A report by Market.US highlights that by the end of 2025, about 91% of insurance companies will adopt AI in their workflows. Not just that, the insurance underwriting segment will hold a 32.8% share of the total adoption. These figures reflect that the spark is there already; all businesses need to do is be a part of this revolution.

Insurance underwriting has never been an easy feat. The process of going through piles of documents, assessing risk, and then offering relevant policies takes forever to complete. What makes this process outdated is the manual handling of tasks. Not only is this time-consuming, but it is also prone to human error.

This is where agentic AI enters the scene, giving the old manual process an intelligent makeover. With RPA, ML algorithms, predictive analytics, and IDP technologies, it automates risk assessment with accuracy and speed.

Want to know more about the role of agentic AI in transforming insurance underwriting? Read this blog to discover everything from the working mechanism to the benefits and use cases of Agentic AI for insurance underwriting.

Key Takeaways:

- Agentic AI in insurance underwriting automates workflows, assists underwriters, legal compliance, and coordination across departments.

- It replaces manual effort with data-driven, fast, and scalable underwriting.

- It streamlines underwriting through data-driven, compliant, and self-learning workflows.

- Agentic AI in insurance underwriting enhances accuracy, speed, scalability, and fraud detection ability.

- Its use cases include smarter client verification, risk assessment, and policy recommendations.

The Role of Agentic AI in Insurance Underwriting

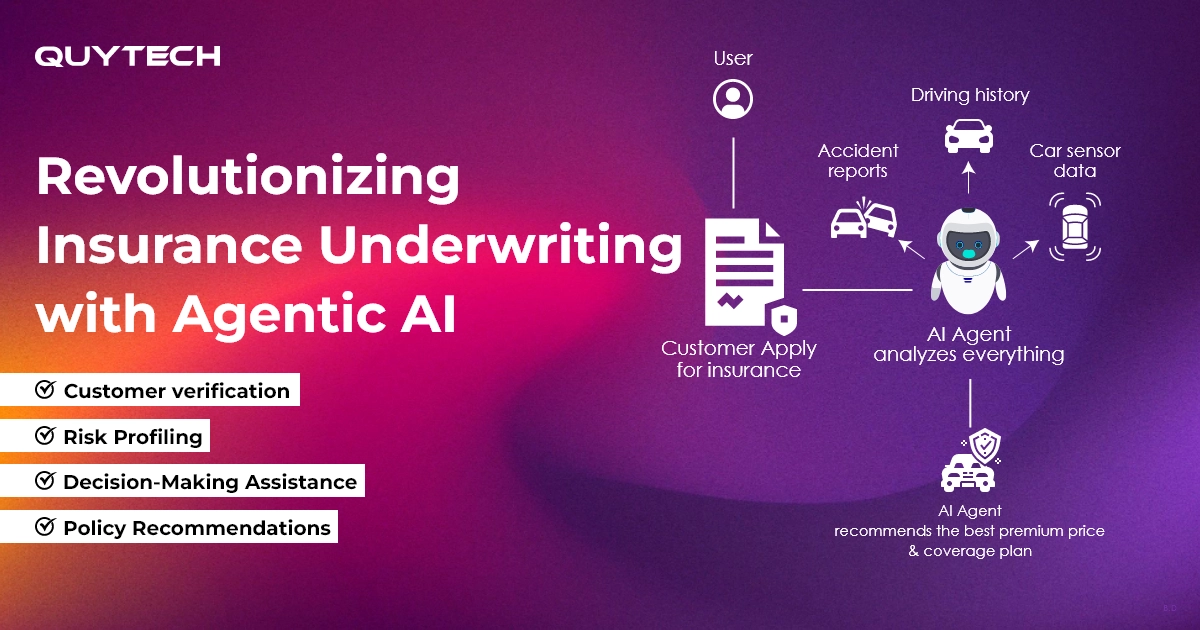

For a better grasp of the role of agentic AI in insurance underwriting, let’s understand its process:

Insurance underwriting refers to the process by which the insurance company assesses the risk of insuring a potential applicant. It helps insurers in understanding the risk factor behind insuring an applicant. Insurance underwriting establishes a foundation for setting the coverage conditions, insurance premiums, and related legal requirements.

The role of agentic AI in insurance underwriting is to transform the time-consuming working mechanism into a speedy and accurate one. And how does agentic AI do that? Here’s how:

Connecting Data with Decisions

The process of insurance underwriting involves going through piles of documents. When handled manually, the process becomes very tedious, tiring underwriters, and impacts their ability to make informed data-backed decisions.

Agentic AI takes over the task of analyzing data to make the decision-making process more accurate and quicker. It utilizes NLP to derive insights from different data sources like medical records, financial statements, etc.

Supporting Human Underwriters

The task of insurance underwriting ranges from data collection and analysis to policy pricing decisions. All these tasks incorporate managing intricate details to ensure that the right policy terms are offered to the applicant.

The role of agentic AI is to support the human underwriter during this whole process. It does so by automating the repetitive tasks, providing more time to underwriters to deal with the strategic ones.

Ensuring Compliance

As mentioned already, the process of underwriting is very detail-oriented. With so much happening altogether, underwriters may feel overwhelmed in handling the compliance-related areas.

Agentic AI ensures that all the processes carried out comply with the regulatory requirements. It does so with the help of data governance frameworks and secure cloud-based infrastructure. These technologies assist in protecting data from cyber threats.

Coordinating the Whole Process

Insurance underwriting is not limited to a certain department. Applicants may request varied insurance policies that require different departments and sources to work together. In such scenarios, coordination becomes necessary but chaotic.

The role of agentic AI is to systematically coordinate the workflows of all the departments. This ensures consistency throughout the process and prevents chaos. Multi-agent systems handle the task of coordinating these workflows.

Traditional vs. Agentic AI in Insurance Underwriting

In the traditional setting, the process of insurance underwriting is handled manually. This not only makes the process slow but also compromises accuracy. But with agentic AI in action, the process is not just speedy but also accurate. Curious about how agentic AI is different from the traditional insurance underwriting process? Here’s how:

| Aspect | Traditional Insurance Underwriting | Agentic AI-Based Insurance Underwriting |

| Nature of Operation | The operations are handled manually by the underwriters themselves. | Agentic AI carries out the repetitive tasks autonomously, lending a hand to underwriters. |

| Decision-Making | The decision-making process is dominated by experience and intuition. | The decision-making process is backed by data-driven insights offered by agentic AI. |

| Speed | The traditional insurance underwriting process is very slow and time-consuming. | The agentic AI-based insurance underwriting process is very fast. |

| Accuracy | Being handled manually, the process is prone to human error. | Being handled by agentic AI, the process is accurate and is supervised by a human operator as well. |

| Adaptability | Traditional insurance underwriting is not adaptable. It is rigid; adaptability is possible if rules are changed. | Agentic AI-based insurance underwriting is adaptable. It acts as and when required in the situations it encounters. |

| Scalability | Scaling a traditional insurance underwriting process means hiring more staff. | Agentic AI-based insurance underwriting scales digitally; it does not require hiring more people. |

Read More: AI Agents for Autonomous Data Analysis

How Does Agentic AI-Based Insurance Underwriting Work?

The role of agentic AI in insurance underwriting is not limited to certain areas. It plays its part in every step involved. To get a better understanding of agentic AI-based insurance underwriting, let’s walk you through its working mechanism:

Data Collection

The first step in agentic AI-based insurance underwriting is collecting data. Here, data is collected from various sources. These include medical, financial, and claim histories, etc. Once data is collected, it’s cleaned and stored for further analysis.

Data Analysis

After collecting data, it is analyzed. This involves understanding the meaning, patterns, and trends behind the data clusters. Advanced technologies like natural language processing are utilized in this step.

Risk Assessment

Once analyzed, the data is used for the process of risk assessment. In this step, data is assessed to find underlying patterns. These may help insurers assess the risk of insuring the applicant. This step is crucial in deciding whether or not to provide insurance services to the applicant.

Decision-Making and Policy Recommendation

After analyzing potential risks, the next step is to make a decision. Here, the insurer decides on the type of policy, conditions, and premium they will offer to the applicant. Data-driven insights offered by agentic AI are used here to make informed decisions.

Compliance and Governance Validation

Post-decision-making, agentic AI works on legal compliance tasks. It compares the decisions with legal standards, highlights areas that could be penalized, and suggests improvements. This helps insurance companies avoid getting into legal complications.

Continuous Learning and Feedback Loop

After completing all the required tasks of insurance underwriting, agentic AI focuses on enhancing the quality of its outcomes. It does so with the help of reinforcement learning models. These models help it learn from every interaction, feedback, and outcome it gives.

Similar Read: AI Agents for Enterprise Workflow Automation: Use Cases, Benefits, Examples, and More

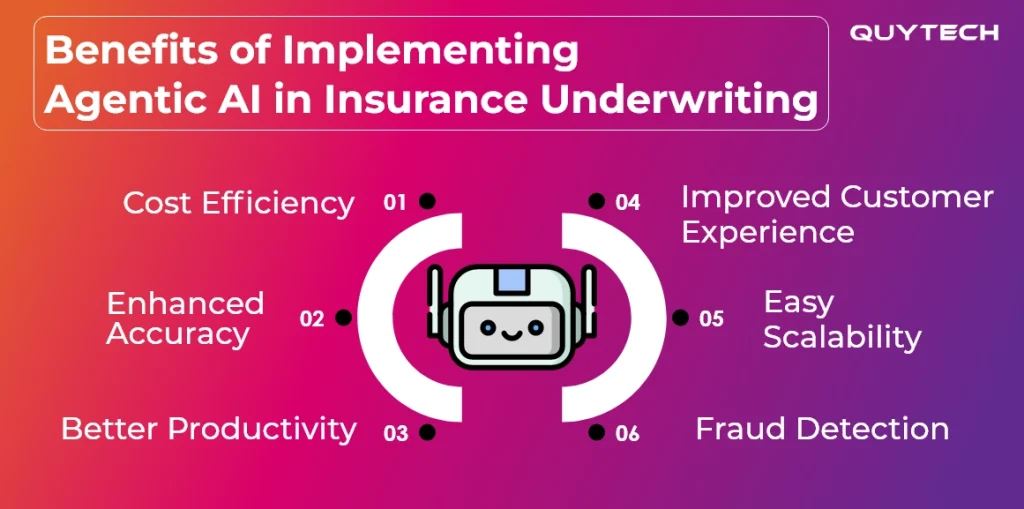

Benefits of Implementing Agentic AI in Insurance Underwriting

Implementing agentic AI in insurance underwriting benefits insurance businesses beyond providing automation. It brings in cost efficiency, enhanced productivity, and much more. Here’s a list of the benefits of implementing agentic AI in insurance:

Cost Efficiency

Implementing agentic AI in insurance underwriting saves the costs that businesses spend on repetitive administrative tasks. Agentic AI frees up human resources from these tasks and allocates them to strategic ones. This also contributes to utilizing resources efficiently.

Enhanced Accuracy

As mentioned already, insurance underwriting is a very document-intensive task. With multiple tasks awaiting, the burden of handling all becomes overwhelming, compounded by personal bias and distractions. Agentic AI introduces accuracy by analyzing documents without bias, distractions, or tiredness.

Better Productivity

With no distractions, bias, or similar factors impacting agentic AI, it multiplies productivity. Automating repetitive tasks cuts off the time spent on completing them manually. The time saved is utilized in working on strategic areas, which contributes to the overall productivity.

Improved Customer Experience

As agentic AI adds speed to the overall process of insurance underwriting, the approvals and outputs rendered to the applicants become faster and more personalized. This contributes to improving customer experience, adding to the reputation of insurance providers.

Easy Scalability

If looked at with a traditional point of view, the scalability factor means hiring more people to carry out the tasks. With agentic AI, scalability becomes not just easy but also cost-effective. It can easily handle more tasks without having to invest in hiring more people.

Fraud Detection

Powered by advanced anomaly detection models, agentic AI is capable of detecting fraud just by analyzing data patterns. With regular data training backing them, agentic AI systems can also detect emerging risks. This helps insurers know whether or not to insure the applicant.

You Might Also Like: How to Build an Agentic SaaS Platform

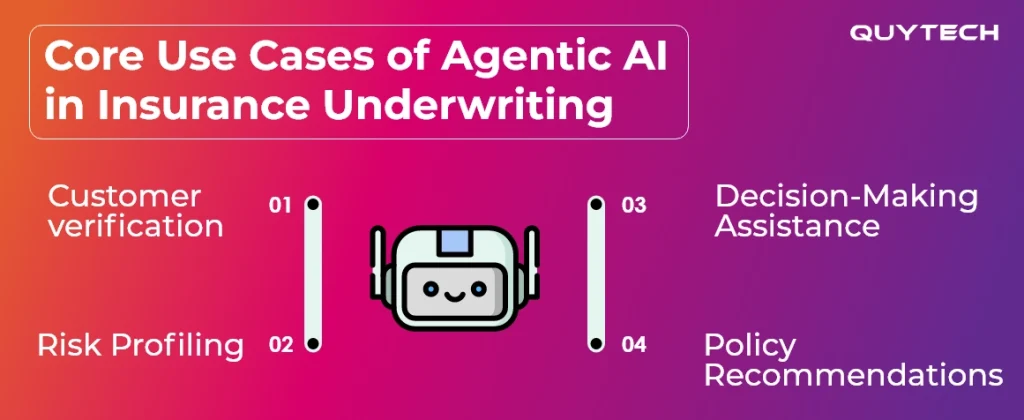

Core Use Cases of Agentic AI in Insurance Underwriting

Understanding a concept without proper applicative knowledge is like filling a leaking pot. So here’s a dedicated explanation of the core use cases of agentic AI in insurance underwriting. This will help you understand how and where agentic AI is actually implied in the process of insurance underwriting:

Customer verification

- In the beginning stages, where applicants apply for insurance policies, agentic AI is used for speedy verification.

- It helps in gathering customers’ data from varied sources, cleaning and organizing it for easy processing.

Risk Profiling

- Agentic AI is capable of catching what the human eye could miss. It makes use of machine learning algorithms to analyze data patterns.

- With the help of anomaly detection, it can identify unusual patterns from data and flag them to reduce potential losses.

Decision-Making Assistance

- The data is not analyzed to just detect unusual patterns; agentic AI offers insights through its observations.

- These observations are utilized to make informed data-backed decisions for insurance companies.

Policy Recommendations

- By knowing the requirements and risk factors behind insuring an applicant, an insurer can offer policies that benefit both parties.

- This will help insurers determine the conditions of the policy, the premium, and the legal requirements for insuring the applicants.

Similar Read: AI in Insurance Claim Processing: Cut the Costs, Fraud, and Delays

Challenges and Ethical Considerations

While implementing agentic AI in insurance underwriting brings its own sweet to the plate, the challenges of implementation add spice to it. But we’ve got your back! Here are some challenges, along with the considerations that can help you clear these hurdles:

Implementation Costs

A big hurdle that many companies face is the cost of implementing agentic AI in insurance underwriting. It makes companies hesitate in investing. While the fear of large investments is genuine, the returns that agentic AI brings in are worth it. If companies still resist investing in agentic AI, they can opt for cloud-based and pre-built solutions, as they cost less comparatively.

Integration with Legacy Systems

A challenge that often surfaces when companies try to implement agentic AI in insurance underwriting is incompatibility. Many organizations have outdated existing systems. These systems fail to support the sophisticated agentic AI systems successfully. Insurance companies facing this issue can opt for gradual integration plans or API-based integration.

Resistance to Change

When integrating agentic AI in insurance underwriting, companies might face resistance to change from employees. This is usually due to a lack of proper awareness. This creates doubts in their minds, leading them to feel that the technology threatens their position. To deal with this, businesses should train and educate their employees about how technology is there to assist them.

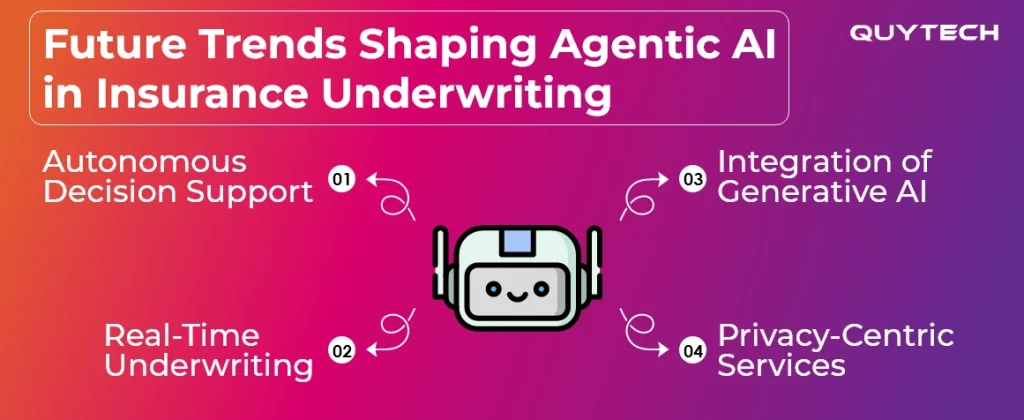

Future Trends Shaping Agentic AI in Insurance Underwriting

Technological trends are not limited to certain capabilities; they are adaptive. Similarly, agentic AI for insurance underwriting will also evolve and serve this dynamic market. Let’s dive deeper and explore the future trends shaping agentic AI in insurance underwriting:

Autonomous Decision Support

With automation already shining, autonomous decision support will be seen as a major component in insurance underwriting. Agentic AI will introduce this ecosystem where all the tasks will be carried out by it without depending much on human operators. Multi-agents will be the core players who will autonomously make decisions based on the situations they encounter.

Real-Time Underwriting

While the current agentic AI-powered insurance underwriting has already reduced the processing time, the future holds more potential. The upcoming trends will introduce real-time underwriting. This transformation will be powered by IoTs, real-time analytics, and many other smart technologies.

Integration of Generative AI

The future holds generative AI integration for insurance underwriting. This trend will introduce the use of generative AI to simulate insurance underwriting situations. Here, gen AI will prepare insurance companies to prepare for different risk assessment tasks, market changes, etc.

Privacy-Centric Services

It’s known already that the process of insurance underwriting requires handling applicant data. In a traditional setting, applicants’ sensitive data is often revealed during risk assessments. The future holds privacy-centric services in insurance underwriting. This will allow data transfers without revealing sensitive information.

Building the Future of Insurance Underwriting with Quytech

When the question of who to choose to implement agentic AI in insurance underwriting arises, the answer is Quytech. With over 14 years of market presence in building customized solutions, we believe in delivering agentic AI solutions tailored to fit your insurance business.

Our deep understanding of the insurance sector is what adds quality to our agentic AI software. We emphasize creating solutions with customization, practicality, scalability, and compliance at their core. With a team that communicates every step without fail, we don’t just develop agentic AI solutions, but also a sense of trustworthiness.

Summing Up

By blending technology and human expertise, the insurance underwriting processes are undergoing a much-awaited transformation. With technologies like multi-agent systems, ML, predictive analytics, and much more, agentic AI is on a mission to redefine insurance underwriting processes.

Transforming the slow and tedious process, insurance underwriting with agentic AI brings in much more than automation. It drives overall growth by saving costs, enhancing accuracy, productivity, and user experience. In conclusion, implementing agentic AI is the step that can help insurance providers become the next big industry leaders.

FAQs

No, agentic AI does not replace human underwriters. Instead, it assists them by taking over the monotonous tasks. This gives them time to work on more strategic tasks.

Yes, agentic AI can work with existing underwriting systems. This can be done by following API-based integration practices.

Agentic AI does not require very frequent training and updates as it learns from every task it carries out. Apart from this, legal updates are done to ensure the system keeps up with legal compliance.

Yes, you can implement agentic AI for insurance underwriting even if you don’t have a tech team. This can be done by partnering with an agentic AI development company or by hiring developers.