Key Takeaways:

- Ethical AI refers to the practice of using artificial intelligence with fairness, responsibility, and regulatory compliance in consideration.

- Ethical AI in FinTech ensures that decision-making is transparent, data usage is responsible, and operations are supervised.

- The benefits of implementing ethical AI in finance include improved customer trust, transparency, data privacy, regulatory compliance, and bias-free decision-making.

- The use cases of ethical AI in FinTech include credit scoring, fraud detection, risk assessment, personalized recommendations, and legal compliance.

- Future trends of ethical AI in financial services range from cross-border financial operations and sustainability integrations to dynamic ethical policies.

Imagine implementing AI automation in your FinTech company that is smart and works within ethical boundaries, without affecting the tasks it carries out. Well, you can stop imagining now because ethical AI is no longer limited to imagination; it is reality.

FinTech is a sector where automation does not mean merely carrying out tasks without human independence. It is a sector that demands fairness, transparency, and responsibility blended with intelligence. Everything from assessing the credibility of a customer to approving loan requests demands unbiased assessment, clear reasoning, and responsible handling of both financial data and resources.

And to facilitate all that, ethical AI comes into play. It establishes a blueprint that guides AI on the data it can access, the activities it can perform, and the boundaries under which it has to perform.

But how does ethical AI do all that while supporting automations and intelligence? That’s exactly what we will explore in this blog, from the concept of ethical AI to the role it plays for FinTech institutions. So read till the end and find answers to all your curiosities.

Understanding The Concept of Ethical AI

As the name suggests, ethical AI refers to the practice of utilizing artificial intelligence technologies in a fair, responsible, and transparent manner. But why is there a need for ethical AI? The capabilities and influence that AI technologies have in the current era are familiar to us all. The same technology used to introduce automation across sectors can also be used for unethical purposes. And to put an end to AI-powered unethical practices, ethical artificial intelligence is introduced.

It establishes standards to guide the outputs AI provides, ensuring the fairness, transparency, and explainability of its decisions. Ethical AI introduces a set of rules, a framework of control, and a guide of supervision. You can also think of ethical AI as a guardrail that ensures that every action carried out by AI, be it accessing financial data or making decisions, operates within approved ethical boundaries.

But in FinTech, the role of ethical AI is not limited to only guiding fair AI uses; it helps institutions in improving their operations while maintaining the quality of AI outputs. Ethical AI plays a vital role in helping FinTech institutions comply with financial and legal regulatory requirements as well.

The Role of Ethical AI in FinTech

The role that ethical AI plays in FinTech goes way beyond laying out a rulebook. It helps enterprises in creating an ecosystem where all the AI-powered operations are carried out, with responsibility and accountability in consideration. But how does ethical AI make this all possible? Let’s dive deeper and understand the role of ethical AI in finance:

Decision Framework Standardization

In the conventional framework, the decisions relating to FinTech institutions, like loan approvals, fraud detections, etc., are made manually. This meant that there was a high possibility of the decisions being influenced by bias. Manually made decisions are also prone to human error.

But with ethical AI in the finance sector, these decisions are taken by utilizing technologies such as machine learning, XAI, etc. ML facilitates past data pattern depiction of a customer, while explainable AI reflects the reason behind the output given.

Responsible Data Usage Governance

When it comes to data protection, the traditional data management systems often lack strictness. This could lead to customers’ financial data being accessed by unauthorized third parties, leading to risks of misuse.

With ethical AI in FinTech, responsibility is added to data governance. It makes use of differential privacy, which hides the personal details of the customers. Along with this, encryption practices ensure that even if security is compromised, the unauthorized person won’t be able to access the actual figures and information behind the encrypted texts.

Operational Oversight

Before the introduction of ethical AI in FinTech, AI-powered operations followed a black box approach. This meant that the outputs that AI gave lacked proper reasoning. It didn’t explain what led to a certain output or conclusion. Lack of proper operational insight made it difficult for the employees to trust the decisions AI made, because if anything goes wrong, accountability will fall on them.

Ethical AI in FinTech introduced the concept of explainability. This gave proper reasoning and transparency with the process that the AI followed, like what documents made it approve a loan request or arrive at a certain conclusion. This explainability helped employees naturally improve operational oversight.

You might Also Like: Revolutionizing Insurance Underwriting with Agentic AI

Benefits of Implementing Ethical AI in FinTech

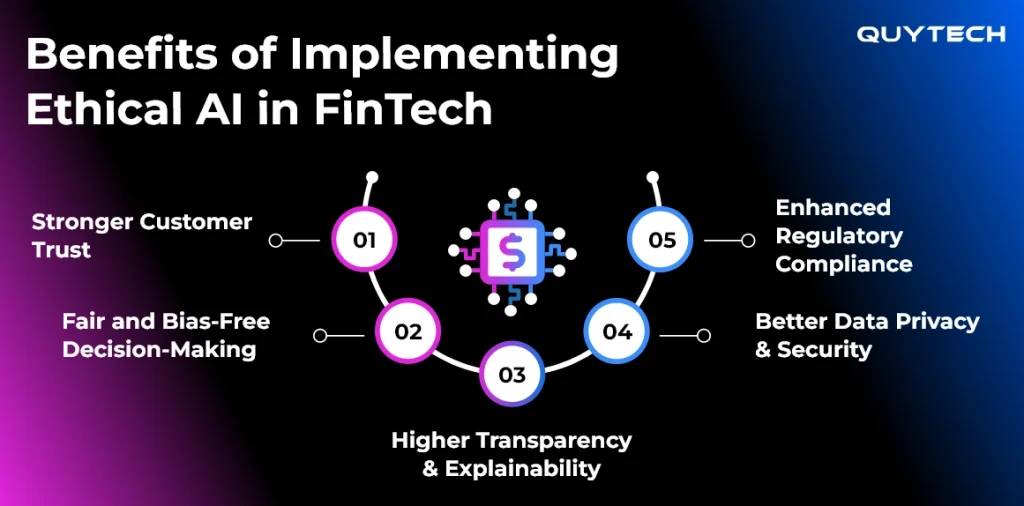

Implementing ethical AI in FinTech helps financial institutions gain customer trust and make smarter decisions. But the benefits don’t end just there. Here’s a dedicated section explaining the benefits of implementing ethical AI in FinTech:

Stronger Customer Trust

Ethical AI builds strong customer trust as it stands for transparency in financial services. It assures customers that their financial information, documents, and data are in safe hands. Along with this, the use of explainable AI models backs AI actions with reasoning. This guides customers in understanding the reason behind certain actions by offering transparency, which naturally contributes to better customer loyalty.

Fair and Bias-Free Decision-Making

The implementation of ethical AI in FinTech creates a fair ecosystem. This ensures that all the activities performed, like risk assessment, loan approvals, fraud detection, etc., are conducted on fair terms and are free of bias against the customer.

Higher Transparency and Explainability

As mentioned already, ethical AI in FinTech makes use of explainable AI models, which eliminate the black box effect. This ensures that every output given is explained and broken down in detail for better understanding. It helps employees understand how AI models work and draw conclusions.

Better Data Privacy and Security

Ethical AI in finance enhances data privacy and security, which is very important as customers disclose confidential financial documents to get assistance from institutions. It follows data governance practices that protect the data of the customers from being accessed by unauthorized parties. Along with this, data encryption also prevents sensitive customer information from being exposed.

Enhanced Regulatory Compliance

FinTech companies need to comply with strict legal regulations. These are not just related to finance but also include data-related regulations. Ethical AI in FinTech automatically checks data usage, monitors model behavior, and ensures that all the financial processes are aligned with current financial and legal regulations.

Interesting Read: AI Agents in Finance: Use Cases, Benefits, Challenges, and More

Real-World Use Cases of Ethical AI in FinTech

Now that you are aware of what ethical AI is and how it’s beneficial for FinTech institutions, let’s walk you through real-world use cases of ethical AI in FinTech:

Credit Scoring & Loan Approvals

Ethical AI in FinTech is applied to the process of credit scoring and loan approvals. Ethical AI helps in making this process more transparent and less of a black box. It does so by breaking down factors and reasons it considers to score and reject or approve a loan request.

Fraud Detection

Ethical AI in financial services helps FinTech institutions in monitoring transactions in real-time. It flags and notifies the authority when it notices unusual or suspicious behaviour during transactions. This helps financial institutions in preventing losses by halting the activities of the suspicious user.

Risk Assessment

In risk assessment, ethical AI is applied to evaluate the financial credibility of customers fairly without any bias. It evaluates all the required information like past repayment history, transaction history, document proofs, etc, and waits for human approval when required.

Personalized Financial Recommendations

Like any other artificial intelligence-powered technology, ethical AI is also capable of providing customers with a personalized experience. It does so by understanding customer preferences and providing relevant financial information and recommendations to them.

Regulatory & Privacy Compliance

Ethical AI in finance automates the regulatory compliance tasks. It ensures that all the procedures being carried out comply with regulatory requirements. Ethical AI assesses how data is being used, by whom it is being accessed, and if it’s encrypted to ensure that no unauthorized person can access it. It helps FinTech institutions in being compliant with all the legal regulations.

Read More: Role of Generative AI in Finance and Banking

Challenges and Best Practices for Implementing Ethical AI in FinTech

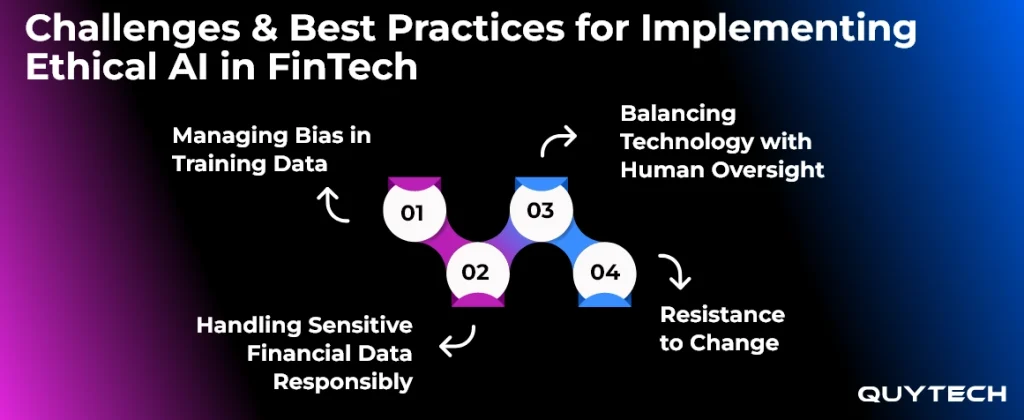

While implementing ethical AI in FinTech brings in a load of benefits for organizations, its implementation process also brings its own fair share of challenges. But worry not, because we will help you overcome these challenges. Here are some challenges and best practices for implementing ethical AI in FinTech:

Managing Bias in Training Data

Ethical AI systems are trained with historical financial data. If this data is biased and inconsistent, it can deeply impact the quality of the output. This challenge is often overlooked, naturally reflecting these biases in the responses AI gives.

Best Practices

FinTech institutions can overcome the challenges of managing bias in training data by utilizing diverse and consistent datasets. This not only helps ethical AI in giving fair solutions but also improves the ability of AI in handling varied situations.

Handling Sensitive Financial Data Responsibly

As is known already, the field of FinTech involves dealing with sensitive customer data. Implementing ethical AI in FinTech means that this data will be accessed by AI. This can raise concerns about the data being exposed to unauthorized parties.

Best Practices

But like any other challenge, this can be overcome by following data encryption practices. This helps in protecting the data from unauthorized parties; even if they do access the data, they won’t be able to access the real information. Along with this, role-based controls can help in limiting data access to authorized users only.

Balancing Technology with Human Oversight

Establishing the right balance between automation and manual work can be challenging. The implementation of ethical AI can instill overdependency on technology in the minds of employees. Inability to trust ethical AI can lead to slow operations due to continuous human intervention.

Best Practices

The challenge of establishing the right balance between technology and human oversight can be overcome by implementing human-in-the-loop systems. This helps ethical AI in carrying out its task, and humans to supervise when required, naturally maintaining an optimal balance between technology and human oversight.

Resistance to Change

While implementing ethical AI, FinTech institutions may see resistance to change among the employees. This usually arises when employees feel that they may not have the right talent to work in collaboration with ethical AI systems. Their hesitant behavior can make it hard for FinTech institutions to introduce ethical AI.

Best Practices

However, this challenge can be addressed by training the employees. Spreading awareness about how ethical AI is, there to reduce their workload, not to replace them, can also help in creating optimism in the minds of employees towards ethical AI implementation.

You Might Also like: AI in Insurance Claim Processing: Cut the Costs, Fraud, and Delays

Future Trends of Ethical AI in FinTech

Ethical AI is not a current trend, but one that will define the future. As the demands and complexities of technology requirements increase, ethical AI will also adapt and integrate with these requirements. Here’s a quick peek at the expected future trends of ethical AI in FinTech:

Cross-Border Financial Operations

The future holds the integration of ethical AI in the FinTech sector across the globe. It will help financial institutions in following the varied financial and data-related regulations of different countries. This future trend of ethical AI will help FinTech companies with a global presence work effectively and efficiently.

Sustainability Integration

Another future trend of ethical AI in FinTech includes integration with sustainability practices. This integration will help FinTech companies avail the benefits of both automated ethical AI implementation and sustainable development. It will guide companies in following responsible financial activities while supporting sustainable practices to gain a competitive advantage in the market.

Dynamic Ethical Policies

The future trend of dynamic ethical policies will help FinTech institutions in adapting their ethical practices as needed. This will help in improving the rigid rules by making them flexible to suit the dynamic requirements of the market conditions.

How Quytech Helps FinTech Companies Implement Ethical AI

Quytech helps FinTech companies in implementing ethical AI by developing and deploying AI models built with fairness, transparency, and responsible handling of data in mind. With over 14 years of experience in the technology industry, Quytech brings the perfect blend of expertise in ethical AI development with dedicated developers to bring the vision of responsible and ethical AI into reality.

By making use of the right tools and technology, we ensure that the AI models developed for your FinTech institution are equipped with secure, transparent, and unbiased mechanisms. With special emphasis on customization and scalability, Quytech delivers ethical AI solutions that are tailored to grow with your business.

Summing Up

As the need for transparent decision-making mechanisms increases, sectors like FinTech are adopting ethical AI practices. By blending in artificial intelligence with ethics like fairness, transparency, responsibility, and accountability, fintech organizations achieve automation paired with compliance with regulations.

With benefits ranging from strong customer trust and bias-free decision-making to high explainability and better data privacy, fintech institutions implement automation that’s both intelligent and responsible. By overcoming the black box effects of artificial intelligence, ethical AI is proving to be a technology that stands for building trust.

FAQs

Yes, ethical AI can be applied to existing FinTech systems. Organizations can adopt ethical AI by layering governance, monitoring, and explainability controls over existing AI models.

Ethical AI identifies unusual financial behaviour and flags it for additional review instead of making fully automated decisions. This helps in dealing with such situations accurately and collaboratively instead of just depending on AI automation.

Ethical AI systems work with humans-in-the-loop. This ensures that even if the AI makes any mistakes, the human oversight can review it, correct it, and update the system to prevent the mistake from happening again.

Yes, ethical AI is relevant for small or early-stage FinTech startups. It can help them cut their manual compliance costs by automating it. Easy scalability and sustainability also make ethical AI beneficial for small FinTech startups.

Yes. Ethical AI adapts to changing regulations over time. It can be updated with new regulations, while other functionalities improve over time with every interaction it has.

Not necessarily. You can implement ethical AI in your financial operations even without a technical team. You can either hire developers or partner with an AI development company.

Yes, being an artificial intelligence technology, ethical AI can make financial decisions in real-time while following predefined boundaries, without impacting the speed of the responses.

Yes, ethical AI automates compliance with regulations, which eliminates the need for separately carrying them out. It saves the cost that otherwise would be spent on manually ensuring compliance with regulatory requirements.