A Business Wire report highlights that 99% of organizations have lost about $414,000 to AI-driven fraud attacks. Sounds quite concerning, right? But what’s more concerning is that many organizations still rely on manual fraud detection methods and are more vulnerable to such attacks

Traditional fraud detection methods do offer protection against fraud to some extent, but they are no longer sufficient to withstand evolving fraud tactics. And the key pain point is the reactive approach, which acts after damage is already done.

This is where AI agents for fraud detection come into play. They transform the reactive approaches into proactive ones. Fraud detection AI agents go beyond pre-defined rulebooks to not just detect fraud, but also take corrective actions.

But how do intelligent agents do all that? In this blog, we will walk you through everything, from the basic definition and working mechanism to the benefits and use cases.

What are AI Agents for Fraud Detection

AI agents for fraud detection can be defined as intelligent software that proactively detects fraud and responds in real-time. As is obvious, they are powered by artificial intelligence and have contextual awareness. Meaning, they can understand situations, evaluate alternatives, make decisions, and take actions all by themselves.

The core technologies that power these sparkling capabilities include machine learning, predictive analytics, anomaly detection, etc. Now, let’s explore some core features to get a better understanding of fraud detection AI agents:

1. Behavioral Analysis

Behavior analysis understands how users, accounts, or systems usually work. It can differentiate between normal and abnormal activities and flag when anomalies are detected.

2. Real-Time Detection

Real-time detection identifies fraudulent activities as they take place. It doesn’t wait for an incident to happen; instead, it flags anomalies at the earliest to avoid damage.

3. Response Automation

Intelligent agents for fraud detection do not stop at identifying fraud. They understand the context and take corrective action. Like, if a user is behaving abnormally, AI agents can restrict their activity to prevent possible damage.

4. Adaptive Learning

Adaptive learning enables fraud detection agents to upgrade their performance over time. Meaning, they learn with every incident and interaction they have with users, devices, and systems. In simple terms, it can be said that every time they function, they become better than before.

Why Fraud Detection is Shifting towards AI Agents

Fraud detection is shifting towards AI agents because fraud tactics are becoming complex for traditional systems to handle. The limitations of rule-based systems and reactive approaches make fraud detection slow and inconsistent. Let’s understand these challenges in detail:

1. Increasing Complexity of Fraud Patterns

Organizations are adopting AI agents because fraud tactics are evolving rapidly. They have become so sophisticated that many times traditional systems cannot even detect them. Naturally, to deal with modern fraud, organizations would need modern solutions.

2. Limitations of Rule-Based and Manual Systems

As is obvious, manual fraud detection systems have many shortcomings. They heavily rely on pre-defined rules, and are also time-consuming. They lack practicality in today’s times because if a fraud tactic, apart from what’s defined, occurs, these systems can’t detect it.

3. Reactive Response Approach

Traditional fraud detection methods follow a highly reactive approach. Meaning, they react after fraud already happened and damage is done. This reactive approach raises questions for the effectiveness of a fraud detection system because it’s not preventing fraud; it’s just reacting to it.

4. Lack of Accuracy

Conventional fraud detection lacks accuracy. This is because it is bound by numerous rules and is handled manually. It adds to the task list because frauds need to be detected while abiding by the rules, which can lead to false positives or overlook actual fraud.

People Also Like: Use Cases of Agentic AI in Enterprise Businesses

How are AI Agents Transforming Fraud Detection

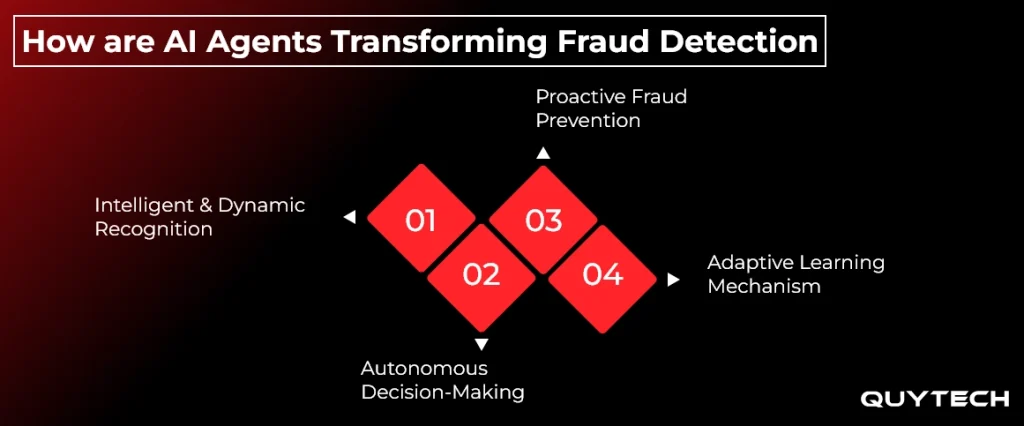

AI agents are transforming fraud detection but turning its reactive approach into a proactive one. They bring intelligence and dynamicity in fraud recognition. But the transformation doesn’t end here. Here’s a detailed explanation of abilities that are redefining fraud detection:

Intelligent and Dynamic Recognition

AI agents for fraud detection are equipped with intelligent and dynamic recognition capabilities. This means that it’s not rule-based like the traditional ones. Instead, it can change its approach to detecting fraud as needed in the situation.

Autonomous Decision-Making

AI-powered fraud detection agents are capable of making their own decisions. They do not rely on manual assistance for every step. These agents can take corrective actions by themselves when they flag abnormalities. What’s truly amazing is that if they aren’t sure about a decision, they reach out for human assistance.

Proactive Fraud Prevention

Unlike traditional systems, fraud detection AI agents do not follow a reactive approach. They don’t sit waiting for damages to take action. Instead, they proactively look for signs of threats and flags and prevent them from causing damage.

Adaptive Learning Mechanism

Intelligent fraud detection agents have an adaptive learning mechanism. This helps them learn from every task they execute and every interaction they have. It enables them to enhance their accuracy and output regularly.

Recommended For You: Top 6 Challenges in Deploying AI Agents: A Technical Guide

How Do AI Agents Detect Fraud

AI agents detect fraud by collecting activity data and analyzing it. They compare real-time data with defined fraud activities as well as historical data to flag fraud. Here’s a step-by-step explanation of how AI agents detect fraud:

Step 1: Data Collection and Processing

The process of AI agent-powered fraud detection begins with data collection. Data from different sources is collected and cleaned, like login activity, transaction details, account behavior, etc.

Step 2: Analysis and Comparison

Once processed, data patterns and behavior are analyzed. The activities that are currently taking place are compared to historical ones.

Step 3: Anomaly Detection

Post-historical data comparison reveals anomalies. Just because an activity is out of the norm, it doesn’t automatically become fraud. So this stage goes a step beyond. It analyzes flagged areas and looks for common patterns or correlations.

Step 4: Real-Time Response Decision

After identifying the fraudulent activity, AI agents begin the real action. They make response decisions by analyzing the risk levels, corrective measures, and are executed in real-time.

Step 5: Continuous Learning

The process of fraud detection does not end just here. Since intelligent agents have adaptive learning capabilities, they utilize every incident to enhance their performance.

You Might Also Like: AI-Powered SOC Agents: The Future of Automated Threat Detection and Response

Benefits of Using AI Agents for Fraud Detection

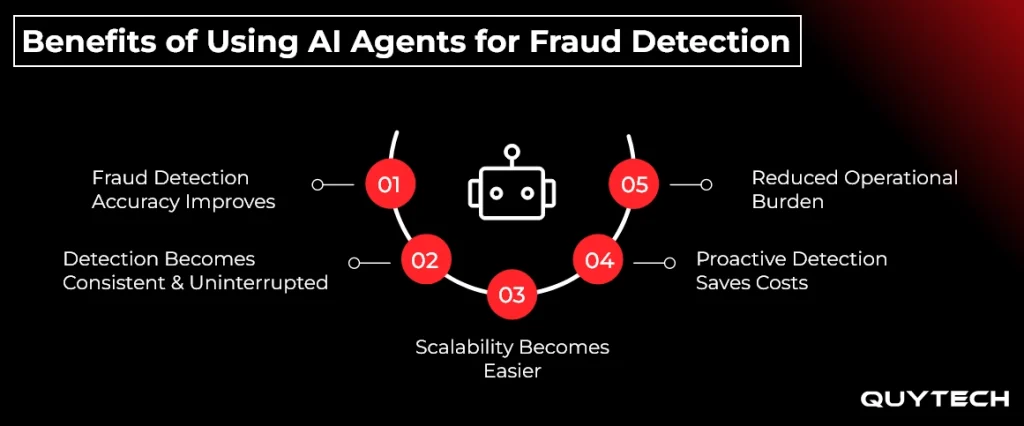

Utilizing AI agents for fraud detection benefits organizations in numerous ways. They improve the accuracy of fraud detection and make scalability achievable. But that’s not all. Here’s a dedicated section explaining the benefits of fraud detection AI agents:

1. Fraud Detection Accuracy Improves

Implementing AI agents improves the accuracy of fraud detection. They do not flag an activity or user as fraud just because they don’t fit a certain image of a normal activity. Intelligent agents analyze historical data, current activity, and correlations between flagged areas to conclude them as fraud.

2. Detection Becomes Consistent and Uninterrupted

Fraud detection AI agents do not depend on human assistance. They function even when humans get off work. They work around the clock and do not get tired or take breaks, which is the reason why fraud detection is more consistent when done using AI agents.

3. Scalability Becomes Easier

In the traditional scenario, scaling fraud detection meant increasing the headcount. But since AI agents do not rely on human assistance, they eliminate the need for hiring more people. These agents can handle large numbers of accounts and activities without affecting the quality of detection activities.

4. Proactive Detection Saves Costs

Intelligent fraud detection agents save costs. How? Well, AI agents can detect fraudulent activities at the earliest stage. You can also say that it can predict fraud, which naturally helps organizations prevent it. And since it’s prevented, organizations save costs that would have otherwise been lost to fraud.

5. Reduced Operational Burden

As mentioned earlier, AI agents do not depend on human assistance for every step and stage of fraud detection. They can automate activities and seek assistance when needed. This reduces operational burden off human agents, as if AI agents were not implemented, they would need to conduct fraud detection manually.

Interesting Read: AI Agents for Intent Recognition: How They Understand What Users Really Want

Real-World Use Cases of Fraud Detection AI Agents

Now you know how AI agents for fraud detection work, but how do they actually apply to real-world scenarios? If that’s what you’re thinking, then your wait is over. Here are some real-world use cases of fraud detection AI agents:

Banking

1. Real-Time Transaction Monitoring

In the banking sector, AI agents for fraud detection play their role by monitoring transactions in real-time. They look for abnormal patterns like the frequency of transactions or spending behavior.

2. Account Behavior Supervision

Apart from transactions, fraud detection AI agents also supervise account behavior. This helps to keep a check on individual accounts and prevent identity theft fraud.

3. Card & Loan Fraud Detection

AI agents prevent card and loan fraud by identifying borrower data, document authenticity, manipulated records, etc.

Insurance

1. Claim Assessment

In the insurance segment, AI agents are used to assess the risks of insuring a customer. They analyze documents, past insurance records, etc., to check for gaps before providing insurance.

2. Pattern-Based Fraud Detection

AI agents also detect pattern-based fraudulent activities. They go through past claims to see if the customer data reflects trends of claims related to similar events or accident types.

Legal

1. Document Fraud Detection

AI agents for fraud detection, when applied to the legal field helps in identifying document fraud. They can detect information forgery, alterations, and inconsistencies.

2. Compliance Monitoring

Compliance monitoring is another area where AI agents play an important role. They can flag areas where compliance requirements are not met and help organizations prevent legal penalties.

3. Financial Misconduct Tracking

Fraud detection AI agents can also track financial misconduct. They can analyze financial records, track fund usage, and highlight points where embezzlement is being practised.

Healthcare

1. Prescription Analysis

Intelligent fraud detection agents can analyze medical prescriptions and detect misuse, over-prescription of medicines, etc.

2. Medical Billing Fraud Detection

Another application of AI agents in healthcare includes medical billing fraud detection. Intelligent agents analyze insurance claims and medical prescriptions. They can highlight mismatches in medical results and inflated bill amounts.

E-Commerce

1. Payment Fraud Prevention

In E-commerce, fraud detection AI agents play their role by detecting and preventing payment fraud. They compare payment methods with normal behavior, like device, location, etc.

2. Order and Return Fraud Detection

AI agents also detect fraud by assessing order and return behavior. They look for patterns from not just one but all the orders and return requests that the user raises.

3. Fake Account Detection

Fraud detection AI agents can detect fake accounts as well. They can trace account creation speed, the legitimacy of credentials, and order-placing behavior. For example, AI agents can flag activities such as placing bulk orders right after account creation.

Read More: The Rise of Voice AI Agents: Revolutionizing Support and IVR Systems

Challenges and Best Practices for Implementing AI Agents for Fraud Detection

Implementing AI agents can be seen as a means of bringing accuracy and intelligent automation to traditional fraud detection systems. But like any other journey, this one brings ups and downs as well. But this section will guide you through them. Here are some challenges and best practices for implementing AI agents for fraud detection:

1. Complex Integration with Existing System

Integrating fraud detection AI agents with existing systems can be quite complex. This is because AI agents are sophisticated technology, and existing legacy systems may not blend in with them.

Best Practices

Organizations can opt for API-based integration to overcome integration challenges. This allows AI agents to work with existing systems without disrupting fraud detection.

2. Insufficient Data Availability and Quality

AI agents require data to work effectively. If organizations do not have sufficient and quality data, implementing AI agents for fraud detection might lack accuracy and the ability to deal with evolving fraud.

Best Practices

Organizations can overcome data-related challenges by following data governance practices. This will allow them to manage their data resources better and tap into the potential of fraud detection AI agents.

3. Lack of Transparency

Now, we know that AI agents can make their own decisions. But this capability often creates a sense of uncertainty. Why? Because AI agents do not explain what influenced them to arrive at a decision.

Best Practices

Implementing explainability in fraud detection AI agents can help organizations address this challenge. Explainability helps AI agents make decisions and provide relevant reasoning for them, naturally creating transparency and building trust.

How Quytech Helps Organizations Modernize Fraud Detection with AI Agents

Quytech helps organizations modernize fraud detection by helping them bring their AI agent vision to life. We bring in-depth knowledge and expertise in technologies like machine learning, behavioral analytics, and decision orchestration. This helps us build AI agents that don’t just automate fraud detection, but take action in real-time.

We understand the real-world challenges that organizations face when it comes to fraud detection, which is why we put special emphasis on developing practical AI agent solutions. Not just practicality, but we strongly believe in building scalable and custom AI agents that go and grow with the organization’s needs.

Conclusion

Fraud tactics are no longer sloppy like they used to be. They have evolved and are so sophisticated now that traditional methods can no longer catch them. But with fraud detection AI agents, organizations can detect fraud at the earliest stage. These agents are intelligent, which enables them to go beyond fixed rules.

They can make decisions without human dependence, proactively prevent fraud, and even learn from every incident. Apart from these features, intelligent agents make scalability easily achievable. Hence, we conclude that AI agents are not just an upgrade to traditional systems, but the real definition of smart fraud detection.

FAQs

A major ethical challenge in fraud detection using AI agents is bias. When trained with incomplete datasets, AI agents can make decisions that may reflect unfairness. However, this challenge can be addressed by training agents on diverse datasets.

No, AI agents do not replace human analysts. Instead, they reduce the workload of human analysts by automating monitoring and other repetitive tasks.

Yes. Small businesses can use AI agents for fraud detection. They can opt for small-scale fraud detection agents. This can help them implement agents without investing in enterprise-scale systems.

Yes, AI agents can adapt to new types of fraud automatically. They are adaptive and learn from every incident and interaction they have.

Yes, you can implement AI agents for fraud detection even without a technical team by partnering with an AI agent development company or hiring developers.

Yes, AI agents do comply with regulatory requirements if designed to do so. If compliance is enforced throughout the development process, AI agents would automatically ensure that fraud detection is carried out while being compliant.

AI agents are autonomous, but for areas where they feel their decision might not be right, they seek human approval. This maintains a balance and prevents agents from making wrong decisions.