence reduces the time spent in every stage from claim filing to resolution.

Eliminates Human Error

The traditional claim processing is handled manually. The chances of missing details or making errors are very high. Utilizing AI for claim processing ensures higher accuracy as it extracts the details, analyzes them, and proceeds with the procedures, ensuring nothing goes wrong.

Fraud Detection

A very prominent benefit of AI in claim processing is fraud detection. Fraudulent activities are often encountered in the insurance industry. Manually handled processes often overlook these frauds and end up costing billions annually. But with AI, these frauds are identified by analyzing historical claim data and anomalies.

Better Decision-Making

AI in insurance claim processing utilizes technologies like machine learning, natural language processing, and many more. These technologies analyze the unstructured data and patterns to offer insights. These insights help insurers in making data-backed decisions.

Similar Read: Generative AI for Insurance

Challenges in Implementing AI for Insurance Claims

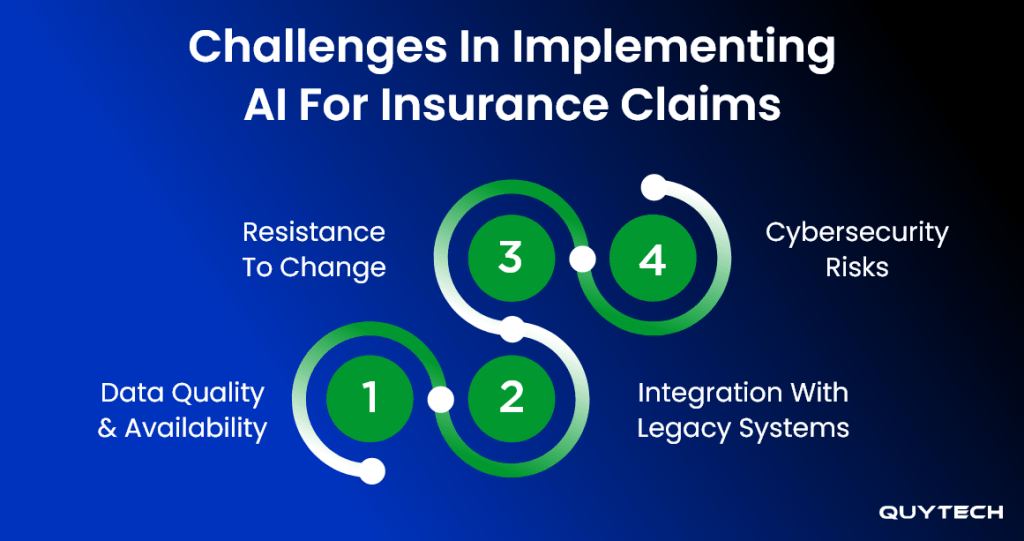

AI in insurance claim processing brings its fair share of challenges. These challenges can slow down or create hurdles in AI adoption. Here are some of them:

Data Quality and Availability

Implementing AI tools for insurance claim processing can become challenging if the data available is not accurate and clean. AI systems are trained on data. Implementation challenges rise due to scattered and low-quality data. If AI systems are trained on these, then they may not give accurate results.

Integration with Legacy Systems

Integrating AI systems into the available legacy systems can be challenging. The legacy systems are often very slow and not compatible with handling advanced AI software. In this situation, implementation can turn out to be very costly and even unsuccessful.

Resistance to Change

Adopting AI in insurance claim processing brings a huge change for both the company and its employees. Some might even see it as a substitute for manual workers and resist this change. In this situation, training the employees is often a challenge and can slow down the adoption process.

Cybersecurity Risks

Another challenge that insurance companies face while implementing AI in insurance claims is cybersecurity risks. AI for Insurance claim processes utilizes customer data. This data can be sensitive and prone to cyberattacks. Protecting this data to maintain customer trust can be challenging.

Read More: Data Analytics For Insurance: A New Era of AI Revolution

Real World Examples of AI-Based Claim Processing Systems

Let’s explore some real-world examples of AI-based claim processing systems:

Blue Cross Blue Shield

Blue Cross Blue Shield uses AI for document verification, historical pattern analysis, fraud detection, and policy reviews.

Allianz Direct

Allianz Direct utilizes artificial intelligence to settle auto claims. The AI analyzes images uploaded by customers, reviews policies, and works on settlement post approval.

Tractable

Tractable has employed AI to analyze auto damage. It uses technologies like deep learning and computer vision to assess damage to vehicles. This helps in reducing claim resolution time.

ICICI Lombard

The ICICI Lombard offers AI-based cashless claim settlements. With technologies like deep learning models, Intelligent Character Recognition (ICR), and Optical Character Recognition (OCR), the company verifies the claims and then proceeds with settlement.

How Quytech Helps with AI-Based Insurance Claim Solutions Development

Quytech brings the expertise and resources to power your insurance claim processes with artificial intelligence. We build AI-powered solutions tailored to blend into your existing systems seamlessly. With over 14+ years of experience, we stand out by meeting customer expectations.

Our dedicated team of developers understands your needs and builds a customized and scalable AI-based insurance claim solution. We believe in offering transparency throughout the development process, so that you can rest assured of the quality and capability of the solution.

Conclusion

The insurance claim processing system has finally made the transition that it desperately needed. With AI in action, the time-consuming and slow process of claim filing, followed by a wave of approvals, is now completed within hours.

With the help of advanced AI-powered technologies, the long wait hours are now cut short. This not only benefits the insurers by reducing their workload, but also satisfies the customers with quick resolutions. Hence, we can conclude this by stating that AI in insurance claim processing brings significant value to both insurers as well as policyholders.

FAQs

The technologies used in AI claim processing include machine learning, natural language processing, computer vision, robotic process automation, and predictive analytics.

Not necessarily, the implementation of AI in insurance claim processing can be done for legacy systems. However, replacement is done if existing systems are very outdated.

No, AI-based claim processing is not limited to just large insurance companies. Small and medium-sized insurance companies benefit equally by implementing AI in claim processing.

Absolutely, you can integrate AI in claim processing without a proper tech team by either hiring developers or partnering with an AI development company.