There was a time when getting financial advice meant asking wealthy friends or family members (thinking they must be pros at financial management). Technological advances have brought us a new, efficient, and easy way to manage our money while saving us from the embarrassment of reaching out to others. Here, we are talking about the personal finance coach, Cleo AI.

Yes, you read that correctly! Money management apps like Cleo AI have become the talk of the town. These apps offer personalized financial coaching while helping users manage budgets, get cash advances, and much more.

Cleo AI, the worldwide recognized cash advances and credit app, has been used by over 5 million users to manage their finances, build credit, or request a cash advance before their paycheck arrives. These apps are high in demand and, therefore, can be a profitable investment.

And if you have made up your mind to build a personal finance assistant like Cleo AI, this blog is for you. It provides you with a step-by-step process for Cleo AI-like app development. But before that, let’s understand what Cleo AI is, the benefits of building a clone of Cleo AI, the features of this popular money management app, and the tech stack required for developing a cash advance app like Cleo AI.

What is Cleo AI

It is a personal finance assistant powered by artificial intelligence. Cleo AI has been designed to enable people to manage their money efficiently and effectively. This smart money manager aims to make budgeting, saving, and understanding finances seamless and highly engaging for individuals of all ages, including Gen Z and millennials.

How Does Cleo AI Work

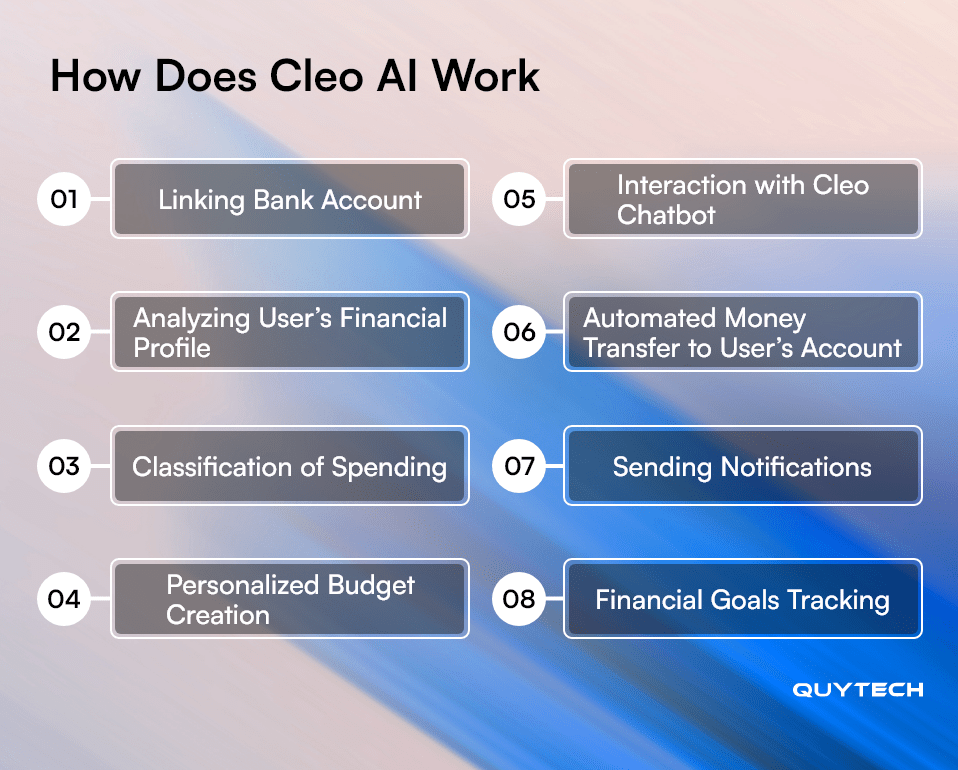

Here is a step-by-step process to understand the detailed working of Cleo, a smart money manager:

- Linking Bank Account: A user links their bank accounts (via third-party services like Plaid) to Cleo.

- Analyzing User’s Financial Profile: Cleo looks into the user’s transaction history, income, and expenses in read-only mode.

- Classification of Spending: The app uses AI algorithms to classify the user’s spending, such as bills, dining, and entertainment, to assess income and expense patterns.

- Personalized Budget Creation: Based on the analysis, Cleo AI enables users to create personalized budgets while suggesting spending limits. It also figures out areas for potential savings and predicts upcoming expenses.

- Interaction with Cleo Chatbot: The user gets the option to interact with Cleo AI via a chatbot interface to get financial guidance, answers to different queries, and even feedback using the roast mode (this is quite amazing).

- Automated Money Transfer to User’s Account: It then suggests and automates small transfers into a savings account, depending on the user’s financial goals and their spending habit.

- Sending Notifications: Cleo automatically sends an alert to users to notify them about upcoming payments, low balances, unusual transactions, or before exhausting their spending limits.

- Financial Goals Tracking: Using Cleo, users can set specific financial goals and also track their progress in the blink of an eye.

Cleo’s premium users can also make the most of its additional features, such as cash advances and credit-building tools.

Cleo AI Personal Finance Assistant: Market Statistics

As aforementioned, investing in a Cleo-like personal finance coach is a great idea; let’s check out some recent statistics that would help you stay firm on your decision to create a Cleo-like app.

- Cleo was launched in 2016, and at the time of writing, it has over 5 million Android and iOS users.

- Cleo has a 4.6 (out of 5) rating on the App Store.

- Cleo, the powerful AI-powered finance assistant, generated an annualized recurring revenue of a whopping $150+ million in October 2024.

- This smart money manager generates 99.8% of its total revenue from the United States of America alone.

- Cleo, a personalized finance assistant, has raised $175 million in funding since its launch in 2016.

- Cleo has 1 million Active Monthly Users (AMU).

These interesting statistics show vast opportunities in building a Cleo-like money management app development.

Benefits of Building a Personal Finance App Like Cleo AI

Want to build a personal finance assistant similar to Cleo AI? How about knowing its benefits first? Let’s explore them for both the businesses and users:

Advantages of Creating a Cleo-Like App for Users

- Improved Financial Literacy and Empowerment

With Cleo-like personal finance coach development, you can enable users to get a clearer understanding of their spending habits, income patterns, and savings potential. They can make informed decisions and take control of their financial future.

- Automated Budgeting and Tracking

Personal finance assistants like Cleo AI prevent users from doing manual budgeting, which is tedious, time-consuming, and prone to errors. Artificial intelligence in finance management apps automates the budgeting process, categorizes transactions, enables tracking of expenses, and predicts future spending.

- Personalized Financial Coaching and Advice

AI-powered smart money managers offer personalized financial coaching and advice by carefully analyzing individual financial data. These managers or personal finance coaches can give suggestions for saving money on subscriptions, identify opportunities to reduce debt, and even promote healthier spending habits.

- Early Detection of Financial Problems

With continuous monitoring of income and spending, an AI-powered smart money manager like Cleo AI can raise potential financial concerns before they actually occur. They might alert you beforehand about an overdraft alert, an upcoming bill that might strain finances, or an unusual spending spike.

- Better Saving Habits

Personal finance coaches powered by AI have features like round-ups or auto-transfers to savings accounts. The feature enables users to effortlessly save while tracking the progress of their financial goals.

- Debt Management Assistance

An AI-powered personal finance coach can analyze the portfolio of users struggling with debt. It can suggest repayment strategies by prioritizing those debts with high interest rates. Users can effortlessly manage and repay their debts.

- Minimized Financial Stress

A personalized financial coach provides clarity, automation, and personalized support, which reduces anxiety and stress while helping users efficiently manage their money. It gives users they are in complete control of their finances.

- Accessibility to Expert Financial Guidance

Cleo-like finance app development enables users to get personalized and expert financial advice that they would otherwise not get. With expert-level insights, they can efficiently manage their finances.

Advantages of Creating a Cleo-Like App for Businesses

- Strong User Engagement and Retention

A personalized finance coach or assistant like Cleo AI brings high user engagement. Users get the benefit of seamless money management, which leads to strong retention rates.

- Crucial Insights

Developing an AI-powered personal finance coach similar to Cleo AI provides crucial data insights into consumer financial behavior. Based on these insights, businesses can identify upcoming trends, develop new features, and refine existing services.

- Multiple Revenue Options

Apart from subscription models, Cleo-like app development gives a business different options to generate revenue. They can choose from partnerships with financial institutions, affiliate marketing, and paid subscriptions.

- Scalability and Reach

An AI-powered personalized finance coach or assistant can offer personalized financial advice or guidance to millions of users all at once. They can be scaled as the business grows and enable a business to cross geographical boundaries.

- Competitive Edge

Building a smart money manager like Cleo AI is a great and innovative idea in the FinTech domain. By developing such an app, you can stay ahead of the competition.

Building a Smart Money Manager like Cleo AI? Explore Its Key Features

Before Cleo AI-like personal finance coach development, let’s take a look at its key features. This would help you understand what Cleo offers and what additional features you should add to your smart money manager to make it stand apart from Cleo AI.

AI-Based Chatbot Interface

Cleo utilizes a conversational AI chatbot that interacts with users like a human assistant. It is sassy and humorous, and offers immediate answers to user questions about their spending, budgeting, and financial habits. Users can even get personalized insights and financial advice.

Smart Saving Goals

Another excellent feature of Cleo AI is that it assists users with setting and achieving savings goals via various functionalities such as “Autosave” (automatically transferring small amounts to savings), “Round-Up” (rounding up purchases to the nearest dollar and saving the difference), and “Swear Jar” (fining users for spending at selected “guilty pleasure” retailers). Users can even get a high-yield savings account by choosing from Cleo’s partner banks.

Budgeting and Expense Tracking

Cleo users can directly connect to their bank accounts in the real-only mode to monitor their income and expenses. The app automatically classifies transactions while providing users with a clear picture of their spending. They can even craft personalized budgets and get alerts for transactions that are not usual or in case the user is about to reach their spending limit.

Cash Advances

This is clearly a remarkable feature that Cleo AI offers. It allows its eligible users to get interest-free cash advances of up to $250 to $500. Using this cash advance, users can fulfill their short-term financial needs and can pay back when their paycheck arrives in their bank account. Unlike personal loans, these advances are called Earned Wage Access.

Credit Building

With the “credit building” feature, Cleo AI provides its users with a credit builder card. This card is generally issued by any of the banks partnered with Cleo AI. Using this card, users can build or improve their credit score without credit checks or interest.

Personalized Financial Insights

Owing to its artificial intelligence-powered capabilities, Cleo offers personalized advice and challenges to its users. It provides them with crucial insights by thoroughly analyzing their spending patterns and financial goals. These insights help users improve their financial habits.

Early Paycheck Access

It’s another amazing feature of Cleo AI. With it, users can get access to their paychecks up to two days before by setting up direct deposits with the app. This feature can be used anytime by Cleo users.

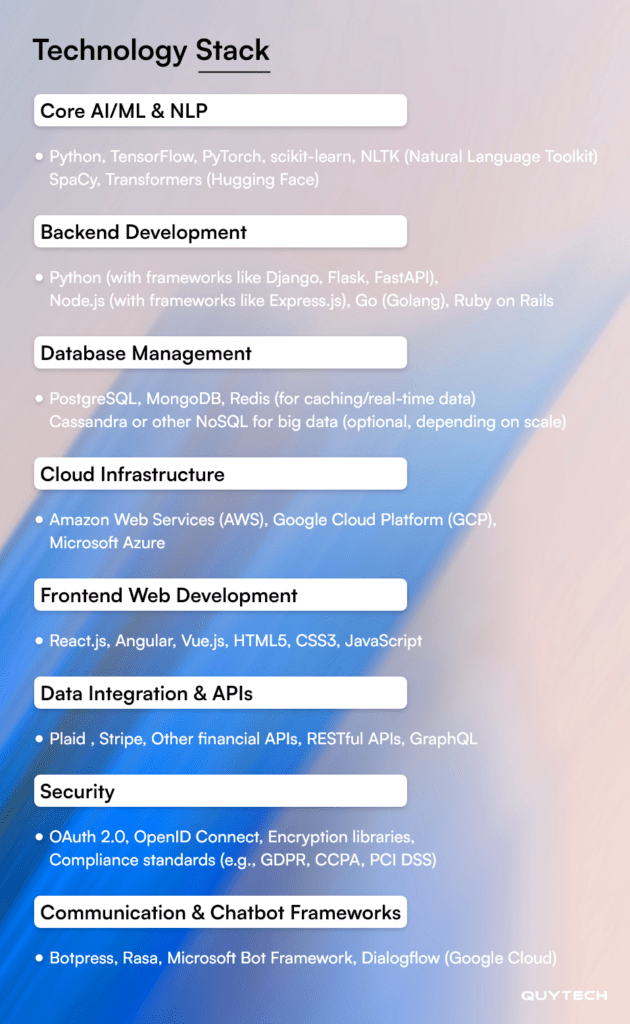

Technology Stack Required to Create a Finance Assistant Like Cleo AI

Development Process to Build a Personal Finance Coach Similar to Cleo AI

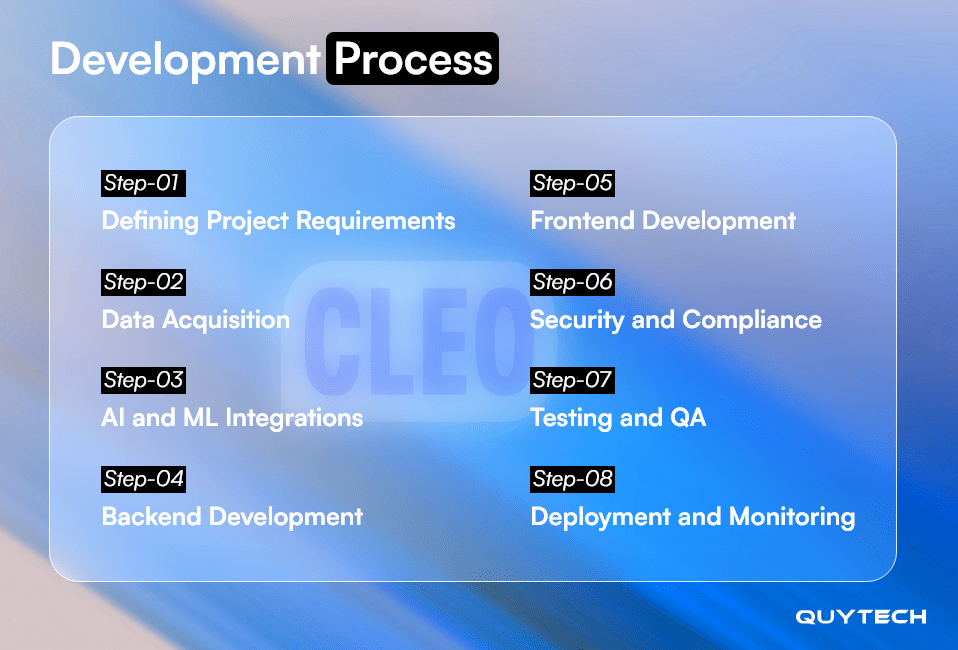

The development process for building a Cleo AI-like personal finance assistant that has been mentioned in this section is what most AI development companies follow. If you want to create a similar application, follow these steps or hire AI developers.

Step 1: Defining Project Requirements

Before you begin, it is important to define your project requirements, including the essential functionalities you need to add, how users will interact with your AI finance coach, top features like an interactive chatbot, budgeting and expense tracking, financial insights & advice, financial goal setting, alerts & reminders, cash advances, credit building, and security & privacy. Also, mention the required technology stack.

Step 2: Data Acquisition

The next step involves financial API integration, i.e., partnering with open banking platforms to securely connect with users’ bank accounts. With this, you would be able to access transaction history, account balances, and other relevant financial data (with user permission). It also includes collecting and unifying data from diverse sources like bank accounts, credit cards, and investment accounts. It also includes data normalization and cleaning to ensure data consistency and accuracy.

Step 3: AI and ML Integrations

This is a highly crucial phase of Cleo-like personal finance assistant development. This incorporates using NLP for chatbot development and response generation. Using machine learning for transaction categorization, spending pattern analysis, personalized recommendations, predictive analytics, and fraud detection.

Step 4: Backend Development

Developing the backend of your personalized finance coach, like Cleo AI, comes next. Build a robust and scalable backend infrastructure to ensure seamless and secure management of financial data and complex AI calculations. Design a scalable architecture, ensure secure data management, utilize top cloud infrastructure or platforms to achieve scalability and reliability, and develop required APIs to ensure seamless third-party integrations.

Step 5: Frontend Development

Develop an intuitive and engaging user interface with a focus on clean and easy-to-navigate interfaces. Ensure a conversational interface that seems natural to users. Also, focus on data visualization and cross-platform compatibility to make your personal finance application or assistant seamlessly run on Android and iOS platforms.

Step 6: Security and Compliance

A finance assistant powered by AI needs to adhere to top security standards and compliance. Implement top data encryption technologies, use strong authentication and authorization methods, conduct regular security audits, use privacy-preserving techniques, and adhere to GDPR, CCPA, PCI DSS, and other laws. Give read-only access to user bank accounts to avoid unauthorized access and fraud.

Step 7: Testing and QA

Conduct unit testing, integration testing, user acceptance testing, AI model evaluation, and other required tests to ensure your app runs effortlessly on targeted platforms and all features and functionalities are running flawlessly. Identify and troubleshoot bugs if you find any. Ensure your app passes all quality checks.

Step 8: Deployment and Monitoring

Once the app or personal finance coach like Cleo is developed and thoroughly tested, deploy it on the targeted platform. After the successful launch, continuously monitor the application’s performance, response time, and model accuracy. Consider user feedback and make necessary adjustments to ensure its continued success.

You might also be interested in: AI Agents in Finance: Use Cases, Benefits, Challenges and More

How to Make Money from a Personal Finance Assistant Like Cleo AI

Now that you have read almost everything about building a personal finance assistant like Cleo AI, it’s time to learn how to monetize your app to make money from it. Let’s check out the top monetization models you can consider while building smart money managers like Cleo AI:

- Freemium Model

Offer users basic functionalities for free and charge for the premium ones. For example, you can provide free access to transaction tracking, spending categorization, simple budget overviews, and other similar features. On the other hand, charge a recurring fee for features like advanced budgeting & forecasting, personalized financial advice, automated savings & investments, credit score monitoring & improvement, and an ad-free experience.

- Affiliate Partnerships

Another popular monetization model to implement in Cleo AI-like personal finance coach development is affiliate partnerships. You can partner with banks, credit card companies, loan providers, investment platforms, and other relevant businesses. When your financial coach recommends their service, you earn a commission.

- Data Monetization

Please note that using the data monetization model requires getting strict user content and anonymization. Keep that in mind.

Utilize your users’ data, process it to offer crucial insights into consumer trends to relevant businesses. The data would be all statistics and should not consider any specific user. Make sure you are absolutely transparent about this with your users.

- Premium Content or Courses

You can offer your users premium finance-related content, educational finance-related courses, and e-books to guide them through financial management. Subscribed users would get access to such content.

- Transactional Fees

If your AI-powered chatbot facilitates direct financial transactions via partnerships, you can charge a transaction fee. Make sure you keep the fee minimal to attract more and more partners.

What the Future Holds for Personal Finance Assistants Such as Cleo

The future of personal finance assistants like Cleo is quite promising. They are and will continue to become a financial companion for people, especially those struggling with financial management. In 2025 and the upcoming years, we can expect trends like hyper-personalization that will also consider and assess behavioral patterns and life goals, along with financial data, to generate personalized advice.

Besides, these assistants will rely on sophisticated AI models, including generative AI, to facilitate even more natural and insightful conversations. These models will also facilitate predicting financial challenges even before they arise. Another future trend that we may witness is the integration of these personal finance coaches with blockchain technology for improved security and transparency.

You may also like to read: Top Use Cases of Blockchain in Finance Industry

Final Thoughts

Cleo AI is a trending personal finance coach that empowers users to manage their finances with expert advice, intelligent insights, and conversational AI. Such personal assistants are quite high in demand and make it a profitable investment idea for those looking to build one. If you, too, are among those who are searching for the steps to develop a personal finance coach like Cleo AI, this blog is for you.

It covers everything, including features, benefits, an answer to how to develop a personal finance coach app similar to Cleo AI, tech stack, and future trends. If you wish to build a Cleo AI-like personal finance coach, connect with an experienced AI development company with a background in creating similar applications.