Data is the new currency for businesses, and industries like insurance receive it in abundance from almost every process, including underwriting, claims processing, and customer service. Now, this data needs to be processed to extract useful information. Doing it manually is next to impossible; using traditional data analytics methods only tells what happened, why it happened, and what might happen next.

With the rising competition in the insurance sector, knowing only these three things is not sufficient. An organization should have a smart tool or technology that can automate data analytics tasks, make independent decisions, learn from historical data, perform cognitive functions, and improve itself autonomously based on the feedback received.

That’s when AI data analytics enters the picture. AI data analytics in insurance focuses on analyzing data and training AI models on that data to fetch intelligent insights, recommendations, and predictions with no manual intervention at all!

Isn’t it sound amazing? Why not explore more? Dig deeper into this blog to learn about how AI transforms data analytics for insurance, its benefits, key technology that sets the foundation, use cases of AI data analytics in insurance, and a lot more.

What is AI Data Analytics in Insurance

AI data analytics in the insurance sector is clubbing AI technology with conventional data analytics methods to obtain faster, intelligent, and next-level predictive insights from business data. It utilizes AI technologies, such as NLP, predictive modelling, and machine learning for data (both structured and unstructured) analysis, patterns and anomalies identification, future trends and events forecasting, and data-driven decision-making.

AI-Powered Data Analytics in Insurance: Market Statistics

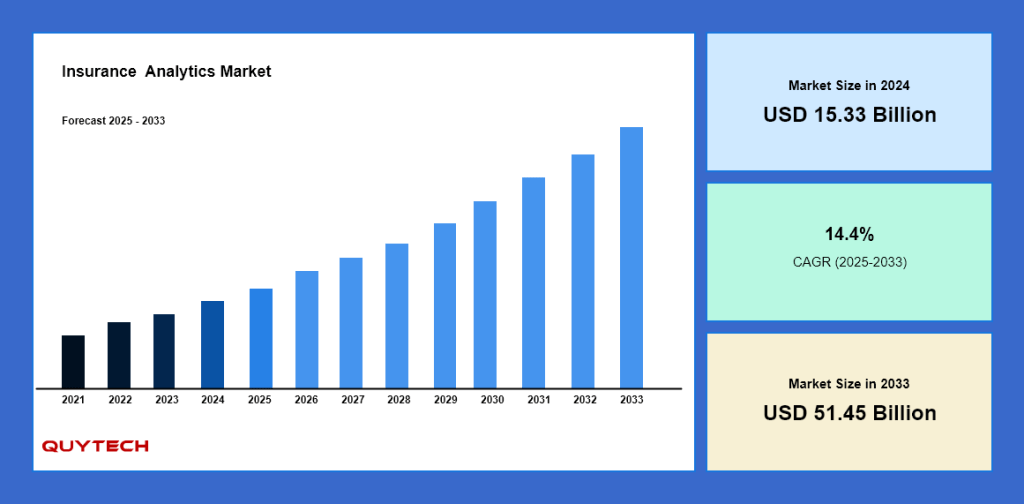

Before exploring further about the areas where AI data analytics can do wonders, let’s take a look at some of the interesting statistics:

- The global market size for insurance analytics was USD 15.33 billion in 2024 and is projected to reach USD 51.45 billion by 2033.

- The market is anticipated to grow at a compound annual growth rate (CAGR) of 14.4% over this period.

- Surge in fraud, the need to adhere to government regulations, and rising competition are some of the driving forces behind the growth of AI data analytics in insurance.

- North America captures the largest market share for insurance data analytics. Insurance firms utilize data analytics to evaluate possible risks and improve policyholder security.

How Traditional Data Analytics Differ from AI Data Analytics in Insurance

Data analytics was already serving the purpose, so why do insurance companies require AI data analytics? Take a look at this table to understand the difference between the two. It will clear all your doubts regarding the implementation of artificial intelligence-powered analytics in insurance.

Traditional Data Analytics Vs. AI-Powered Data Analytics in Insurance

| Aspect | Traditional Data Analytics in Insurance | AI Data Analytics in Insurance |

| Approach | Follows a rule-based approach and involves manual analysis of historical data | ML-based approach to learn from data patterns and adjust automatically. |

| Scope | Offers what happened and why it happened | Provides prescriptive and predictive analysis about what will happen and what should be done |

| Speed | The conventional way is slower and can work on structured and simple data. | AI data analytics is faster and capable and can efficiently work on structured, semi-structured, and unstructured data of any complexity. |

| Decision-Making Ability | Completely dependent on human analysts to interpret data and take action. | Completely automated for processing data and providing insights, making decisions, and offering recommendations. |

| Scalability | Needs more human analysts to scale | Can be seamlessly scaled as the data evolves |

| Example | Analyzing the number of claims filed in Q1 | Predicting which customers are most likely to file a claim in Q2 and why |

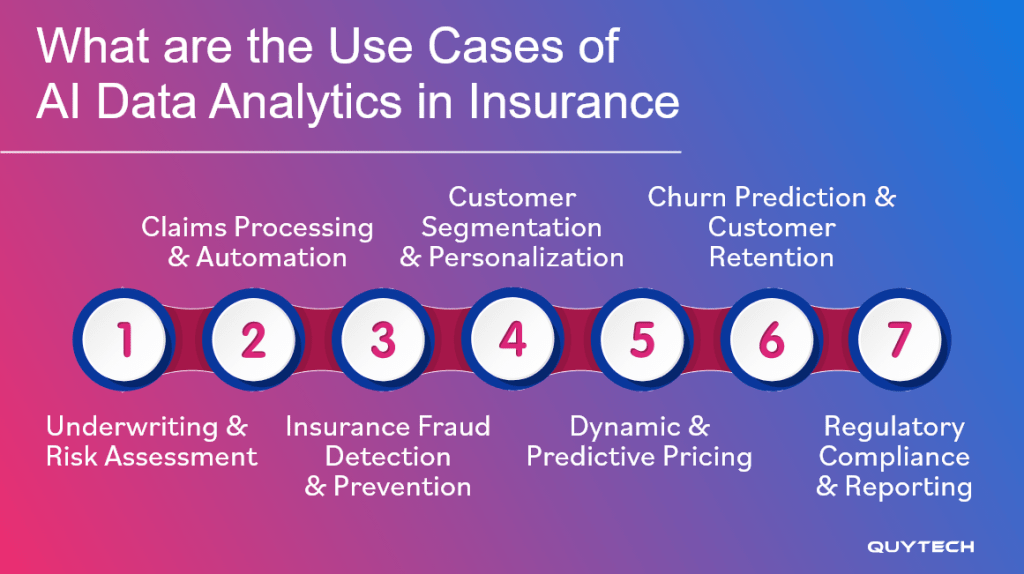

What are the Use Cases of AI Data Analytics in Insurance

Now that you know enough about artificial intelligence-powered data analytics in insurance, let’s check out the areas where AI data analytics can be applied in insurance:

- Underwriting & Risk Assessment

One of the biggest applications of AI data analytics in insurance is that it enhances underwriting by auto-analyzing customers’ credit scores, lifestyle patterns, and medical history. With data analytics in insurance underwriting, insurers can predict risks with great precision. Two major technologies that play a pivotal role in this are machine learning and predictive analytics.

- Claims Processing and Automation

The second key use case of AI data analytics is that it automates claim submission, claim settlement, and claims processing to expedite the entire process and save time, effort, and costs. It utilizes computer vision, OCR, NLP, and RPA to auto-extract data from documents for validating claims and identifying anomalies.

- Insurance Fraud Detection and Prevention

Both artificial intelligence and data analytics, when they join hands, can detect suspicious claims by analyzing the policyholder’s behavior and finding inconsistencies in real-time. Anomaly detection, deep learning, and behavioral analytics are three key technologies that make this happen.

- Customer Segmentation and Personalization

The next amazing application of AI data analytics in insurance is that it can assess demographic, behavioral, and transactional data of customers to segregate them and help insurers build personalized insurance and pricing plans. Machine learning, clustering algorithms, and predictive modeling are the technologies that work in the background for this use case.

- Dynamic and Predictive Pricing

With AI data analytics, insurance firms can automate the process of building pricing strategies and real-time premium adjustments. It considers data from wearables, driving behavior, health records, and market conditions to dynamically adjust policy prices.

- Churn Prediction and Customer Retention

Artificial intelligence-driven data analytics can efficiently predict the chances of a policyholder who might leave or not continue with the policy. Insurers can use this data to take proactive retention measures. Predictive analytics, ML classification models, and sentiment analysis are used in this use case.

- Regulatory Compliance & Reporting

For any insurance company, adhering to regulatory compliance is non-negotiable. Integrating AI data analytics in insurance automates compliance processes to ensure adherence to the defined regulations and generates reports. Rule-based AI, NLP, and document AI take the charge to make this happen.

Read More: The Role of AI in Insurance: Notable Use Cases and Industry Changes

Which AI Technologies Empower Data Analytics in Insurance

To upgrade data analytics, various AI technologies run in the background. Each of these technologies serves different purposes. Let’s learn about them in detail:

- Machine Learning: It makes the AI data analytics solution capable of learning from historical insurance data to improve accuracy in predictions. It also helps in building pricing policies, predicting claim volumes, and evaluating customer risk profiles.

- NLP: Natural language processing enables AI-driven data analytics solutions for insurance to analyze various types of data from multiple sources to extract crucial insights.

- Predictive Analytics: This technology enables AI data analytics systems capable of forecasting future events, like customer churn chances, fraud risks, and others, to facilitate proactive decision-making.

- Deep Learning: Deep learning ensures that AI data analytics is capable of processing datasets in different formats, including images, audio, and text. This expedites claim processing, anomaly detection, and customer behavior modeling.

- Computer Vision: This AI technology is used to understand visual inputs for real-time claim validation and asset inspection for minimized turnaround time and highly accurate outputs.

- Speech Recognition and Voice AI: With voice-based artificial intelligence, AI data analytics systems can transcribe, comprehend, and respond autonomously to customer queries via IVR systems and other sources.

You may like to read: Generative AI in Insurance: Key 10 Use Cases and Benefits

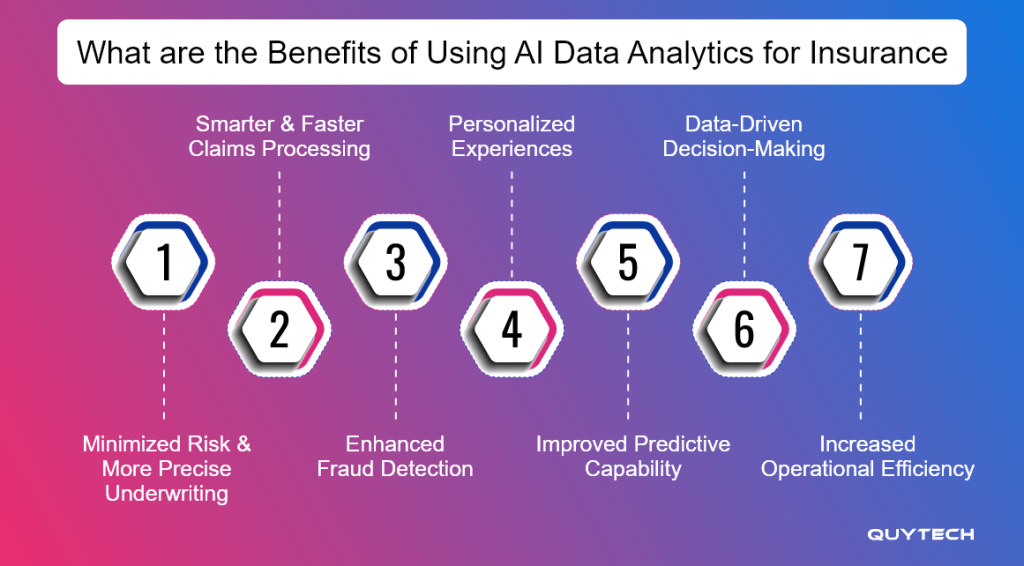

What are the Benefits of Using AI Data Analytics for Insurance

AI-powered data analytics in insurance empowers insurance organizations to adopt a predictive and proactive approach, which further minimizes risks, ensures accurate underwriting, facilitates

smarter claims processing, and offers other amazing benefits. Let’s read them in more detail:

- Minimized Risk and More Precise Underwriting

AI and data analytics, when used together for the insurance domain, can minimize risks by analyzing historical as well as real-time data to provide crucial insights. Based on these insights, insurance firms can offer personalized premiums and enhance portfolio profitability.

- Smarter and Faster Claims Processing

With AI data analytics, insurers can expedite claims processing. These technologies automate document verification, damage assessment, and fraud detection. Automation speeds up claim processing without any errors. It also boosts operational efficiency and customer satisfaction.

- Enhanced Fraud Detection

With AI data analytics in insurance, it becomes easy for insurance companies to enhance fraud detection by identifying abnormal patterns in large datasets. AI data analytics can analyze customer data to learn new fraud tactics and mark suspicious activities for fraud prevention.

- Personalized Experiences

Every sector, including insurance, benefits immensely from personalization. For this, it is necessary to have an understanding of each customer’s behavior, preferences, and life events. AI data analytics can help insurers get these insights.

- Improved Predictive Capability

Conventional data analytics can give only basic predictions, while AI data analytics can forecast future claim volumes, customer churn, and other high-risk events. This empowers insurance companies to optimize resource allocation and forecast future events and demands.

- Data-Driven Decision-Making

By implementing AI and data analytics or AI-powered data analytics, insurance providers can identify customer needs and learn about market gaps. Using the identified patterns, they can improve their offerings and expand into new markets.

- Increased Operational Efficiency

Automation of critical insurance operations, including risk and credit scoring, report generation, and data entry, enhances operational efficiency, minimizes dependency on human resources, and reduces costs.

Top Insurance Companies Leveraging AI-Powered Data Analytics: Real-World Examples

Check out AI data analytics in insurance examples, i.e., top companies that are using AI-powered data analytics to serve diverse use cases in insurance:

Allianz

This world-renowned insurance company uses AI-driven analytics to automate critical insurance processes, such as processing claims and detecting insurance fraud. These technologies analyze humongous datasets to flag suspicious patterns and automate tasks to expedite claims processing.

AXA

AXA, the popular French multinational insurance corporation, leverages AI data analytics for predictive modeling. With this, the company forecasts claims volume and manages risks with accuracy and efficiency.

MetLife

MetLife utilizes AI-driven data analytics to streamline its operations, including employee benefit management, predictive underwriting, and real-time customer services. The company has implemented it across all its key insurance functions.

How to Implement AI Data Analytics in Insurance with Quytech

Implementing artificial intelligence-powered analytics in insurance is no easy feat. It requires thoroughly analyzing pain points or areas of improvement, an in-depth understanding of the insurance sector, preparing relevant and clean data, and the right AI data implementation strategy.

You get all this by partnering with Quytech, an experienced AI data analytics services and solutions provider with all these qualities. Here is how we have helped over 50 insurers and will continue to empower insurance companies to implement AI data analytics for diverse use cases:

- Understand Your Business Objectives

The first thing we do is analyze your insurance business processes to identify the gaps or opportunities that can be grabbed with AI data analytics implementation. We also understand the goals, such as fraud detection, automating claims processing, customer segmentation, dynamic pricing, risk scoring, churn prediction, and underwriting automation, that you want to achieve with this implementation.

- Evaluate the Readiness of the Data

Our team of AI professionals and data experts then assesses data readiness by analyzing your existing data sources, quality, and structure. In case it requires any improvement, our team implements robust techniques to modernize your business data.

- Develop Custom AI Models

Our experts then design tailored AI models and train them on your specific business data to deliver desired outcomes like detecting anomalies, preventing fraud by identifying suspicious activities, extracting crucial insights, and others.

- Integration with Your Existing Infrastructure

The next step we follow is to implement AI data analytics into the CRM, ERP, Claims Management, Policy Systems, and other tech infrastructure that you are using. We ensure seamless integration without disrupting the data flow.

- Test and Monitor

After the successful integration of AI data analytics, we run multiple tests to verify its performance based on defined metrics, which could be prediction accuracy, processing ROI, operational efficiency improvement, and others. With continuous monitoring, we ensure your AI data analytics solutions remain updated and trained on evolving data.

- Scale and Optimize

Once the AI data analytics solution or implementation of AI-driven data analytics in insurance processes starts to deliver value, we empower insurers to scale it across different departments and processes.

Also Read: Insurance Mobile App Development: Expert Insights!

Final Words

With increasing operational complexities and customers’ expectations, and the rising risks of fraud, the insurance sector is adopting AI data analytics at an unprecedented rate. AI-powered data analytics goes beyond traditional data analytics and enables insurers to assess risks with greater precision, offer personalized insurance policies, detect fraud in real-time, and ensure intelligent claim processing.

To make the most of AI-powered data analytics, insurance companies can either choose to upgrade their existing infrastructure with AI data analytics implementation or simply build such a solution from zero to one by connecting with a reputable and trusted data analytics solution development company.

FAQs

Major use cases of data analytics in insurance include risk assessment and underwriting, fraud detection, telematics, customer segmentation, claims processing, and personalizing customer experiences.

AI data analytics in insurance of AI in insurance analytics relies on structured data such as customers’ profiles, policy information, and claims history. It also considers unstructured data like emails, conversation logs, images, and others to train the AI model.

The cost for this depends on the size and type of data, operational complexities, the particular use case you wish to achieve with AI data analytics implementation, and a few other factors.

Yes, it is. Insurance companies of any size can make the most of AI data analytics, provided the company has sufficient data to train the AI models for any specific use case.