In most organizations, financial data comes from different sources, including bank accounts, credit card transactions, point-of-sale systems, and vendor invoices. Those who rely on manual methods to reconcile this data often face many challenges, including errors, delays, and non-compliance with IFRS, GAAP, and SOX standards.

That’s probably one big reasons why worldwide renowned companies JP Morgan Chase, Amazon, and others are using AI-powered reconciliation for accounting. AI bank reconciliation is a game-changer as it automates the core reconciliation tasks, i.e., matching transactions, identifying discrepancies, and updating records with great accuracy and unmatched speed.

Dig deeper into this blog that covers how AI transaction reconciliation transforms accounting operations. It also highlights its key use cases for sectors like banking and finance, real-world examples, and major benefits.

Let’s start!

What is AI-powered Reconciliation for Accounting

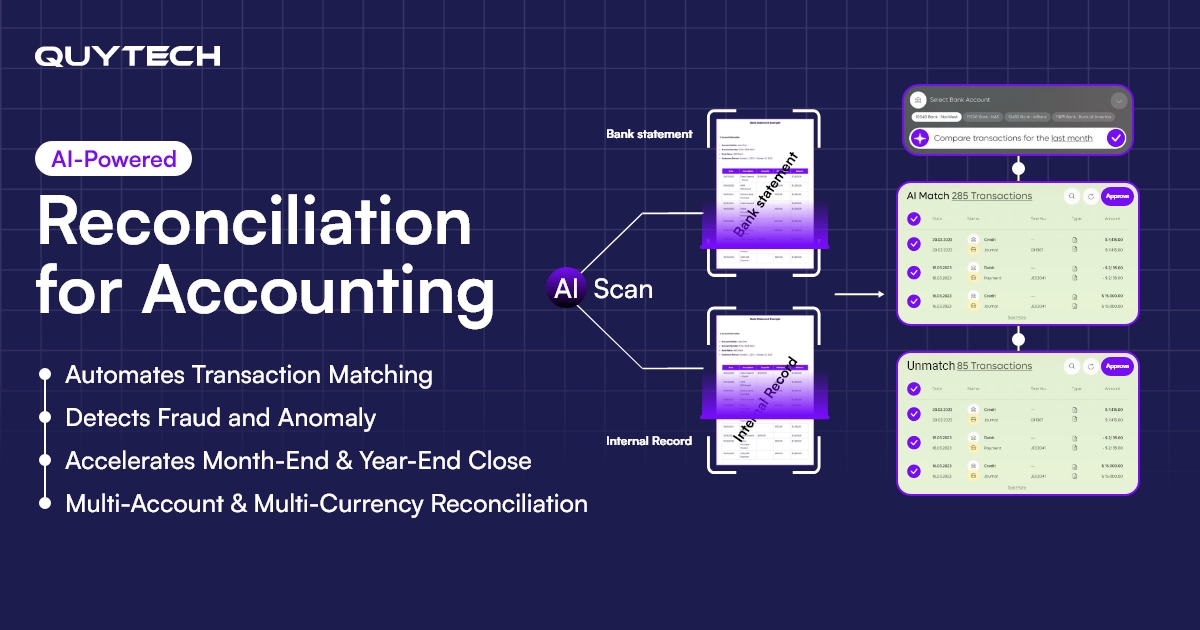

Reconciliation, powered by artificial intelligence, simply means automating the process of matching two sets of financial records. It could be comparing your company’s internal ledger with bank statements. Conventional reconciliation methods require an accountant to do this manually, which consumes a lot of time and has a higher possibility of errors, especially if there are thousands of transactions to match.

AI in reconciliations for banking and financial transactions automates this process and frees up the accountant for other strategic or complex tasks. Not only matching, artificial intelligence also helps with detecting the reason behind the mismatch. The technology also automatically updates the financial records to make them ready for audits.

Key Takeaways

- AI-powered reconciliation for accounting uses AI and ML algorithms to automate the reconciliation tasks, such as matching transactions, identifying anomalies, and updating records.

- AI ensures faster, accurate, and real-time conciliation to detect anomalies and make the financial data ready for audits.

- AI transaction reconciliation has multiple use cases in banking, finance, retail, and other similar industries.

- Faster reconciliation, enhanced compliance, and fraud & anomaly detection are some benefits of bank reconciliation powered by artificial intelligence.

- JP Morgan Chase and Amazon are two well-known real-world examples of bank reconciliation.

How AI Transaction Reconciliation Works

Here is how AI transaction reconciliation works:

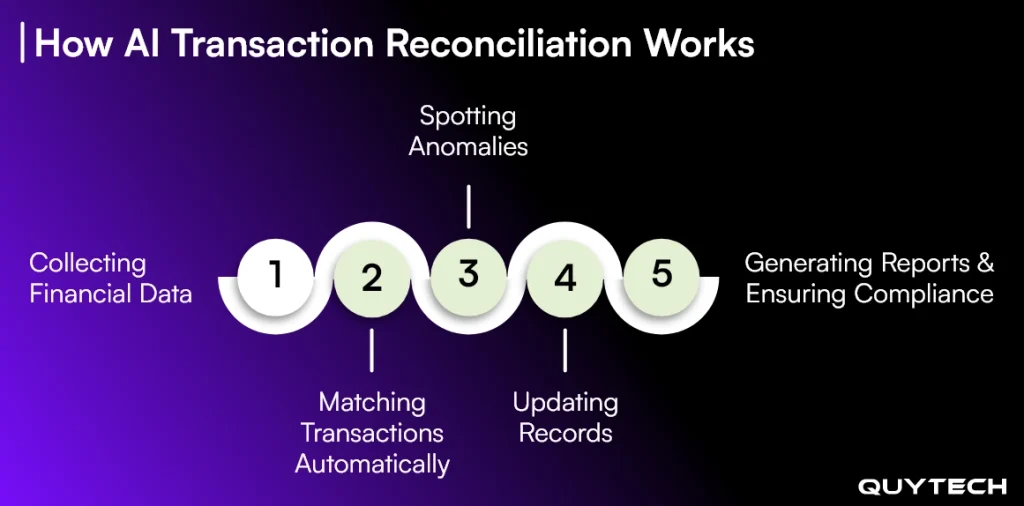

- Collecting Financial Data

The system designed for AI reconciliation collects financial data from different sources such as bank accounts, vendor invoices, and point-of-sale systems. This collection is totally automated.

- Matching Transactions Automatically

In the next step of artificial intelligence bank reconciliation, the technology compares one transaction record with the other.

- Spotting Anomalies

If an AI-powered reconciliation system for accounting finds any transaction that does not match perfectly with the record, it marks it immediately.

- Updating Records

The AI transaction reconciliation system then automatically updates the accounting records to ensure all books are accurate and updated.

- Generating Reports and Ensuring Compliance

The system then generates reconciliation reports that highlight both matched and different transactions. This enables auditors to verify them for precision and compliance without any hassle.

Why is Investing in AI-Powered Bank Reconciliation the Need of the Hour

AI-powered bank reconciliation overcomes errors, delays, and other challenges associated with manual methods of doing the same. Since the financial transactions data is evolving unprecedentedly, not adhering to regulations is non-negotiable, and closing delays can be costly, it is indeed a wise decision to invest in artificial intelligence reconciliation. Let’s explore these reasons in detail:

- Transaction Volumes are Exploding Beyond Manual Capacity

As a large enterprise, bank, and e-commerce & retail business, you must be dealing with thousands of transactions on a daily basis. With a transaction volume of this extent, it is obvious that you need an intelligent reconciliation system that can automate time-consuming processes to analyze high volumes of transaction data and accelerate month-end or quarter-end closings.

- Human Errors Cost Enterprises Time, Money, and Credibility

Collecting and processing high volumes of transaction data, that too from different sources, is no joke. Anyone can make a mistake while matching transactions, identifying anomalies, and generating reports. Even a misplaced decimal or missed invoice can be costly and lead to inaccuracy in the records. This is not the case with AI-powered reconciliation for accounting.

- Manual Reconciliation Slows Down Month-End Closings

Manual reconciliation requires time for data collection, transaction entries comparison, and every task involved in the process. Slow execution of these processes may lead to delayed closing and decision-making. This may also impact financial reporting and verifying compliance adherence.

- Compliance Gaps are Putting Businesses at Regulatory Risk

In today’s time, it is absolutely non-negotiable to ignore compliance such as IFRS, GAAP, and SOX. Even a single missed entry or reconciliation can lead to audit-related issues. In some cases, banks or financial institutions may also have to pay hefty penalties or fines. AI reconciliation for accounting automates the compliance adherence process and saves the company from paying fines.

- Traditional Systems Miss Fraud and Anomaly Red Flags

With manual reconciliation, it is not possible to detect anomalies or exceptions in the transaction data. Now, these anomalies can be unusual transaction patterns or two entries for a single payment. Traditional accounting reconciliation systems may also fail to flag fraudulent transactions, which, if ignored or missed, can lead to bigger financial losses and risks.

AI Reconciliation Use Cases for Banking and Finance

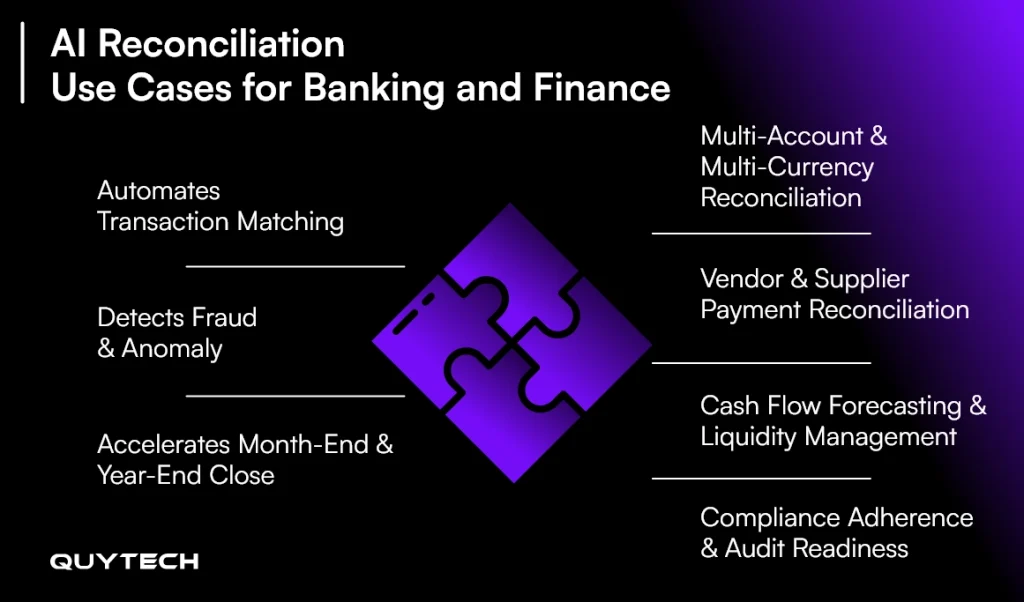

Let’s explore AI reconciliation use cases for banking and finance, the two industries where the transaction data is massive and the need for accurate reconciliation is high. These use cases will help you understand how AI-powered reconciliation transforms these two industries:

- Automates Transaction Matching

You have thousands of transaction data collected from your bank account, payment system, and internal ledger. Imagine someone asks you to match these transactions with the bank records or statement. It would definitely take days or even weeks with manual methods.

However, AI can do this work in minutes with the utmost accuracy. Yes, automated transaction matching is one of the best AI reconciliation use cases for banking and finance. This saves time, costs, and resources while minimizing workload on the dedicated team.

- Detects Fraud and Anomaly

Banks and financial institutions are always the top targets of cybercrimes like data breaches and fraud. With traditional methods, it is difficult to identify those unusual transaction patterns.

With AI-powered bank reconciliation, you don’t need to keep any manual watch on the data. AI transaction reconciliation systems continuously monitor transactions to mark suspicious ones immediately. It can also flag duplicate transactions and mismatched entries.

- Accelerates Month-End and Year-End Close

Slow execution of account reconciliation processes, errors, and other similar challenges often cause delays in reporting and, ultimately, the month-end and year-end close. It may also invite compliance issues.

AI reconciliation for accounting can speed up the processes with automation and ensure the enterprise closes books without any delay and with complete adherence to IFRS, GAAP, and SOX.

- Multi-Account & Multi-Currency Reconciliation

Large enterprises with a presence across different geographies generally have multiple accounts and receive payments in different currencies. Reconciliation of those accounts may be a little difficult because of cross-border complexities and currency exchange rates.

AI-powered reconciliation for accounting can do wonders here by seamlessly managing both multi-currency and multi-account. Such systems can efficiently handle the balancing of accounts with great precision.

- Vendor & Supplier Payment Reconciliation

One of the biggest sources of transaction data is vendor invoices, supplier payments, and payment orders. Fetching the right data and comparing it with bank statements manually can be cumbersome with manual methods.

AI-powered account reconciliation comes into action and facilitates quick verification of invoices and payments. This is done in real-time; it means no lag in reporting. It is also one of the best AI reconciliation use cases for banking and finance that ensures there are no disputes while strengthening relationships between vendors and suppliers.

- Cash Flow Forecasting & Liquidity Management

A company with inaccurate reconciliation may find it difficult to predict cash flow. Besides cash flow, managing liquidity is also not easy.

Cash flow forecasting and liquidity management, these two use cases of AI reconciliation in banking and finance, come as a savior. The technology offers real-time visibility into different cash positions. With this visibility, enterprises can make accurate predictions and take data-driven decisions.

- Compliance Adherence & Audit Readiness

Almost every bank and financial institution, small or large, has to abide by strict compliance and regulatory requirements. Lack of this can lead to penalties. Manual accounts reconciliation doesn’t do it efficiently and also increases the audit risks.

AI bank reconciliation ensures that every transaction is recorded, updated, and reported accurately. The technology keeps on looking for exceptions to ensure there are no flaws or chances of fraud. AI makes account reconciliation audit-ready and compliant.

You may like to read: Digital Transformation in Banking & Finance: A Complete Guide

AI Reconciliation Use Cases in Other Sectors

In the last section, you explored AI reconciliation use cases for the banking and finance sector. But, intelligent reconciliation is also used in other sectors such as e-commerce, retail, healthcare, and insurance. Here are the use cases of AI-powered reconciliation for accounting in other industries:

- E-Commerce and Retail

Customer payment reconciliation is one of the biggest use cases of artificial intelligence reconciliation in e-commerce and retail. The technology efficiently handles and matches payment records from credit cards, UPIs, PayPal, and other sources with sales orders. This eliminates the chances of mismatches, delays, and refund errors. All this happens in real-time.

Dive Deeper: How AI is Used for Fraud Detection and Prevention in Retail

- Healthcare

A key application of AI reconciliation for accounts in healthcare is insurance claim reconciliation. AI-powered reconciliation systems enable hospitals and clinics to efficiently reconcile patient billing with insurance claim settlements and avoid revenue leakages. The technology automates matching claims against insurance policies and payments to facilitate precise reimbursements.

Discover More: How AI Is Transforming the Healthcare Industry

- Insurance

Premium and payment reconciliation are the two major AI reconciliation use cases in insurance. AI makes sure there are no manual errors with premium reconciliation with insurance policyholder accounts. This streamlines the entire process while enhancing transparency and regulatory compliance.

To explore use cases of AI-powered account reconciliation for your specific industry, you can take AI consulting services from a trusted company.

Read More: AI in Insurance Claim Processing: Cut the Costs, Fraud, and Delays

Benefits of AI-Powered Bank Reconciliation: From a Business POV

The benefits of bank reconciliation are immense; it ensures faster reconciliation, offers real-time updates, guarantees error-free transaction matching, and ensures adherence to compliance. Let’s read them in detail:

- Faster Reconciliation

The first benefit of AI bank reconciliation is speeds up transaction matching and identification of exceptions in the data. Days of work can be completed within minutes, which further accelerates month-end and quarter-end closings.

- Enhanced Accuracy

Another amazing advantage of AI-powered reconciliation for accounting is that it doesn’t leave room for errors or mistakes. It guarantees accuracy even when it finds a slight difference in the transaction. For example, if the transaction entry done by the company says $40 and the bank statement says “$43.5, the AI reconciliation system can understand that the difference amount is the bank charges.

- Real-Time Updates

One advantage of AI bank reconciliation is that it never stops reconciling transactions. In other words, it means regularly comparing or matching transactions to ensure every record is updated, which helps you to make informed decisions with a real-time view of your cash flow.

- Enhanced Compliance

While manually matching transactions or reconciling them, one may miss checking for compliance with regulatory requirements. But with AI transaction reconciliation, it is next to impossible. The technology ensures complete accuracy and compliance with all standards and regulations. It further reduces the chances of audit failure or penalties.

- Fraud and Anomaly Detection

Artificial intelligence reconciliation for accounting can easily identify duplicate transactions or the ones that seem a fraud. During the conciliation process, the AI-powered system finds anomalies or entries that are different or unusual. This gives decision-makers enough time to take action beforehand.

Continue Reading: Anomaly Detection Guide: Use Cases, Types, Methods, Benefits, and More

- Saves Costs and Resources

Automation of transaction reconciliations frees up finance teams or resources from doing repetitive tasks. They can work on complex tasks or focus on making strategic decisions. This reduces the overall reconciliation cost and resources, which is yet another super benefit of bank reconciliations.

You may like to read: Role of Generative AI in Finance and Banking

Step-by-Step Process to Implement AI-Powered Reconciliation for Accounting

Here is how are the steps you need to follow to integrate AI-driven accounting reconciliation into your business:

Evaluate Existing Reconciliation Processes

This is the first step to implementing AI in any operations, let alone accounting. Identify what challenges you face with manual workflows. It will help you determine where exactly to implement AI to get maximum value and efficiency.

Define Objectives

As an enterprise or business, you must be managing different accounts or transactions. In this step, you have to decide which of those accounts will get an AI transformation. Clearly mention the goals you want to achieve with AI transaction reconciliation. These goals could be reducing errors, accelerating month-end closing, decreasing manual workload, etc.

Prepare Transaction Data

Identify the sources of collecting data (bank accounts, credit cards, point-of-sale systems, vendor bills, etc.) and capture the same. AI models required to reconcile transactions work perfectly if the data is clean, consistent, and standardized. Implement required techniques for data cleaning and labelling.

Build and Train AI Models

Develop custom AI models or use pre-built AI models and train them on your specific transaction data. Thoroughly define rules for matching transactions. Also, train the models to manage exceptions and self-learn from historical data to deliver accurate outputs.

Start Small

Don’t apply the models to all transaction data in the beginning. Test with a pilot program that considers only small datasets. Based on the model’s performance, scale further and implement AI in other datasets. Continue to monitor it for accuracy, anomaly detection, and ROI. Keep the model updated with exception trends and by considering feedback from the teams using it.

Real-World Examples of AI Transactions Reconciliation

AI-powered reconciliation for accounting is being used by many big and powerful companies. Take a look:

- JP Morgan Chase

This multinational finance corporation, and the largest bank in the United States, relies on AI-powered transaction reconciliation to process millions of transactions across international accounts. The reconciliation system automates matching customer deposits, credit card transactions, and transfers within the different branches of the bank.

With artificial intelligence-powered reconciliation, JP Morgan Chase minimizes manual effort, accelerates month-end closings, and ensures high accuracy in the reports.

- Amazon

Amazon is one of the perfect examples of bank reconciliation. The company uses the technology to deal with a high volume of daily sales and payments. The AI system Amazon uses for reconciliation in accounting matches payments from different sources. With automated reconciliation, the company gets real-time visibility on financial transactions while ensuring there are no mistakes or errors in the accounts.

- Carter Bank

This American bank uses an AI transaction reconciliation system for automating account reconciliation. With the system, the bank automates 80% of the tasks, freeing up its accounting and finance team for other strategic and complex tasks.

Future of AI in Accounting Reconciliation

AI bank reconciliation redefines the way transactions are handled or processed to ensure accuracy, updated records, and spot exceptions. In 2026, we may see many other powerful changes that can level up the game for banking and financial services providers. Let’s take a quick look at what the future of AI transaction reconciliation looks like:

- We may soon witness an era of predictive reconciliation, which will flag potential late payments, possible mismatches, and cash flow problems even before they occur.

- In 2026 and beyond, we may also expect the transaction reconciliation to be deeply integrated within ERP, banking, and financial platforms.

- Block and smart contracts may also work with AI to add an additional layer of security and verify transactions automatically. These technologies will also make transaction records immutable and transparent.

- Autonomous finance teams may also get a spot in the list of future trends for AI in reconciliation for accounting. Agentic AI technology integration will automate end-to-end reconciliation.

Seamless Adoption of AI in Reconciliation for Accounting with Quytech

At Quytech, the best AI development company, we can help you with the seamless integration of AI in your reconciliation process or build an AI-powered reconciliation system from the ground up.

We have AI, Predictive Analytics, NLP, Cloud Computing, and Machine Learning experts who thoroughly assess your reconciliation automation requirements, evaluate your transaction data volume, complexity, and current infrastructure, and then design a roadmap to the successful implementation of AI into your reconciliation process.

By developing secure and scalable systems for AI-powered bank reconciliation for accounting, we aim to scale your finance operations without scaling the resources.

Final Thoughts

AI-powered reconciliation for accounting saves hours of work by automating the matching of transactions and finding discrepancies in large volumes of transaction data. It works in real-time to ensure finance records are updated and are ready to be audited. The best part of AI transaction reconciliation is that it leaves no room for mistakes and ensures adherence to compliance, the non-compliance of which can lead to penalties.

Frequently Asked Questions About AI Bank Reconciliations

For AI transaction reconciliation, you should have proficiency in:

– AI

– ML

– NLP

– OCR

– RPA

– Data Analytics

– Cloud Computing

– Security and Compliance Frameworks

Traditional systems are rule-based, whereas AI-powered reconciliation systems automatically learns from previous data, handle unstructured and structured transaction data to make smart decisions, and provide accurate output. It can even spot exceptions flawlessly.

Yes. For this, you need to partner with an experienced AI reconciliation system development company. They will build a custom system or seamlessly integrate the technology into your existing ERP systems.

The cost of implementing AI in accounting reconciliation depends on the transaction data complexity and volume, specific integration requirements, and a few other factors. Share your requirements with Quytech’s AI experts for an accurate estimate.