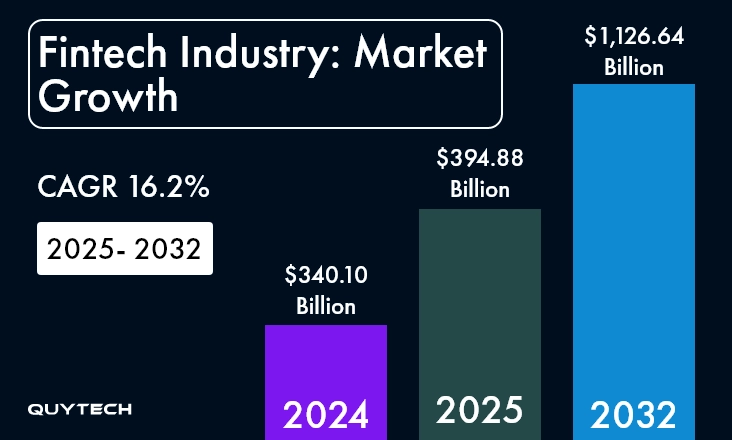

The world of fintech (finance + technology) has been evolving at an unprecedented rate, with its market anticipated to grow from USD 340.10 billion in 2024 to USD 1126.64 billion by 2030. These statistics clearly depict that now is the right time to invest in fintech software.

However, building the same is not child’s play. Custom fintech software development requires identifying your exact needs, deciding which type of finance software and technology integrations would fulfill them, and then following the correct series of steps.

Apart from these, knowing its costs and the value you will receive from software development for fintech is equally important. If you, too, are planning to invest in a fintech app or solution, this blog is for you. It provides you with answers to all these questions by thoroughly explaining the benefits, use cases, types, cost, development process, and much more about fintech solution development.

Without further ado, let’s begin!

What is Fintech: Definition and Market Statistics

Integrating top technologies like AI, blockchain, cloud, and data analytics into financial technology makes Fintech. The aim of fintech is to automate financial services and meet evolving customer expectations. It also improves speed, transparency, and accessibility to financial services.

Traditional finance management solely relies on human resources and provides similar services to all users. But, with custom fintech software development, which includes creating mobile banking solutions, digital wallets, and others, financial organizations can bring intelligence while delivering unparalleled and personalized experiences.

Fintech Stats and Market Snapshot (2026 Outlook)

Driven by the increasing demand for cashless transactions (especially after the pandemic), integration of AI automation, and open banking regulations, the fintech market is growing exponentially.

- According to KPMG, the industry has witnessed a significant focus on AI-powered fintech or the transformation of existing financial solutions with AI integration.

- Some fintech software dominating this industry are digital banking solutions, electronic payment solutions, and regtech. AI-powered risk management solutions are also in demand.

- The fintech market is projected to reach approximately USD 1126 by 2032.

- Increasing adoption of AI, ML, and cloud computing is fueling the tremendous growth of this industry.

Fintech Industry: Market Growth (HEADING OF THIS IMAGE)- CAGR 16.2% Between 2025- 2032

You might be interested in: Role of Digital Payment Solutions in the Finance Industry

Why Businesses Are Investing Heavily in Fintech Software Development

The demand for software development in fintech is at an all-time high because customers expect digital-first experiences, the need for cost and efficiency is non-negotiable, companies are getting results with informed decisions, and adherence to compliance and regulations is a must. Let’s understand these reasons in detail:

1. Consumers Now Demand Digital-First Experiences

Modern customer expects a fintech company to provide real-time and effortless access to their banking information, payments, and investments. Fintech software and applications can help finance organizations easily achieve this goal.

2. Operational Efficiency and Cost Optimization are Non-Negotiable

Implementation of AI-powered fintech software accelerates fintech operations. For example, traditional ways take a few days or sometimes a week for the KYC/AML process, but automation finishes the same task within minutes. It enhances efficiency and reduces the overall costs.

3. Informed Decision-Making is the Need of the Hour

Advanced analytics provided by artificial intelligence and machine learning processes financial data to offer predictive insights. Financial institutions can use these insights for multiple use cases or applications, including evaluating credit-related risks, building and sharing personalized offers, and detecting fraud.

You may want to read: How AI is Transforming Fraud Detection in Digital Transactions

4. Compliance and Transparency Build Trust

Adherence to compliance and regulations is non-negotiable in fintech organizations. Custom fintech solution development can make this easy, as they are built with frameworks such as

PCI, DSS, PSD2, and GDPR.

5. Organizations Need Scalable Systems for Future Readiness

Fintech software development, when done by an experienced and trusted fintech app development company, ensures that the created solution is scalable and adaptable. They do this by choosing the most suitable cloud architecture and API-based integrations.

Types of Fintech Software You Can Build in 2026

If you know your exact business requirements and have already made up your mind to build a fintech software, then you can skip this section and jump straight to the software development for fintech process. However, if you want to explore fintech software development types or ideas, then continue reading:

1. Digital Banking Platforms

Digital banking software enables neobanks and digital financial organizations to offer their customers exceptional services. For instance, they can provide real-time access to banking services without the need for establishing a physical branch. Companies like Revolut and N26 use digital banking solutions, based on the digital-first architecture, to offer a one-of-a-kind banking experience to their customers.

2. Payment Gateways and Wallets

Payment gateways and digital wallets are another type of fintech solutions that are gaining popularity in these times, and the demand for which will continue to rise in 2026. These advanced solutions are equipped with multi-currency support, tokenization, and fraud detection features to deliver an exceptional experience.

Explore in Detail: Digital Wallet App Development: A Detailed Guide

3. Lending and Credit Platforms

Lending (p2p lending platforms) and credit platforms are gaining popularity as they simplify and automate various loan-related processes. To make them stand apart from the competition, you can add automated document verification, EMI scheduling, and other amazing features. Upstart is a perfect example of lending and credit platforms.

4. WealthTech and Investment Software

Investment and wealth management solutions are also a popular type of fintech solution that you can build in 2026. With such a solution, you can provide seamless access to portfolio management and financial advisory services. To make them unique, add robo-advisors, real-time portfolio tracking, and other amazing features. Robinhood and Wealthfront are examples you can refer to.

5. InsurTech Solutions

Building an insurance software can help you manage and automate policies and claims processing. Add AI to the software and get risk analytics. For its success, integrate features like AI-driven underwriting, chatbot assistance, fraud detection, and predictive analytics. Lemonade is an example of popular insurtech solutions.

6. RegTech

RegTech is a popular type of software development for fintech. By building a RegTech solution in 2026, you can ensure compliance with evolving regulations required, especially in cross-border transactions.. Add features AML/KYC automation, compliance monitoring, transaction reporting, and audit trails to make it stand out from the competition.

7. Trading & Brokerage Platforms

Trading software and brokerage platforms offer users real-time access to markets and investment opportunities. They can even get live market feeds, access to charting tools, an analytics dashboard, and algorithmic trading. You can plan to build this type of software development for fintech in 2026.

Interesting Read: How to Develop a Stock Trading App: Step-by-Step Guide

8. Blockchain and Cryptocurrency Solutions

When it comes to exploring the types of fintech software, blockchain and cryptocurrency solutions hold a prominent place. These solutions build secure, decentralized financial systems with features like smart contracts, digital wallets, and token exchanges. Coinbase and Binance are the top examples of blockchain-powered fintech solutions.

Discover More: Guide to Multi Cryptocurrency Wallet Development

9. Accounting and Financial Management Tools

For fintech software development in 2026, you can plan to build an accounting and financial management software. Such a solution will help you track transactions, manage invoices, and maintain complete transparency among stakeholders. QuickBooks and Xero are two popular accounting and financial management software.

10. Embedded Finance Solutions

This type of fintech software can integrate financial services directly into non-financial products and platforms. Add API-driven payments, credit, and insurance features to make them different from the ones that are already there in the market. You can refer to Shopify if you are looking for an example of embedded finance solutions.

Business Benefits of Software Development for Fintech

By investing in fintech software development, businesses can reap amazing benefits in terms of enhanced efficiency, customer satisfaction, revenue, decision-making, and others. Let’s understand how:

1. Enhanced Operational Efficiency

Fintech software and applications eliminate the unnecessary burden of performing repetitive tasks from human professionals. In other words, they don’t have to make entries for payments, generate reports, and perform manual reconciliations. Now, this automation minimizes the likelihood of errors, reduces operational costs, and improves operational efficiency.

2. Better Customer Experience

Whether it is finance, banking, or any other business, the success of it is highly dependent on the satisfaction of its customers. Fintech applications and solutions with mobile-first interfaces, personalized dashboards, and AI capabilities make it easier for customers to manage their finances. This enhances customer experience and loyalty.

3. Data-Driven Decision-Making

AI-powered fintech solutions offer real-time analytics by processing large volumes of data. AI models, when integrated into fintech software or applications, also offer predictive modeling to build successful strategies. These capabilities can help businesses identify future trends and optimize their financial planning to reduce risks and improve the bottom line.

4. Compliance with Regulations

Fintech software with built-in know your customer, anti-money laundering, and other specific compliance can ensure adherence to legal requirements. With them, businesses can avoid penalties and the risk of fraud. They can even build a positive brand image, which is crucial for growth and expansion.

5. New Sources of Revenue

By building custom fintech software in 2026, a banking or finance company can generate new sources of revenue. They can monetize the application or solution with a subscription-based model, data analytics, transaction fees model, and others.

Features That Can Make Your Fintech Software Stand Apart

In 2026, building fintech software with basic features mightn’t work due to increasing competition and ever-increasing customer expectations. Therefore, it is imperative to have an idea of what such features are before beginning with software development for fintech:

1. Secure User Authentication & Identity Management

The first critical feature of software you develop for the fintech company is user authentication. For this, you can choose from various security methods, such as biometric verification, OAuth-based authorization, and multi-factor authentication. This would help to prevent unauthorized access to accounts and the chance of fraud.

2. Payment Processing and Transaction Management

To ensure the successful integration of these two, you need to build a robust payment infrastructure or integrate with reliable payment gateways. This will help to maintain transparency and security during fund transfers. It will also allow you to settle bills and manage cross-border transactions seamlessly.

3. Data Encryption & Cybersecurity

Data protection is of utmost importance in any financial organization. Therefore, implementing advanced AES and RSA encryption, TLS 1.3, and tokenization is non-negotiable. You should implement them at every layer where data exchange happens. It ensures the data associated with financial transactions, along with PII, is protected from cyber attacks like breaches and data leaks.

4. Real-time Analytics and Reporting

Another feature that a fintech application or software must have is AI-powered analytics. This will ensure that it offers real-time analytics by making the most of your business data. You, as an organization, can take advantage of these analytics, insights, and reports to track performance, revenue, and compliance metrics to make data-backed decisions.

5. Regulatory Compliance and Audit Trails

With this feature, you can equip your fintech software with built-in compliance verification. It will make sure that every process that is executed or transaction that is made complies with financial regulations. Besides, you can also automate user consent tracking, reporting, and audit trails.

6. Transaction Monitoring and Fraud Detection

The next amazing feature you should consider equipping during custom fintech software development in 2026 is real-time transaction monitoring and fraud detection. For this, rely on ML algorithms that can efficiently and accurately detect unusual transactions or spending. Also, implement anomaly detection and alert management to prevent or reduce the impact of fraud.

7. Audit Logging and Data Traceability

This feature will trace and log the entire user journey and their actions. This is highly imperative to ensure compliance audits and provide the right and lawful resolutions to disputes, if any. It will also help you maintain transparency, especially in large-stakes transactions, with stakeholders.

Apart from the aforementioned fintech software features, ensure that your software is scalable by choosing the right cloud platform. In other words, it is capable of handling large transaction volumes and the increasing number of users. Moreover, make sure the software is interoperable and can be integrated with third-party APIs and systems for instant data exchange.

Technology Stack & Architecture Patterns for Fintech Software

Before you invest in finance solution development, let’s take a look at the technologies and architecture that can build a solid foundation for the software:

| Web frameworks | React.js, Angular, Vue.js |

| Mobile platforms | Native (Swift for iOS, Kotlin for Android) or cross-platform (Flutter, React Native) for mobile-first experiences |

| Programming languages | Java, Python, Node.js, Go |

| Frameworks | Spring Boot, Django, Express.js |

| Serverless & containerization | AWS Lambda, Kubernetes, Docker |

| Databases | PostgreSQL, MySQL, MongoDB, Cassandra |

| Architecture Pattern | Microservices, Serverless, Event-Driven |

| Cloud | AWS, Azure, GCP |

Similar Read: Steps to Develop a Personal Finance Coach App Like Cleo AI

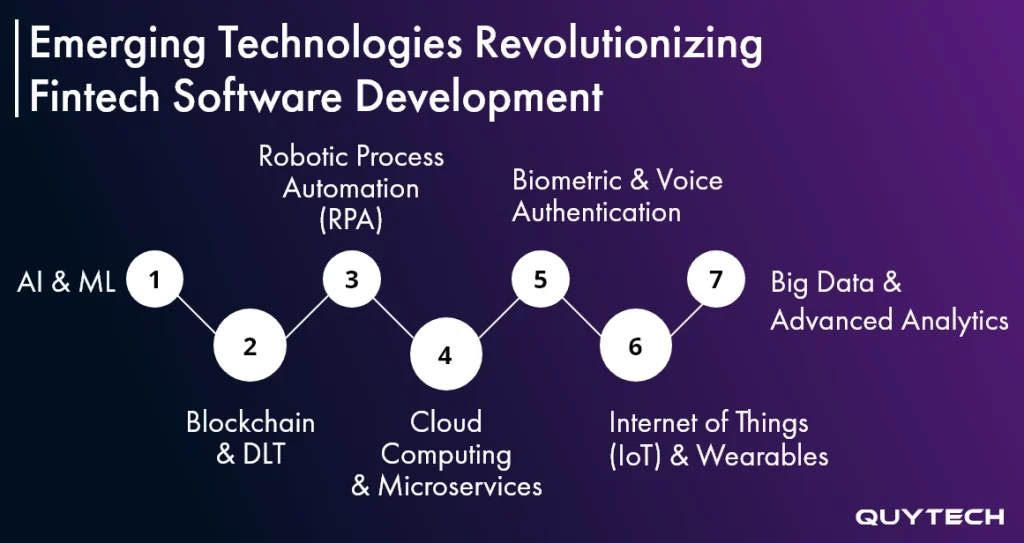

Emerging Technologies Revolutionizing Fintech Software Development

The finance industry is witnessing new advancements every day, thanks to technologies like artificial intelligence, machine learning, blockchain, robotic process automation, and others. From detecting and preventing fraud and ensuring highly secure transactions to seamless accessibility of financial services, these technologies have transformed the way financial businesses run their operations. Let’s dig deeper:

1. AI & ML in Fintech

Artificial intelligence and machine learning models can do wonders in custom fintech solutions. They can be used for detecting fraud, credit scoring, recommending personalized services, and offering round-the-clock support services. Both technologies bring automation, both in routine and complex tasks, to minimize operational costs and boost customer satisfaction.

- Fraud detection

- Credit scoring

- Personalized financial recommendations

- Chatbots

- Predictive analytics

Explore More: AI in Fintech: Critical Roles, Benefits, and Use Cases

2. Blockchain & Distributed Ledger Technology (DLT) in Fintech

Blockchain can be used to bring unmatched transparency and next-level security in financial transactions. Similarly, DLT can be used to create decentralized fintech systems that can increase the speed at which transactions happen and reduce the cost associated with them.

- Secure transactions

- Smart contracts

- Tokenization of assets

- decentralized finance (DeFi)

- Cross-border payments

3. Robotic Process Automation in Fintech

Processes like reconciliation, verifying KYCs, and generating finance-related reports consume a significant time. The implementation of robotic process automation, or RPA, can automate these processes to accelerate process execution and ensure there is no error in reports or reconciliation.

- Automation of financial operations

- KYC verification

- Report generation

4. Cloud Computing and Microservices in Fintech

These two technologies ensure that the software development for fintech is scalable and accessible from anywhere. Scalable microservice architecture also makes sure that the addition of new features can be done in no time. It also lowers the overall infrastructure costs.

- Serverless computing

- Containerization

- Seamless accessibility of fintech platforms

5. Biometric & Voice Authentication in Fintech

Biometric and voice authentication are two crucial technologies that help a financial organization build trust with its customers. They also contribute to enhancing security and keeping fraud and cybercriminals at bay. Adding fingerprint authentication, facial recognition, and voice-based authentication to your fintech software can make it future-ready.

- Fingerprint recognition

- Facial recognition

- Voice-based authentication

6. IoT and Wearables in Fintech

In 2026, we may witness fintech solution development companies increasingly use the Internet of Things and wearable technologies in fintech software to offer convenience and data-backed insights. They can be used in payment-enabled wearable devices (for instance, making a payment using your smart watch).

- Payment-enabled wearable devices

- Real-time spending tracking

- Insurance risk monitoring

7. Big Data and Advanced Analytics in Fintech

Big Data and advanced analytics for custom fintech software development facilitate real-time finance monitoring. These two technologies also work wonders in ensuring efficient risk management and segmenting customers. Investors and financial institutions can rely on them for getting predictive insights for informed decision-making and strategy building.

- Real-time financial monitoring

- Risk management

- Customer segmentation

- Informed decision-making

You might be interested in: AI Agents in Finance: Use Cases, Benefits, Challenges, and More

Regulatory & Compliance Requirements for Fintech Solution Development in 2026

It is mandatory for a fintech application to comply with the regulatory and compliance requirements. These compliances regulate how the app works, how data is stored, processed, and shared, and how transactions are executed.

Non-compliance with these requirements may require an organization to pay hefty fines and even shut down operations. It may also impact the reputation of the company. Therefore, it is essential that you know important compliances in different regions or countries before beginning with fintech solution development:

- United States: Regulations that you need to consider during software development for fintech are: FinCEN, OCC, and CFPB guidelines. Apart from these, AML (anti-money laundering) and KYC (know your customers) are also mandatory requirements. Adhering to PCI-DSS compliance is also needed.

- European Union: PSD2, GDPR, eIDAS, MiFID II, SCA (strong customer authentication) for online payments, explicit consent management, data portability under GDPR, and secure electronic signatures for eIDAS compliance.

- United Kingdom: FCA guidelines, PSD2 adoption, and open banking standards are the main considerations for finance software development.

- India: RBI guidelines, Payment and Settlement Systems Act, data localization mandates need to be complied with for custom fintech software development.

In short, regulations and compliance are totally dependent on the country and region where you want to run the fintech application or software. For example, if you are building a custom fintech software in Singapore, you need to get the Monetary Authority of Singapore licensing. For Hong Kong, refer to the HKMA regulatory sandbox for fintech innovations.

Please note that these regulations may change from time to time. Therefore, it is recommended that you check them before fintech software development.

How to Build Custom Fintech Software in 2026: 6 Easy Steps

Follow these simple steps for successful fintech solution development:

Step 1: Define Project and Regulatory Needs

The first step is to clearly mention your project requirements. Include objectives, target users, and monetization model. Also, state the regulatory requirements that are imperative for the successful development and launch of your fintech software. Now, choose the technology stack and system architecture needed for financial solution development.

Step 2: Build an MVP

Design a minimum viable product with essential features and functionalities to quickly test it among your target audience and investors. Collect feedback and begin preparing for full-fledged custom software development for fintech. Building an MVP first will minimize time-to-market and increase the chances of your software’s success.

Step 3: UI/UX Design and Development

The next step is to design a user-friendly interface with clear navigation. Follow an agile development process that provides room for immediate feedback and changes. You can also automate the testing and deployment process by creating CI/CD pipelines. Develop APIs or use custom APIs for third-party integrations of your custom finance software.

Step 4: Compliance Adherence and Security Sprints

Conduct sprint cycles to validate regulatory compliance adherence, security controls, and risk mitigation. This will eliminate any risk of non-compliance at the launch of your software, resulting in its long-term success.

Step 5: Testing

Run functional, performance, load, security, and other required tests to make sure that there are no errors. Testing and quality assurance will also ensure that the software works as expected, even under high transaction volumes and peak hours.

Step 6: Launch and Monitor

Launch the fintech software and clearly establish operational workflows for incident response, compliance reporting, and updates. Regularly monitor the software for any bugs or glitches. Also, keep updating the software with new features and functionality.

Read in Detail: How to Develop a Fintech App: A Step-by-Step Guide

Software Development for Fintech: Cost & Time Estimates

Calculating both the time and the cost of software development for fintech depends on multiple factors, including the following:

- Complexity of the project

- Data availability

- Features to be added

- Compliance requirements

- Technology stack

- Development team experience

- Fintech software development company location

- Type of fintech software

- Third-party integrations

- Post-launch support and maintenance needs

For an accurate estimation of the fintech software development cost and time, it is recommended to reach out to a technology company with prior experience in building similar software. A best practice is to build an MVP first and validate your idea and its profitability.

Similar Read: Top 10 Best Finance Apps

How to Earn Money from Your Custom Fintech Software: Top 8 Monetization Models

A successful fintech platform or software is not only about making it future-ready by integrating advanced technologies. Rather, it is also about building it in a way to generate sustainable revenue. Here are 8 monetization models you can consider for finance software development in 2026:

| Monetization Model | How it Works | Benefits |

| Transaction-Based Fees | Charge users or businesses a small fee per transaction processed through the platform. | Predictable revenue based on usage; scales with transaction volume. |

| Subscription Models | Users need to pay a recurring fee, which could be monthly, quarterly, or annual basis for premium access or advanced features. | Stable and predictable revenue; encourages long-term engagement. |

| Lending & Interest Income | Platforms offer loans, credit lines, or BNPL (Buy Now Pay Later) services and earn interest or late fees. | High revenue potential per user; aligns directly with financial services. |

| Asset Management & Advisory Fees | Charge users a percentage of assets under management (AUM) or fees for personalized financial advice. | Recurring revenue tied to portfolio growth; attractive for high-net-worth individuals. |

| Data Monetization | Analyze anonymized financial data to provide insights, benchmarks, or predictive analytics to third parties. | Additional revenue stream without charging end-users directly. |

| Freemium Models | Offer core services for free while charging for advanced features, integrations, or premium support. | Attracts a large user base quickly; converts a percentage to paying users. |

| Partnerships & Embedded Finance | Integrate financial services into non-financial platforms and earn revenue through commissions, referral fees, or shared revenue agreements. | Access to an existing customer base. Enables passive monetization. |

| Advertising & Lead Generation | Generate revenue through targeted ads or by referring users to other financial products like credit cards, loans, and insurance. | Monetizes non-paying users; scalable if the user base is large. |

Useful Insights: Digital Transformation in Banking & Finance: A Complete Guide

Real-World Case Studies in Fintech Software Development

Now that you have learned enough about software development for fintech, let’s take a look at the top companies that are using various types of fintech software for diverse use cases:

1. Revolut – Digital Banking & Payments

This well-known UK-based Neobank offers banking services internationally via a mobile application. The digital banking and payment application it has is equipped with multi-currency accounts, instant transfers, and cryptocurrency support features. The app also has an AI-powered feature for immediate fraud detection and prevention. Revolut has over 25 million users worldwide.

2. Stripe- Payment Gateway

It is a US-based payment processing platform that is being used by millions of online businesses. Stripe has an API-first architecture and comes with advanced features like multi-currency support, PCI-DSS compliance, subscription management, and fraud prevention tools.

3. Robinhood – WealthTech & Investment

Robinhood is a world-renowned commission-free stock trading platform that is being used by millions of retail investors. It features Real-time trading, portfolio tracking, AI-powered insights, gamified investing, and other advanced functionalities.

Read More: How Stock Trading Apps like Robinhood are Disrupting The Financial Markets?

Future Trends in Fintech Software Development (2026 and Beyond)

Before you invest in custom fintech software development, how about knowing what the future holds for financial solutions, applications, and software? Interesting, right! So, let’s dig deeper into these future trends in software development for fintech:

- The Rise of AI and ML: In 2026, we may see AI and ML being used increasingly in fintech software for credit scoring, fraud detection, customer support, analytics, and other purposes.

- Embedded Finance: Embedded finance is also expected to become the talk of the town in 2026. It will be used in integrating banking, lending, insurance, or payment services directly into non-financial platforms.

- Use of Blockchain and Decentralized Finance: We may also see an increase in the integration of blockchain technology and DeFi for secure transactions, smart contracts, tokenized assets, cross-border payments, and decentralized lending.

- Open Banking and API-First Fintech: 2026 may bring the trend of open banking and API-first fintech for securely sharing financial data between banks and third-party providers via APIs.

- Rise of RegTech & Automated Compliance: In the upcoming times, we may see the integration of RegTech and automated compliance to facilitate AI-powered monitoring for KYC/AML compliance, fraud detection, and reporting automation.

- Use of AI Agents: AI agents also have a promising future in the fintech industry. These agents will take autonomous decisions for fintech-related tasks.

Apart from the aforementioned, cloud-native and microservices architectures, and voice and biometric payments may also become a common thing or trend in 2026. Besides, sustainable and green finance will also gain popularity. This will take the fintech industry to the next level.

Delve Deeper: Top 10 Fintech Tech Trends

Conclusion

The fintech world has been undergoing a massive transformation. Thanks to rapid technological advancements, evolving regulatory frameworks, and ever-evolving customer expectations. If you are in this industry and want to change the way you run operations, offer financial services, or make your business profitable, then this fintech software development in 2026 guide is for you.

However, if you want to kick-start your custom fintech software development project, reach out to the most trusted fintech app development company, Quytech. At Quytech, we have highly experienced and certified developers to build all types of financial software and applications.

What differentiates fintech apps and solutions that we develop is customization, scalability, integration of AI, ML, blockchain, and other technologies, advanced features, and compliance with international standards and regulations.

FAQs About Fintech Software Development

For the successful development of financial software, adopt a secure and scalable architecture, adhere to compliance and regulatory requirements, use agile development, and rely on APIs for payments, KYC, and analytics.

Different regions and countries have different regulatory requirements. Therefore, you must comply with them all to ensure the success of your fintech software. These regulations have been clearly mentioned in this blog.

Fintech software automates various processes, including payments, billing and invoicing, loan processing, report generation, and others. This reduces manual errors and operational costs. It also enables financial institutions to make informed decisions.