You have a goal of saving your money for the down payment of a house that you wish to buy five years down the line. What will you do? In conventional scenarios, you will create a spreadsheet listing your current income, savings, expenses, and other details. Then, manually analyze all of them to plan a finance management strategy to achieve your goal. Now, there is no certainty that this way of wealth management will help you save the amount of money you need five years later.

What if we tell you that all of this can be done in minutes with the help of an AI agent? Not just for individuals, AI agents are no less than a boon for financial institutions that offer wealth management services to thousands of people. AI agents for wealth management can analyze the given data against market conditions and create a strategy with a very high success rate.

From portfolio rebalancing to figuring out profitable investment options, AI agents autonomously perform all these tasks, enabling human wealth managers to focus on other decisions. Owing to the immense benefits these agents offer, the demand for AI agents in wealth management is skyrocketing.

And if you, too, wish to build an artificial intelligence agent for wealth management, this blog is a must-read for you. It covers everything from the types, benefits, and use cases of AI agents for wealth management to how to build a custom one for you.

Without further ado, let’s begin!

What are AI Agents for Wealth Management

AI agents for wealth management that can process and analyze financial data to automate tasks associated with wealth management, provide personalized insights for data-backed decision-making, and learn and adapt to changing market conditions.

- AI agents collect data from client portfolios, news feeds, and other sources.

- They analyze the data to understand financial goals, time horizons, risk tolerance, and other parameters.

- AI agents continuously monitor global market conditions, economic trends, and the performance of clients’ assets.

- Portfolio optimization and recommendation are the next steps an AI agent for wealth management takes.

- The agents then assess potential risks with the client portfolios to ensure proactive risk management and adherence to compliance.

After this, real-time monitoring and alerts, automating rebalancing, personalized communication and reporting, and behavioral coaching are the processes or operations that an AI wealth management agent performs. The best part about such an agent is that it keeps on learning from new data and feedback for improvement.

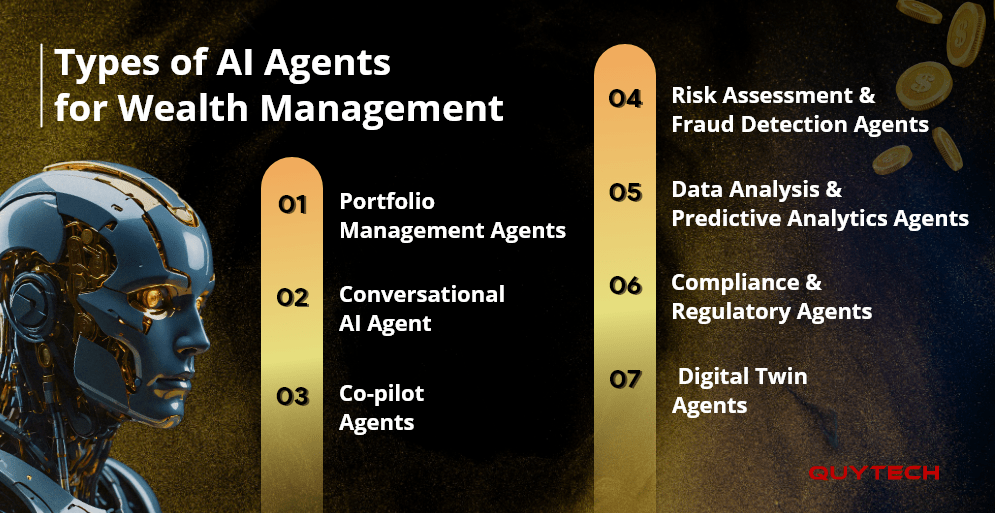

Types of AI Agents for Wealth Management

Financial institutions and professionals can make the most of the following types of AI agents:

#1 Portfolio Management Agents

These AI agents automate critical tasks such as managing investments, creating and rebalancing portfolios, and others based on the client’s financial goals, along with other factors.

Portfolio management agents evaluate market data to identify trends and execute trades. They don’t require manual intervention and are capable of performing complex tasks such as tax-loss harvesting and diversification.

Similar Read: Portfolio Management App Development: A Technical Guide

#2 Conversational AI Agent

Conversational AI agents are designed to interact with clients to provide answers to their queries and offer guidance. These agents utilize NLP and NLU to understand the intent of the queries and respond to them in a human-like manner.

Conversational agents improve client engagement and experience with round-the-clock assistance on financial planning and wealth management.

#3 Co-pilot Agents

Co-pilot agents or advisor agents automate administrative tasks that consume a lot of time and human effort. These agents can also generate crucial insights by analyzing lengthy reports and market sentiments.

Advisor agents can even identify potential risks that can impact the efficient management of finances.

#4 Risk Assessment and Fraud Detection Agents

AI agents, designed particularly for risk assessment and fraud detection, in wealth management can identify and eliminate financial risks while keeping fraud at bay. These agents keep a strict vigil on financial transactions to analyze historical data, suspicious activities, and patterns that are different from usual.

By implementing this type of agent, financial institutions and individuals looking for wealth management can enhance security and minimize losses that may occur due to fraud.

Also Read: AI and Machine Learning in Fraud Detection- How Does it Work?

#5 Data Analysis and Predictive Analytics Agents

When it comes to AI agents for wealth management, this specific type of agent is highly useful. Data analysis and predictive analytics agents can process enormous amounts of data to figure out patterns, market trends, and predict future demands.

Such artificial intelligence agents make the most of machine learning and deep learning models to analyze different factors, including market data, economic indicators, and others, to extract valuable insights.

#6 Compliance and Regulatory Agents

These agents can do wonders for wealth management. These agents can automatically track regulatory changes, monitor transactions to find whether there is any compliance breach, generate audit trails, and more.

They not only make wealth management easier but also minimize the burden on human resources by eliminating manual compliance verification.

#7 Digital Twin Agents

This type of AI agent incorporates creating an AI twin that works efficiently for both the client and the financial advisor. A digital twin agent powered by artificial intelligence can look into and understand each individual’s financial goals and spending habits to create personalized recommendations.

Similarly, a digital twin that is an “advisor twin” assists a human advisor with streamlining tasks and evaluating client data to make informed decisions.

Benefits of AI Agents for Wealth Management

Artificial intelligence-powered agents for wealth management and financial planning render immense benefits. Some of the key advantages of intelligent agents for wealth management:

#1 Enhanced Personalization

By automatically evaluating client data and other critical parameters like spending habits, lifestyle, and more, AI agents can create personalized wealth management strategies with a high success rate of achieving financial goals. Not just this, AI agents also facilitate proactive engagement to ensure that clients remain aligned with their financial goals. Artificial intelligence used for wealth management also improves client experiences.

#2 Increased Operational Efficiency and Automation

AI agents automate complex tasks (data entry, portfolio rebalancing, KYC checks, and others) that consume a significant amount of time. Financial management professionals can use this time for other strategic tasks. These agents also streamline work and ensure faster processing of data to get useful insights.

#3 Data-Driven Decision Making

AI agents that are used for managing wealth can help with advanced data analytics to obtain real-time financial data, forecast market movements, and investment performance. It can optimize portfolios while recommending or suggesting asset allocations.

#4 Better Risk Management and Compliance Adherence

Artificial agents can improve risk management and ensure adherence to compliance with real-time risk assessment, detect and prevent fraud, and automate checking adherence to compliance. Wealth managers can utilize AI agents to manage each client’s wealth easily.

You might be interested in: How to Develop an AI Trading Assistant App Like Walbi?

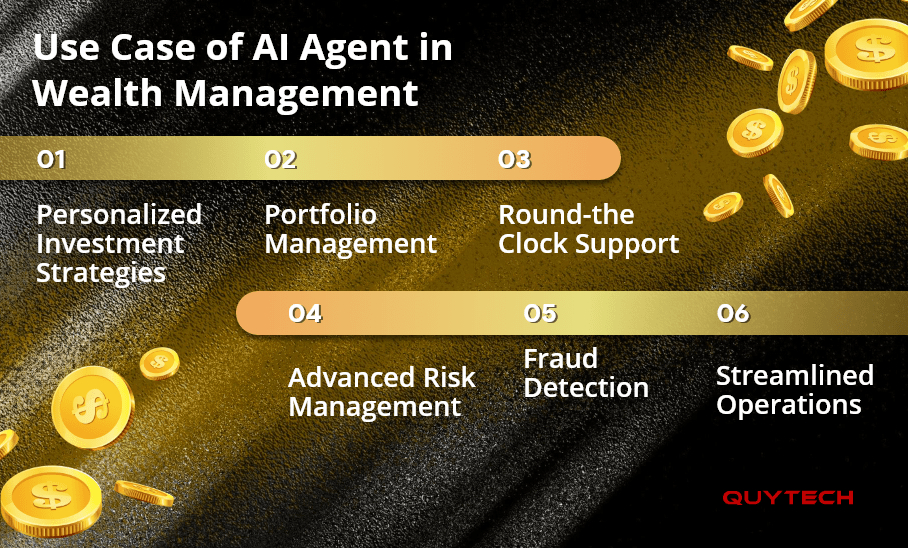

Use Case of AI Agent in Wealth Management

Here are some key applications of AI agents in wealth management:

#1 Personalized Investment Strategies

From risk tolerance, financial goals, and behavioral patterns to spending habits, an AI agent can automatically process any type of financial data. Based on this data analysis, it can generate hyper-personalized investment strategies, which financial institutions and individuals can rely upon to make investment-related decisions.

#2 Portfolio Management

Portfolio management is another popular application of AI agents in financial planning and wealth management. These agents can keep a continuous watch on market conditions to evaluate portfolio performance and rebalance assets to ensure maximum benefits, considering the client’s risk profile and financial goals.

#3 Round-the-Clock Support

AI agents can be used to render 24*7 support services. Individuals can connect with these agents to get instant support, wealth management-related guidance, portfolio updates, financial insights, and other answers to their queries.

Apart from rendering support services, AI agents can also do sentiment analysis for proactive servicing. They can understand client sentiments by analyzing emails, call transcripts, and other sources. AI agents can also personalize communication and act as a virtual behavioral and personal finance coach.

Also Read: AI Agents in Customer Service: Benefits, Use Cases, Real-World Examples, and More

#4 Advanced Risk Management

Implementing AI agents for wealth management can help with real-time risk assessments. Financial institutions don’t require human professionals to keep a tab on the global markets and each client’s portfolio. AI agents can do this without manual intervention to ensure proactive risk mitigation.

#5 Fraud Detection

Best agents for wealth management can flag suspicious transactions and also analyze login patterns. For instance, in case of a large withdrawal request from an unknown IP address, the agent will automatically raise an alarm or ask for verification to enhance security.

#6 Streamlined Operations

From client onboarding, tax-related operations, ID verifications, compliance checks, and regulatory adherence to reporting and reconciliation, there are multiple processes associated with wealth management. An AI agent can perform all these processes automatically to free up human resources for other strategic decision-making.

How to Develop an AI Agent for Wealth Management

Building an AI agent for wealth management is not child’s play. It requires strong technical skills, AI expertise, and knowledge of development methodologies. If you don’t want to build an AI agent for wealth management on your own, connect with a reputed AI agent development company or hire AI developers. Here is a step-by-step guide to creating an AI agent for wealth management:

Step 1: Define the AI Agent’s Objective

The first step to AI agent for wealth management development is to define its core capabilities, including the tasks it will perform. These tasks could be anything from automated portfolio monitoring & rebalancing, personalized financial insights, risk assessment & mitigation, client verification, to tax optimization, fraud detection, and financial planning.

Step 2: Data Collection and Preparation

The second step is to collect, clean, and prepare high-quality financial data. The sources to collect data may be internal (client profiles, transaction records, portfolio holdings, CRM data, etc.), external (real-time stock prices, bond yields, news feeds, etc.), and client communications, meeting notes, and others. After collecting reliable and relevant data, move further to cleaning, normalization, feature engineering, and other data analysis.

Step 3: Tech Stack Selection

The next step is to carefully analyze your requirements and select the right technology stack, including programming language, LLMs, agent management frameworks, data infrastructure, APIs, and integrations. Remember, the selection of tech stack not only determines the successful development of your AI agent for wealth management but also its desired performance and functioning.

Step 4: AI Agent’s Architecture Design

To ensure building a scalable and maintainable AI agent, it is imperative that you focus on building a robust and modular architecture. Therefore, design the perception layer, reasoning layer, action layer, and feedback loop.

Step 5: Build, Train, and Test the AI Agent

It’s time to build, train, and test the AI model using supervised learning or reinforcement learning. You can also use existing models and fine-tune them on prepared data. Whether you build an AI agent for wealth management from zero to one or refine an existing model, don’t forget to test its performance by performing UAT, unit, integration, scenario, and other testing techniques.

Step 6: Deploy and Monitor the AI Agent

Build the right deployment strategy to deploy the agent using the right cloud platform. To accelerate the process, you can even create CI/CD pipelines. Once successfully deployed, continuously monitor the performance of the AI agent, equip it regularly with new features, and ensure security to prevent cyberattacks.

Future of AI Agents in Wealth Management

Let’s check out what the future holds for AI agents in wealth management:

- Intelligent agents for wealth management will focus more on hyper-personalization to design customized investment strategies.

- AI agents in wealth management will scale automation to enhance efficiency and ensure cost-effectiveness.

- AI agents will empower human professionals to offer deep market research and insights, and bring an era of hybrid models where AI’s analytical power will be blended with human empathy and judgment.

- In 2025 and beyond, we may also see the evolution of AI agents’ predictive intelligence capabilities and the integration of other emerging technologies such as blockchain for enhanced transparency.

- More and more companies and individuals will utilize AI agents for wealth management.

Real-World Examples of AI Agents

The world is already using intelligent agents for wealth management and financial planning. Below are three companies to look for:

Wipro’s WealthAI

This cloud-powered AI agent helps the firm with wealth and asset management. It is an advise-the-advisor platform that integrates AI and analytics with high-value data sources to generate and deliver insights through customized dashboards. WealthAI aims to improve advisor productivity and client relationship scores.

Morgan Stanley

Morgan Stanley, a global leader in financial services, uses AI agents to amplify its wealth management services. Its AI agent offers advisors with deeper and personalized insights into clients’ portfolios, risk exposure, and financial goals.

Arta Finance

Arta AI is a well-known example of AI agents in wealth management. It offers a comprehensive range of AI agents that are proficient in investment planning, market research, and other wealth management tasks. Arta AI is designed for real financial complexity and is also offered to partner banks and financial institutions through a “Wealth as a Service” platform.

You may also be interested in: Top 10 AI Agents in 2025

How Quytech Can Help

Quytech is a leading AI agent development company that builds future-ready AI agents for wealth management. We have built over 150 AI agents that intelligently automate investment analysis, personalize financial advice, and enhance client engagement. While building an AI agent for financial planning and wealth management, our ML and AI experts focus on customization and scalability to ensure your agent tailors to your unique requirements, adheres to required compliances, and can perform exceptionally well even in the most complex scenarios.

Final Thoughts

AI agents in wealth management can be used to personalize investment strategies, enhance client servicing and engagement, ensure advanced risk management and fraud detection, and streamline operations that consume a lot of time and effort. Curious to know how? Give this a detailed guide to AI agents for wealth management blog a read.

It covers everything from detailed information on intelligent agents for wealth management, types of AI agents that can be built for wealth management, and benefits, use cases, and the step-by-step development process. It also covers the list of companies that use AI agents to manage their wealth and financial planning.

FAQ

Calculating the cost of developing an AI agent for financial planning and managing wealth requires considering multiple factors, such as the complexity, features, type of agent, and more.

Like the cost, the time required for creating the best agent for wealth management depends on its complexity, type, development team size, and a few other factors. It may take from six months to up to a year to build an AI agent.

AI agents in wealth management can be used for various purposes, including financial data analytics, portfolio management, robo-advisors, customer relationship management, compliance management, and streamlining operations.

Depending on your requirements, you can build a portfolio agent, an advisor assistant agent, a digital twin agent, a conversational AI agent, a co-pilot agent, a compliance and regulatory agent, and others.