Like any other industry in the world, the banking sector is also evolving remarkably. Whether it is automating routine banking processes, understanding customer needs, scaling operations, or enhancing their experiences, banks are innovating by developing customized, secure, and scalable software.

The increasing adoption of technology is one of the factors why the banking software development market size is anticipated to reach USD 64.96 billion by 2032. There are other factors, too. But the real question is what exactly banking software does to create a win-win situation for both the banks and customers?

Another question is how to develop customized banking software solutions that can improve operational efficiency, ensure regulatory compliance, and help a bank achieve other goals. This blog is a one-stop place to get answers to each of these questions. Besides, it also digs deeper into the benefits, features, technology stack, challenges, and future trends of how to develop banking software.

Let’s get started!

What is Banking Software Development

Banking software development is about creating a software solution that automates banking operations to increase speed, enhance accuracy, and level up customer experience. These operations could be as simple as entering customers’ details and as complex as executing cross-border transactions or compliance management. By building tailored software, banks can modernize their legacy systems and lower operational risks and costs.

Please note that not every bank needs the same software; therefore, we have covered different types of banking software. In case you are skeptical about what type of software will meet your needs, going through that section would definitely bring you clarity.

Key Takeaways

- Banking software development enables banks and financial institutions to automate their core tasks that otherwise would take great effort, time, and cost.

- Some types of banking software are core banking systems, lending platforms, payment gateways, and CRMs.

- The steps to develop banking software include defining the exact requirements, creating a robust architecture, complying with regulations, and ensuring post-deployment maintenance.

- Technologies required for advanced banking software solution development are AI, ML, blockchain, cloud, and data analytics.

- Improving efficiency, compliance with regulatory requirements, and informed decision-making are a few benefits of building banking software.

- Open banking, zero-trust security, and low-code platforms are expected to become future trends of the banking and finance software market.

Banking Software Development: Market Statistics

Before you know how to create banking software, how about reading some interesting statistics about its market size, key driving factors, and dominating regions? Sounds perfect! Let’s take a look at the same:

- The banking software market worldwide is projected to reach 64.96 billion by 2032.

- North America is the dominating region for this market. It has captured 42.88% market share in 2024.

- Banks are going digital, the increasing demand for SaaS and Cloud-based solutions, and the growing use of chatbots and virtual assistants are a few factors driving this growth.

- Core banking software solutions are highly demanded among different banking systems.

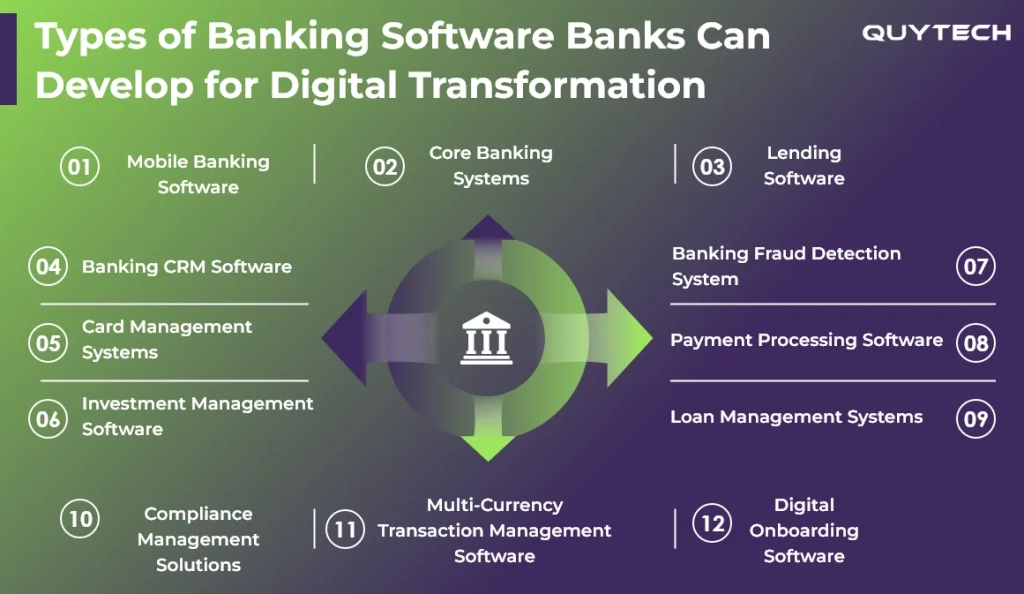

Types of Banking Software Banks Can Develop for Digital Transformation

When it comes to banking solution development, a one-type-fits-all approach doesn’t work. Here are different types of banking software that can bring digital transformation:

- Mobile Banking Software

Mobile banking software enables a bank to seamlessly manage accounts. Using the same software, they can manage other operations like transferring funds and paying bills via mobile devices.

Explore more: How to Develop a Mobile Banking App Like Chime?

- Core Banking Systems

One software or system that can make it possible to manage every banking operation under one roof is a core banking system. From deposits, withdrawals, loans, and transactions, banking institutions can have real-time and secure access to these operations being executed across all channels and branches.

You may also like: Building a Banking App Like Bank of America

- Lending Software

By investing in lending software development, banking organizations can streamline the complete loan lifecycle. Right from loan origination to credit assessment and final loan approval and repayment, the software automates every process with AI. AI-powered lending software also helps with risk evaluation.

- Banking CRM Software

With banking CRM software, banking professionals ensure complete visibility into client profiles, previous interactions, and preferences. Based on the data and insights, banks can deliver personalized services and increase client retention rates.

- Card Management Systems

This is quite clear from its name. Banks can create a secure and scalable card management system for the management of debit, credit, and prepaid cards. They can automate operations like issuing cards, their activation, and even transaction monitoring. Apart from this, they can even keep fraud at bay by ensuring top-level security powered by AI.

- Investment Management Software

Banking organizations build an investment management software solution. Such a solution will empower professionals to track portfolios, manage wealth, and analyze risks. They can even make informed decisions to grow their financial assets.

- Banking Fraud Detection System

Build a banking fraud detection system to protect against fraudulent transactions. You can make it even stronger by integrating AI that can further empower you to monitor patterns, detect anomalies, and spot risks to take a proactive approach.

Read further: How AI is Transforming Fraud Detection in Digital Transactions

- Payment Processing Software

Creating a payment processing system helps banks ensure secure, seamless, and consistent experiences across all payment modes and mediums. The software make sure high transaction speed, precision, and compliance with defined payment regulations and laws.

- Loan Management Systems

Banking organizations can build a loan management system that can automate loan disbursal. The software can even make EMI calculations easier and more accurate. Loan collection processes can also be automated while ensuring that all regulatory requirements are met.

- Compliance Management Solutions

By developing a compliance management system, a must-have banking software, banks and financial institutions can simplify regulatory adherence. The systems can automatically monitor processes to ensure compliance. They can even generate audit-ready reports.

- Multi-Currency Transaction Management Software

A multi-currency transaction management software facilitates secure cross-border payments and internal transfers. The software instantly converts currency and provides real-time rate management and global compliance.

Interesting read: Guide to Multi-Cryptocurrency Wallet Development

- Digital Onboarding Software

Digital onboarding software is what most banks build to accelerate customer acquisition with highly secure, paperless onboarding through electronic KYC. The software also automates document processing and verification, and biometric authentication.

Also read: Suspicious Behavior Detection in Banks: Complete Development Guide

Technology Stack Required to Build Different Banking Software Solutions

When you hire dedicated developers or a reputable banking software development company, they carefully analyze your requirements and choose a technology stack from the following:

| Frontend | React, Angular, Vue.js, Typescript, Tailwind CSS |

| Backend | Node.js, Express.js, Java, Python, Django, .NET Core, Ruby on Rails, PHP Laravel |

| Database Management | MySQL, Oracle, MongoDB, PostgreSQL, Cassandra, SQL Server |

| Cloud | AWS, Azure, GCP |

| Security and Compliance | OAuth 2.0, JWT, SSL/TLS, PCI DSS |

| AI & Analytics | TensorFlow, PyTorch, Tableau, PowerBI |

| DevOps and Monitoring | Jenkins, GitLab CI CD, ELK Stack, Data Dog |

6 Steps to Developing Future-Ready Banking Software

Now comes the most important section, i.e., how to develop a successful banking software solution. For this, all you have to do is follow the steps below:

Step 1: Define Software Requirements

The first crucial step is to set a strong base to avoid any confusion during the banking software solution development process. Therefore, prepare a detailed list including specific operational goals or customer expectations that you want to meet. Define the type of software you need and the features it should have. Also, mention the technologies you want to use for the software development.

Step 2: Ensure Regulatory & Compliance Readiness

Whether it is a core banking system, banking CRM, or any other type of digital banking solution, it is mandatory for all of them to comply with regulatory requirements. Ensure the same by integrating compliance mechanisms in this step. Please keep in mind that skipping this step may become a significant roadblock to the successful development and long-term success of your software.

Step 3: Design a Secure and Scalable Architecture

The next step is to craft a secure and scalable architecture using the most suitable technology stack. For example, use API integrations to ensure transparent and seamless connectivity with other third-party financial services. Similarly, leverage cloud, such as AWS, GCP, or Azure, to achieve desired flexibility. Make sure the architecture serves its purpose well, even when the customer base grows.

Step 4: Implement Advanced Security Mechanisms

To ensure end-to-end security of your cloud or on-premises banking software, add multi-factor authentication, strong encryption techniques, biometric authentication, and other strict access controls. Leverage technologies like artificial intelligence and anomaly detection to keep cyber fraud at bay.

Step 5: Develop and Test

Use an agile development approach to build the complete banking solution- be it a core banking system, investment management solution, or mobile banking applications. Make sure you run rigorous tests at each development milestone for smooth, error-free, and timely development and launch of your software. You can also choose automated testing frameworks for the same.

Step 6: Deploy and Monitor

Lastly, deploy your digital banking system on the cloud or a defined platform. Implement highly advanced monitoring tools to keep a tab on the software performance, security incidents, and transaction flow. Also, review feedback from users to make the necessary changes, add new features, or fix glitches.

Similar Read: Fintech Software Development in 2026: Benefits, Types, Steps, Cost, and More

Technologies Required to Build Custom Banking Software

Anyone can develop banking software, but it takes implementing advanced technologies (suitable ones, of course) to create one that stands apart from the competition. Here are some key technologies you can use to build that powerful and future-ready banking software solution:

1. Artificial Intelligence (AI)

AI-powered banking software can be used for delivering personalized services and extracting crucial insights for decision-making. AI in banking software development can also be for:

- Instant customer support by AI chatbots

- Intelligent document processing for loan applications and KYC

- Credit scoring and underwriting automation

- Personalized financial recommendations and offers

Get insight: How Artificial Intelligence is Reshaping Banking

2. Machine Learning (ML)

Implementing machine learning software enables banking systems to process enormous data to predict trends and make self-improvement decisions. ML can be used for:

- Fraud detection through anomaly pattern recognition

- Predictive risk management and customer churn analysis

- Transaction categorization and spending pattern insights

- Loan default prediction and credit risk modeling

3. Generative AI

Generative AI in digital banking solution development can create intelligent systems that can be used for:

- Personalized report generation for customers

- Conversational virtual assistants and smart onboarding flows

- Automated content creation for customer communication and alerts

- Scenario simulations for financial risk forecasting

Continue reading: Role of Generative AI in Finance and Banking

4. Cloud Computing

Cloud computing makes banking software secure and scalable. The technology can be used for:

- Core banking modernization with cloud-native architecture

- Real-time data synchronization across multiple branches

- Scalable digital payment and lending platforms

- Disaster recovery and backup solutions

5. Data Analytics

Data analytics-powered banking software can provide actionable insights by processing datasets. These insights can be used for:

- Customer segmentation and targeted marketing

- Performance analytics for loan portfolios and investments

- Real-time monitoring of transactions and KPIs

- Regulatory reporting and compliance analytics

6. Blockchain Technology

Powering your digital banking software with blockchain brings in unmatched transparency and security. Blockchain in custom banking software development can be utilized for:

- Cross-border payment settlements

- Smart contracts for automated loan agreements

- Secure digital identity management

- Transparent audit trails for compliance

7. Robotic Process Automation (RPA)

Modern banks can utilize robotic process automation in digital banking systems for various use cases, including:

- Automated KYC and data entry

- Loan processing and reconciliation

- Compliance reporting and audit preparation

- Account opening and customer onboarding workflows

Banking Software Development for Different Types of Banks

Whether it is retail, corporate, investment, or private banks, any type of bank can build digital banking software. Let’s read more about these banks and the type of banking software they can use:

Retail Banks

Retail banks serve individual customers; therefore, the software built for them should be highly secure and user-friendly. They can build:

- Mobile and online banking applications

- Digital onboarding software

- AI-powered support chatbots

- Fraud detection systems

Corporate Banks

Corporate banks have complex financial management processes. They can invest in:

- Loan origination systems

- Cash and liquidity management platforms

- Integrated ERP-banking interfaces

Investment Banks

Investment banks can build digital banking solutions like:

- Algorithmic trading platforms

- Risk analytics engines

- Compliance automation tools

Private Banks

Private banks have customers with high net worth. Therefore, it becomes critical for them to deliver personalized service. They can invest in:

- Client relationship management (CRM) systems

- Wealth management platforms

- AI-driven portfolio advisory tools

- Secure communication channels

Digital Banks and NeoBanks

Digital banks and Neo banks don’t have any physical branches. According to the nature of their organization, they can invest in:

- Core banking-as-a-service (BaaS) platforms

- Instant KYC onboarding

- Payment gateway integration

- AI-based customer analytics

Explore further: How to Build a Neobank App From Scratch?

Commercial Banks

Commercial banks require enterprise-grade banking software systems like:

- Unified core banking systems

- Credit risk management tools

- Loan servicing platforms

- Automation solutions

Central Banks

Central banks need highly secure, scalable, and regulatory-compliant systems. Digital banking solutions that fit perfectly with their needs are:

- Real-time gross settlement (RTGS) systems

- Digital currency platforms (CBDC)

- Macroeconomic data analytics tools

Related read: Central Bank Digital Currency (CBDC): The Future of Money

Advanced Features to Make Your Banking Software Successful and Stand Apart

Modern banks, these days, don’t need any banking solution; they need one powered with exceptional features. Here are some to consider while developing your banking software:

| Feature | Description |

| AI-Powered Personalization | This enables the software to deliver customized insights, spending analytics, and financial advice. |

| Biometric Authentication | To improve your software’s security and ensure authorized access, integrate fingerprint, facial, or voice recognition |

| Real-Time Fraud Detection | Ensure safer transactions by relying on AI-driven anomaly detection capabilities that identify and block suspicious activities instantly. |

| Chatbots and Virtual Assistants | Offer 24/7 customer support with AI chatbots that can handle queries, transactions, and issue resolution by engaging in human-like conversation. |

| Blockchain-Powered Transactions | Build next-level trust and security to make sure transparent, tamper-proof payments, settlements, and identity verification. |

| Voice-Enabled Banking | With this, you can enable users to check balances, pay bills, or transfer money using voice commands. |

| Advanced Data Analytics Dashboard | By adding an intelligent dashboard to banking software, the software can provide actionable insights on transactions, user behavior, and financial performance. |

| Multi-Currency and Cross-Border Payment Support | The feature enables banking software to seamlessly process international transactions with real-time currency conversion and compliance with regional payment regulations. |

| Predictive Risk Management | Assess credit risks, detect anomalies, and optimize lending decisions with higher accuracy. |

| Gamified Financial Experiences | Banking software with this feature can increase user engagement with reward systems, spending goals, and savings challenges. |

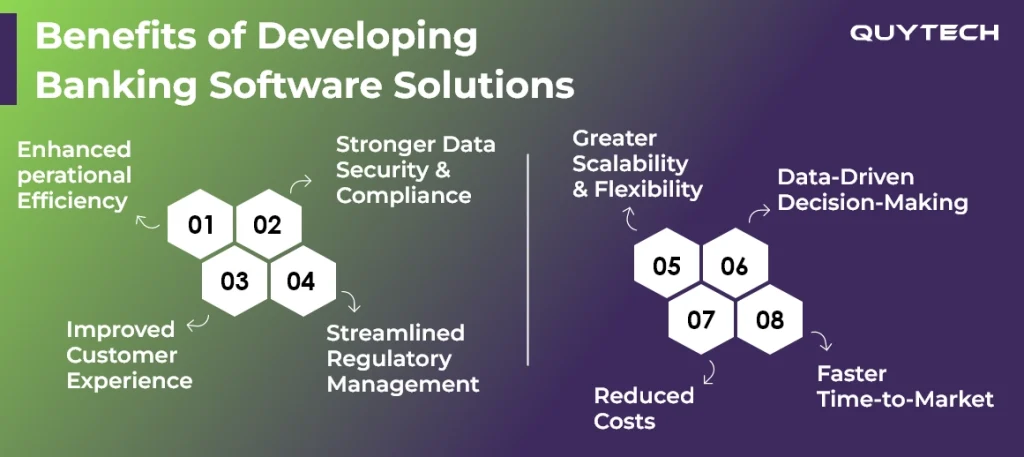

Benefits of Developing Banking Software Solutions

Let’s take a look at some key advantages of banking software development.

- Enhanced Operational Efficiency

AI-powered banking software automates loan approvals, customer account management, tracking of transactions, and almost every other operation. This not only minimizes the chances of errors but also enhances operational efficiency.

- Stronger Data Security and Compliance

The next amazing benefit of developing a core banking system is that it can help ensure data security and adherence to compliance and regulatory requirements, such as AML, PCI DSS, and others. The software protects financial data by implementing access controls, encrypting data, and real-time monitoring.

- Improved Customer Experience

By enabling banks to deliver personalized services, a core banking solution improves customer experience. Apart from this, such software also makes banking accessible to everyone, even without visiting a physical branch. Whether it is transferring money overseas or simply checking the account balance, customers can access banking services at their convenience.

- Streamlined Regulatory Management

With banking software powered by top technologies like AI, ML, and others, banks can automate compliance with regulatory requirements. They can even simplify audit trails and other similar operations.

- Greater Scalability and Flexibility

Most banking software solutions are cloud-based and have a modular architecture. This enables banks to seamlessly scale their services or handle customers effortlessly, even when the volume increases. They can even adapt to market demands without much effort.

- Data-Driven Decision-Making

By integrating AI and data analytics during banking software development, banking professionals can get real-time insights. Whether they want to get insights associated with customers, operational risks, or investment decisions, the software can help with everything.

- Reduced Costs

A digital banking solution, when developed by a reputable company, automates operations. It also ensures accuracy in various operations and compliance with regulations. All this contributes to minimizing the overall costs of operations.

- Faster Time-to-Market

Banks using digital solutions can accelerate product launches. They can stay ahead of the competition with an early-mover advantage for their new digital services.

Regulations and Compliance Considerations for Banking Software Development

Banking software development requires considering laws and regulations for the particular region or country where the software will operate/be used or where the bank offers its services:

Global Regulations and Compliance Frameworks

- AML (Anti-Money Laundering)

- KYC (Know Your Customer)

- Basel III

- PCI DSS (Payment Card Industry Data Security Standard)

- IFRS (International Financial Reporting Standards)

- FATCA (Foreign Account Tax Compliance Act)

- IOSCO (International Organization of Securities Commissions)

- Risk-Based Capital Regulations

European Union (EU) Regulations

- GDPR (General Data Protection Regulation)

- PSD2 (Payment Services Directive 2)

- MiFID II (Markets in Financial Instruments Directive II)

- SEPA (Single Euro Payments Area)

- Solvency II

United Kingdom (UK) Regulations

- FCA (Financial Conduct Authority)

- FSCS (Financial Services Compensation Scheme)

- PRA Prudential Rules (Derived from Basel III)

United States (US) Regulations

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- SOX (Sarbanes-Oxley Act)

- Volcker Rule

- BSA (Bank Secrecy Act)

- SEC (Securities and Exchange Commission)

- CFPB (Consumer Financial Protection Bureau)

India and Asia-Pacific Regulations

- RBI Guidelines

- DPDP Act (Digital Personal Data Protection Act, 2023)

- FATCA/CRS Reporting

Please note that these regulations may evolve from time to time. Therefore, it is recommended to check them before you create banking software.

Challenges You May Encounter During Software Development for Banks

Developing digital banking systems is not all roses. One may encounter several challenges with banking software development. However, by taking care of a few points, these challenges can be avoided:

1. Stringent Regulatory Compliance

Banks work globally; it is non-negotiable for them not to comply with global and regional regulations. Meeting all those requirements can be challenging sometimes.

Implement regulations and standards during the development phase to overcome this challenge.

2. Data Security and Privacy Risks

Ensuring the security and privacy of customer data, which is of a highly sensitive nature, is also another challenge. Banks need to protect data against cyber attacks and data breaches.

Implementing robust security techniques and role-based access controls can be a solution to this.

3. Legacy System Integration

Banks may also find it difficult to integrate new digital solutions with their legacy systems or platforms.

With the right API strategies and careful migration planning, the challenge can be avoided.

4. Scalability and Performance Issues

Banking software development may lead to scalability and performance issues due to poorly designed architecture.

Go for a cloud-based banking solution development or design a robust architecture to avoid this issue.

5. Ensuring Seamless User Experience

Banks may find it difficult to deliver a seamless and consistent user experience, which is a key requirement for modern customers.

This problem can be solved by building banking solutions with simple and user-centric interfaces.

Apart from the above challenges, banking solution development may incur issues like high development and maintenance costs, not being able to keep up with the evolving technology landscape, and the risk of downtime and operational disruption.

6 Factors Affecting the Cost of Banking Software Development

This is probably the most important or common question that everyone planning to build a core banking solution thinks about. The answer to this question is not simple; that is because it depends on multiple factors, including:

- Type and complexity of the software

- Features and functionalities

- Advanced technologies integration

- Regulatory and compliance requirements

- Technology stack and third-party integration needs

- Location and expertise of the development team

Software Development for Banks: Emerging Trends

Now that you have decided to build banking solutions, it is critical that you know the emerging technology trends in banking software development:

- AI-powered personalization to deliver hyper-personalized experiences and virtual assistants to next-level support services.

- AI agents for autonomous data analysis and performing banking operations.

- Open banking and API-driven ecosystems for secure data sharing between banks and third-party providers.

- Integration of blockchain to ensure transparency and security in cross-border payments, digital identity verification, and smart contracts.

- The rise of cloud-first banking architecture to achieve scalability, cost-efficiency, and faster innovation.

- Generative AI to redefine customer interactions and documentation.

- Zero-trust architecture and advanced cybersecurity for maximum data protection and resilience against evolving cyber threats.

- Using low-code and no-code development platforms so that banks can quickly adapt to market demands.

- Focus on sustainable and green banking.

How can Quytech Help

Quytech is a trusted mobile app and software development company that global banks and financial institutions trust to build secure, scalable, and regulation-compliant banking software solutions. We have dedicated data engineers with fintech, AI, blockchain, and cloud expertise.

Whether you want to develop a banking software solution from zero to one or simply modernize your legacy banking software with tech integrations, we can do anything. From core banking modernization, digital onboarding, and payment processing to AI-powered fraud detection, we have built all types of solutions. Customization, timely delivery, and innovative solutions are three principles that make us a preferred choice of banking and fintech institutions.

Final Words

Banking software solutions have been redefining the way banking and fintech organizations work and deliver service. Whether it is core banking systems, investment management solutions, compliance management software, or fraud detection systems, global banks and financial institutions are building different types of software to accelerate their digital footprint and deliver exceptional services.

The only thing that requires attention is following the right process to build banking software or choosing the right technology partner for the same. Therefore, the blog covers both the development process and connecting with an experienced company like Quytech.

FAQs

Advanced banking software solutions can have multiple security measures, including end-to-end encryption, multi-factor authentication, biometric verification, tokenization, secure access control for top-level data, as well as transaction security.

By integrating compliance frameworks such as AML, KYC, PCI DSS, and GDPR during the banking software development process, banks ensure compliance with regulatory requirements.

Yes. It is possible using API integration, microservices, and cloud migrations. However, you need to partner with an experienced technology company like Quytech for the same.

It depends on the type of software you want to build, its features, functionality, complexity, technology stack requirements, and a few other factors.