Key Takeaways

- AI agents in crypto trading blend automation, intelligence, and adaptability to buy, sell, and trade cryptocurrency independently.

- Crypto AI agents can streamline simple to complex trading tasks, such as managing portfolios, analyzing sentiments, and detecting fraud.

- Apart from AI, autonomous trading bots in the crypto ecosystem utilize machine learning and blockchain to evolve and perform data-backed trading.

- Risk management AI agents, market sentiment analyzing agents, and intelligent agents for trading execution are some common types of agents.

- Developing AI agents for crypto trading begins with building a trading strategy and ends with deploying the agent on cloud or on-premises infrastructure.

- Speed, scalability, and round-the-clock market monitoring are some exceptional benefits offered by smart crypto trading agents.

We have already provided detailed insights into how AI will transform crypto trading; this blog is entirely dedicated to the role of AI agents for trading. The cryptocurrency trading market is evolving and is quite volatile and complex. However, the arrival of crypto trading AI agents, especially the ones that can self-learn, has made trading as easy as ABC.

The question is how? Well, the amazing benefits, impact, and use cases of autonomous agents cannot be summed up in just one line. For now, understand that the intelligent agents analyze market signals, detect patterns, and auto-execute trades, if permitted, across diverse exchanges.

Let’s dive deeper into this blog to get critical insights into everything from the working of crypto AI agents, their capabilities, real-world use cases, development process, and emerging trends.

Understanding Crypto AI Agents

Let’s briefly understand AI crypto trading agents. They are autonomous and self-learning systems that eliminate the requirements of manually analyzing the market and executing trades of cryptocurrencies like Bitcoin, Ethereum, Tether, and Cardano.

The agents utilize ML, AI, and other powerful technologies to comprehend the market, predict trends, and auto-execute trades across diverse crypto exchanges and even decentralized finance (DeFi) platforms.

How Intelligent Crypto Trading AI Agents Differ from Traditional Bots

Traditional bots follow a set of pre-defined rules. For example, if they find situation “A”, they will perform action “X”. But if the situation has not been defined beforehand, they won’t be able to make a decision or take action.

On the other hand, AI trading agents autonomously learn and adapt to market conditions. They have analytical capabilities to quickly, intelligently, and accurately make crypto trading decisions and even execute trades.

Continue Reading: AI Agents Vs. Traditional Automation: A Detailed Comparison

How Crypto Trading AI Agents Work

Here is the step-by-step process to understand how AI agents in crypto trading work:

Step 1: Collecting Data: The agent collects data from multiple sources, including social media platforms, exchanges, blockchains, and news.

Step 2: Analyzing Market: Smart agents then utilize ML models to analyze the market to find out patterns and forecast price trends.

Step 3: Formulate Trading Strategies: This involves considering market insights to build and test trading strategies.

Step 4: Executing Trades: AI agents can independently execute trades and rebalance assets. They do the same in this step.

Step 5: Monitoring Performance: Agents can track results or the performance of crypto in real-time. They make the required adjustments.

Step 6: Learning and Evolving: Smart trading bots improve their accuracy and performance by looking into the received feedback on past trades and evolving market data.

Explore More: Using AI Agents in Code Security: Benefits, Challenges, Types, and More

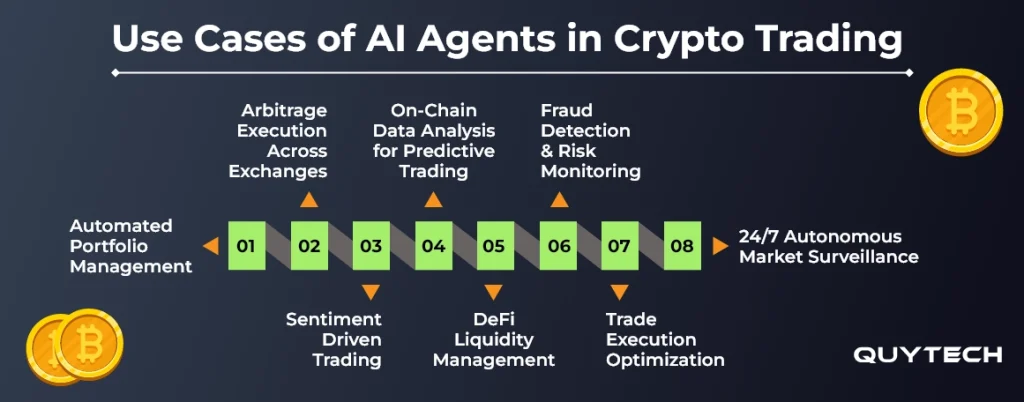

Use Cases of AI Agents in Crypto Trading

AI agents for crypto trading are intelligent systems that can be used to automate portfolio management, conduct sentiment-driven trading, and more, which are covered in this section:

- Automated Portfolio Management

Built for crypto trading, AI agents can independently manage diversified portfolios. They keep on assessing each asset’s performance to rebalance allocations. This optimizes return on investment and ensures maximum profitability. For example, an AI agent automatically shifts investments from volatile to stable assets when there is a high risk of loss.

- Arbitrage Execution Across Exchanges

Crypto trading AI agents can monitor multiple exchanges at the same time; doing it manually would require a large time. Intelligent agents can identify and exploit price differences and other factors to take necessary actions or offer recommendations. For instance, if the agent detects a 0.5% price difference for bitcoin on different exchanges, it automatically executes a buy or sell. This increases the profit.

- Sentiment-Driven Trading

It is one of the best use cases of AI agents for crypto trading. Smart agents and trading bots leverage NLP to comprehend crypto-related news, social media posts, and community forums. By thoroughly analyzing the sentiments of conversations and the intent of discussions, agents can amend trading strategies.

- On-Chain Data Analysis for Predictive Trading

Autonomous AI agents are capable of analyzing blockchain data. They can keep a watch on wallet movements, token transfers, potential market moves, and liquidity shifts. Based on this, they execute predictive trading and initiate short-term sell actions.

You may like to read: AI Agents for Autonomous Data Analysis

- DeFi Liquidity Management

Artificial agents are capable of directly interacting with smart contracts. This enables them to automate liquidity provision. The agents can even eliminate the need for manually performing yield farming and staking.

- Fraud Detection and Risk Monitoring

One of the best applications of intelligent agents in cryptocurrency trading is that it can continuously analyze transaction patterns and detect irregularities. You can even develop front-running crypto bots and enable your trading agent for potential rug pulls in decentralized finance markets.

- Trade Execution Optimization

Another powerful use case of AI agents is that they can independently manage the size of trades. For this, the agents leverage algorithms. They can help minimize slippage and optimize gas fees as well.

- 24*7 Autonomous Market Surveillance

Crypto trading AI agents can operate all day long. Whether it is about tracking trading volumes, analyzing market depth and trends, or order book movements at any hour of the day, they perform with the same consistency and accuracy.

Explore Further: Top 20 Use Cases of AI Agents

Steps to Build AI Agents for Crypto Trading

Building a crypto trading AI agent needs expertise in artificial intelligence, machine learning, blockchain, and other emerging technologies. Then you need to follow this practical roadmap to building an AI agent in crypto trading:

Step 1: Define the Trading Strategy and AI Agent Needs

The first step is to define the goal you want to achieve by building an AI crypto trading agent. Whether it is about executing trades, detecting fraud, or identifying price gaps across exchanges, mention it clearly and prepare the right trading strategy that will bring life to this vision.

Step 2: Collect and Preprocess Data

Mention the sources of the trading data that the intelligent agent will consider while performing its functions. Make sure the sources are reliable and data, such as price history, transaction volumes, or market sentiments, are relevant. Clean and process the data, if necessary.

Step 3: Design AI Agent Architecture

Now, decide which type of AI agent would suit your requirements. You can choose between reactive, predictive, or hybrid agent models after considering their specific functionality. Make sure you pick the one with modular decision layers.

Step 4: Integrate with Exchanges and Smart Contracts

The next step to build an AI crypto trading agent is to leverage REST or WebSocket APIs to connect with crypto trading platforms and exchanges. Make sure you choose the right API and architecture for the agent creation and integration.

Step 5: Implement Learning Mechanisms

Clearly implement top-notch learning mechanisms, such as reinforcement learning or supervised learning. This will enable the agent to make adaptive decisions. Apart from this, connect agents to crypto exchanges, DeFi protocols, or wallets for automated execution.

Step 6: Set Risk Mechanisms and Compliance Rules

The next step is to thoroughly define stop-loss, portfolio limits, and KYC/AML monitoring logic. This will ensure that the trades that are being executed comply with regulatory requirements and compliance.

Step 7: Test

Test the agent in simulated environments and make changes, if required. Test its functionality, performance, and other critical performance indicators. Refine the agent or retrain it in case there is an error in the output.

Step 8: Deploy and Monitor

Launch the AI crypto trading agent and continuously monitor its performance. Also, review user feedback and implement changes from time to time to ensure it doesn’t impact user experience.

Take a look at: AI Agents in Finance: Use Cases, Benefits, Challenges and More

Benefits of Using AI Agents in Crypto Trading

The rise of AI agents in crypto trading offers a wide range of benefits, including improving trading efficiency, data-driven decision-making, and round-the-clock market monitoring. Let’s understand how they benefit traders, investors, and financial institutions:

- Data-Driven Decision-Making

The first advantage of using AI agents for cryptocurrency trading is that it eliminates intuition-based decision-making and ensures that the decisions are data-backed. How? Crypto AI trading agents leverage ML and predictive analytics to make evidence-based decisions when trading cryptos. This contributes to receiving more consistent outcomes.

- Round-the-Clock Market Monitoring

AI agents work all day long with the same consistency. They keep an eagle eye on global exchanges to make sure every opportunity is grabbed and no risk goes unnoticed, even outside of trading hours.

- Unmatched Speed and Scalability

AI crypto trading agents have the capability to independently process and react to changes in the volatile trading market. They can execute multiple trades, all at the same time, on different platforms. AI agents, undoubtedly, outperform manual traders in terms of speed.

- Reduced Human Bias and Emotional Trading

The next amazing benefit of crypto trading bots or agents is that they don’t consider any emotional element while executing trades. Every decision is made based on data and algorithms.

- Improved Risk Management

AI trading agents can monitor portfolios in real time. Based on any market fluctuation or trend, they can automatically adjust the position. This maintains an optimal target risk ratio. Besides risk management, crypto AI agents can detect anomalies and automatically trigger stop losses and rebalancing of assets before any loss.

- Cost Efficiency

The automation of trading and market analysis eliminates the need for setting up large teams to constantly supervise market trends. Businesses can leverage agents to lower operational costs and get higher returns.

Please ensure the right balance of human expertise and AI agent automation to successfully execute trades.

Types of AI Agents You Can Build to Automate Crypto Trading

Crypto trading is not one process; rather, it involves multiple processes that can be successfully performed by different types of AI agents. Below is the list of AI agents to build for crypto trading:

- Market Analysis Agents

AI agents for market analysis can:

- Monitor price fluctuations

- Analyze historical data

- Predict market trends in real-time

- Empower traders to make data-driven decision-making

- Risk Management Agents

AI agents for trading risk management can:

- Detect potential market downturns

- Assess portfolio exposure

- Automatically rebalance assets

- Maintain stability during volatile periods

- Compliance and AML Monitoring Agents

AI agents for compliance and AML monitoring:

- Ensure adherence of transactions to regional and international crypto regulations

- Detect suspicious wallet activities

- Identify wash trading

- Flag potential money laundering patterns

- NFT Valuation and Pricing Agents

Autonomous agents for NFT valuation and pricing can:

- Evaluate NFT assets based on market demand

- Assess creator credibility and rarity

- Recommend pricing in real-time

- Execute profitable trades in NFT marketplaces

- Sentiment Analysis Agents

Intelligent trading agents for sentiment analysis can:

- Understand investors’ sentiments by analyzing news, social media, and community forums

- Predict sudden bullish or bearish moves

- Understand people’s perception

- Arbitrage Detection Agents

Smart crypto trading agents for arbitrage detection can:

- Identify price discrepancies

- Auto-execute trades to grab arbitrage opportunities

- Scan multiple exchanges simultaneously

- Fraud Detection Agents

AI agents for cryptocurrency fraud detection utilize anomaly detection algorithms to:

- Identify irregular trading behaviors

- Prevent phishing scams

- Secure assets from automated exploit attempts

- Trade Execution Agents

AI agents for trade execution can:

- Autonomously execute complex trade strategies

- Optimizing order timing, slippage, and transaction fees

Continue Reading: Types of AI Agents: Use Cases, Benefits, and Challenges

Real-World Examples of Autonomous Crypto Trading Agents

Let’s take a few examples of intelligent crypto trading agents to have a better understanding of what they do or how they function:

- Fetch.ai – It uses autonomous economic agents to automate DeFi trading, optimize liquidity, and execute arbitrage across exchanges.

- SingularityNET – Hosts AI trading agents that collaborate through decentralized marketplaces to analyze market signals and make trading decisions.

- Numerai – A hedge fund powered by AI models and autonomous agents that crowdsource predictive insights for crypto and stock markets.

Challenges and Risks of AI Agents in Crypto Trading

By now, you have explored almost everything about AI agents in crypto trading. Now is the time to check common challenges and risks associated with the same:

- Overfitting to Market Conditions

Crypto trading agents can stick to historical data and may not consider upcoming trends or market forecasts. This may generally happen when market behavior changes.

- Coordination Failures Across Agents

This challenge occurs mainly when multiple trading agents work together. This generally happens when they use the same platform. Lack of coordination may impact their functionality.

- Problems with Decision-Making

Due to a lack of transparency, artificial intelligence agents may fail to interpret or validate trading decisions, which can affect profitability.

- Security Vulnerabilities

When building AI agents, one of the common challenges is security vulnerabilities. Cybercriminals can exploit smart contract glitches and even manipulate data sources.

- Latency and Execution Delays

This challenge can occur when AI agents operate across different exchanges. Latency and execution delays can impact the bottom line.

- Regulatory and Compliance Risks

Not adhering to compliance and regulatory requirements may lead to failure of automated trading agents.

Interesting Read: AI Agents in Customer Service: Benefits, Use Cases, Real-World Examples, and More

The Future of AI Agents in Crypto Trading

The future of artificial intelligence agents in crypto trading or crypto trading AI agents is quite promising. In 2026 and the upcoming years, these intelligent, fully autonomous, and self-optimizing systems can do cross-platform collaboration, execute multi-layered trading strategies, and evolve more. Let’s take a look at the future trends of AI crypto trading agents.

- We may witness the rise of agentic autonomy, where agents will trade, hedge, and manage investment portfolios without manual input.

- AI agents will have multi-platform collaboration across diverse exchanges and DeFi markets.

- In 2026 and the upcoming time, we may get to use personalized trading agents that will align with the unique goals of investors.

- Explainable AI will also become an integral part of agents and enable them to make interpretable and compliant decisions.

- We may also witness on-chain governance integration that will enable agents to participate in DAO governance and the optimization of tokenomics.

- The rise of security-first frameworks for advanced threat detection and auditing smart contracts will become a trend.

- Agents will have adaptive market intelligence.

Create Powerful AI Agents with Quytech

Quytech is a custom AI agent development company that builds intelligent and autonomous agents for crypto trading. We have dedicated experts in artificial intelligence, machine learning, blockchain, and other powerful technologies. Our experts have in-depth knowledge of cryptocurrency and the blockchain ecosystem that enables businesses to grab new market opportunities.

The custom AI agents that our experts create can continuously learn from real-time market data, predict patterns, and execute trades without manual intervention. Whether you are a fintech startup or an established enterprise exchange, we can build a simple to complex AI agent that can autonomously execute trading.

You may be interested in: AI Agents for Enterprise Workflow Automation: Use Cases, Benefits, Examples, and More

Conclusion

AI agents in crypto trading transform how crypto trading is done. Agents are intelligent systems that can independently execute trades while learning from market data and historical data. Crypto AI agents ensure smarter risk management, faster trade execution, and data-driven decision-making. All it requires is building customized AI agents by choosing the right technology partner. But before you do so, it is imperative that you understand AI crypto trading agents thoroughly.

FAQs

Whether you are choosing a pre-built AI agent or building your own from the ground up, these are the must-have features to consider:

– Real-time data processing

– Adaptive learning

– Risk management

– Sentiment analysis

– Automation capabilities

– Multi-exchange integration

– Transparent decision logs for auditability and compliance

Yes, custom AI agents for trading for high-frequency trading, risk mitigation, portfolio diversification, and other business requirements.

For this, you need to implement robust security protocols, API encryption, and secure key management. Besides, set real-time monitoring to prevent unauthorized access or data leaks.

Depends on the goals you want to achieve. Typically, AI agent developers use Python, TensorFlow, PyTorch, and blockchain integration tools such as Web3.js or Solidity for smart contract connectivity.

Traditional trading bots are rule-based. AI agents learn from real-time data and adapt their strategies dynamically. They continuously improve and evolve through machine learning and reinforcement learning models.