Crypto trading is the talk of the town! And for all the right reasons. With custodial wallets holding 41% of users and non-custodial wallets holding 59% of users in 2025, the cryptocurrency market is rising in the financial landscape. It is no surprise that investors see cryptocurrency as a valuable and beneficial investment. With the increasing shift to crypto trading, the need to keep digital assets safe arises naturally.

This is where crypto wallets come into play. With different approaches towards convenience, control, and security, crypto wallets do much more than simply store your assets. There are custodial and non-custodial wallets to manage not just your crypto assets but also the accessibility to them. These wallets add to the layer of security, preventing cyber threats. But how do you choose the right cryptocurrency wallet?

If that’s what you’re curious about, then you’re at the right place. We will walk you through the concepts of custodial and non-custodial wallets, especially their differences, to get answers to all your curious questions.

Key Takeaways:

- Cryptocurrency wallets are software that securely store and manage digital assets through blockchain.

- Custodial wallets are the type of crypto wallets that are handled by a third party. These wallets offer security and compliance but limit user control.

- Non-custodial wallets are handled by the owner themself. These wallets give users full control, but responsibility for security is also on them.

- The future trends include AI integration, better recovery options, and emphasis on user education.

What Are Cryptocurrency Wallets?

Crypto wallets are digital wallets that store, transfer, receive, and manage cryptocurrency. These wallets provide users with an address and a key. The key allows users to access their crypto assets. It also serves as proof of ownership. Let’s break it down simply:

Think of cryptocurrency wallets as your regular wallets. Just like you store your cash and coins in your wallet, similarly, crypto wallets also allow you to store your cryptocurrency in them. The only difference is that, unlike your regular cash, cryptocurrency is not tangible. This is what makes its storage and accessibility digitally handled.

Unlike regular wallets, cryptocurrency wallets store and manage crypto assets through blockchain. This blockchain keeps a track of all the crypto transactions. It is very secure, as no transaction data can be manipulated or deleted. Crypto wallets are broadly classified as custodial wallets and non-custodial wallets.

What is a Custodial Wallet?

To understand what a custodial wallet is, we will break it down in elementary language. As you can already tell, the term “custodial” originated from the word “custody.” Custody means to be responsible or in charge of something that is allotted.

Similarly, a custodial wallet is a concept where a third party, such as a service provider, is responsible for managing users’ crypto assets. In this setting, user can access their crypto assets but cannot take charge of the activities. The service provider handles the access keys. In case the user wants to access their account, they have to inform their custodian.

Here’s how the custodial wallet works:

- Primarily, as the user onboards, an account is created by the service provider. Here, the user is provided with basic credentials to log into their account.

- The custodian manages the keys; they are not offered to the user. They are handled by the custodian only.

- When cryptocurrency is received, the custodian updates it to their system and reflects the balance to the users.

- Every transaction automatically gets tracked and updated in the blockchain after confirmation.

- In the case of transferring assets, the user submits a request. The request is followed by authentication.

- Once authenticated, the custodian signs your transfer request, carries out the transaction. Upon confirmation, it reflects the transaction on the blockchain and the remaining balance on the user’s account.

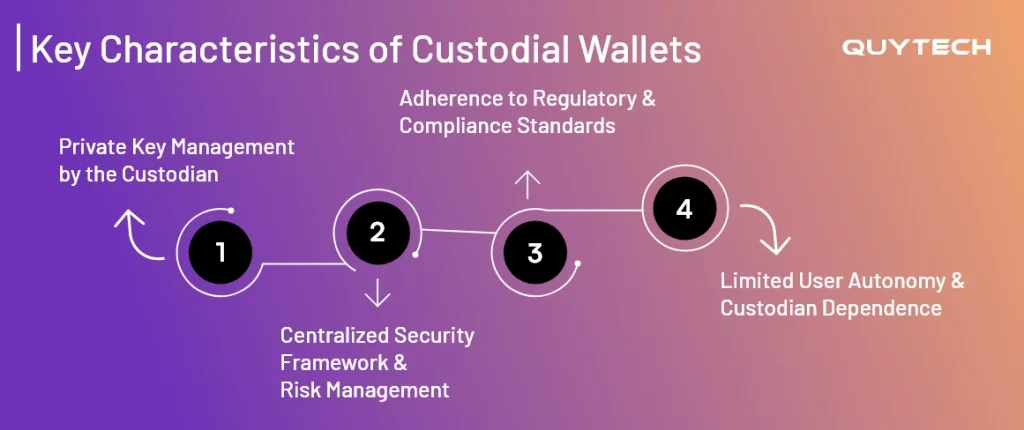

Key Characteristics of Custodial Wallets

The differentiating factor in the types of crypto wallets lies in their characteristics. Here are some core characteristics of custodial wallets:

Private Key Management by the Custodian

In a custodial wallet system, the private keys of the user are in the custody of the service provider. While the ownership of the crypto assets remains with the user, the control rests in the hands of the custodian.

Centralized Security Framework and Risk Management

In custodial wallets, the service provider takes charge of the security of user accounts. They utilize security practices like encryption, authentication, multi-stage approvals, etc, to protect the crypto assets of users.

Adherence to Regulatory and Compliance Standards

Since most of the authority of user crypto accounts is with custodians, regulatory compliance is also handled by them. They ensure that all the required user-related regulations are adhered to. Service providers also ensure ethical trading compliance, as they are observed by authorities.

Limited User Autonomy and Custodian Dependence

The autonomy of the user is very limited. If the user wishes to carry out transactions, they will have to inform the custodian. The desired transactions are also carried out by the custodian only.

Advantages of Custodial Wallets

Choosing custodial wallets brings in much more than just ease of use. They offer high-level security, customer support, and much more. Here are some of the core advantages of custodial wallets:

Easy to Use

Custodial wallets are very easy to use. From the perspective of a user, you don’t have to struggle with generating and managing the private keys. Credential-based access offers users ease of logging into their accounts.

Security

Since custodial wallets are mainly operated by custodians, their security is also handled by them. This means that the chances of cyber attacks are reduced, enhancing the security of digital assets.

24/7 Customer Support

As already mentioned, custodial wallets are handled by service providers. This allows users to connect with their assigned custodian in case of technical issues. 24/7 support ensures that users can trust their service providers.

Read More: Crypto Wallet App Development: A Complete Guide for 2025

What is a Non-Custodial Wallet?

A non-custodial wallet refers to the type of cryptocurrency wallet where there is no third party involved to handle transactions. With non-custodial wallets, everything from private keys to making transactions is handled by the user themself.

You can think of a non-custodial wallet as a user connecting to their bank account. The user can initiate or accept transactions without having to connect to any third party. The ownership and control of the crypto assets lie with the user.

Here’s how non-custodial wallets work:

- Firstly, the onboarding process begins with wallet creation. In this step, the user is provided with a key and a seed phrase. The key here acts like the username, and the seed phrase is like the password

- Once all these details are provided to the user, they will be responsible for maintaining their non-custodial wallet. If the user loses the seed phrase, they cannot access their wallet.

- Unlike custodial wallets, the user here directly interacts with the blockchain. The role of the non-custodial wallet is to provide a medium to carry out transactions.

- To initiate transactions in non-custodial wallets, the user doesn’t have to wait for approval from any third party. They approve their transactions themselves, which is later verified and reflected by the blockchain.

- Once approved, blockchain reflects the transactions and remaining balance on your non-custodial wallet.

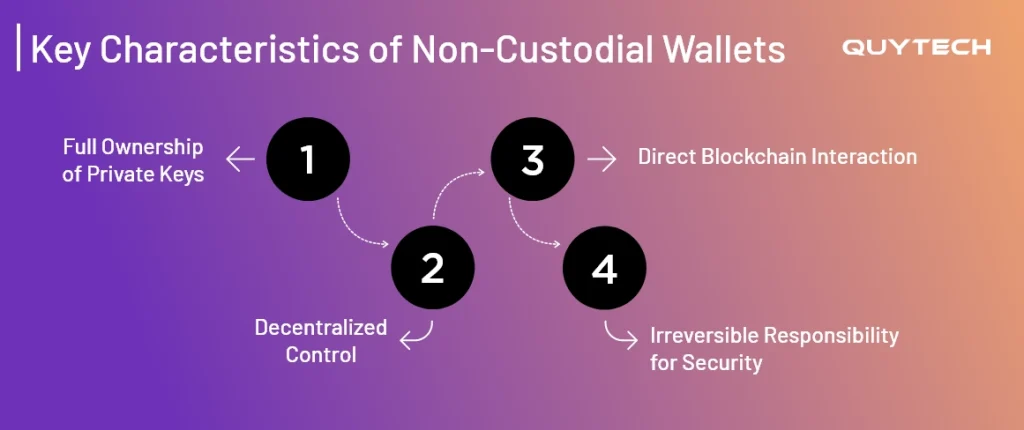

Key Characteristics of Non-Custodial Wallets

To understand the concept of non-custodial wallets better, let’s take a look at their characteristics:

Full Ownership of Private Keys

Unlike custodial wallets, non-custodial wallets provide users with full ownership of private keys. This means that the user does not have to create accounts to access their wallet.

Decentralized Control

With non-custodial wallets, users do not need to connect with a custodian to control their wallet. Instead, the control of wallets and crypto assets lies completely in the hands of the owner.

Direct Blockchain Interaction

When utilizing non-custodial wallets, the users interact directly with the blockchain. There is no intermediary between the user and the blockchain. Transactions made by the user are reflected through the blockchain post confirmation.

Irreversible Responsibility for Security

The responsibility for the security of the assets of a user lies with them. If the user loses their wallet credentials, like the private key or the seed phrase, the loss is not reversed. So the overall responsibility of the non-custodial wallet lies with the user themself.

Advantages of Non-Custodial Wallets

When it comes to non-custodial wallets, the benefits range from full ownership of own assets to privacy and decentralization. Let’s take a glance at the advantages of non-custodial wallets:

Complete Ownership

With non-custodial wallets, the users have complete ownership over their crypto assets. They do not have to connect with an intermediary to make transactions. They can trade and receive cryptocurrency as and when they desire.

Permissionless Access

Unlike custodial wallets, where the user has to inform the custodian before accessing their assets, non-custodial wallets offer permissionless access. This means that the user can access their wallets anytime and anywhere.

Enhanced Privacy

In non-custodial wallets, users do not have to share their personal information to create wallets. They can maintain their anonymity while trading. This is so because the user connects directly to the blockchain, which does not require personal details of the user.

Similar Read: How to Build a Crypto Trading App like Coinbase

Key Differences Between Custodial and Non-Custodial Wallets

Now that you are familiar with the concepts of custodial and non-custodial wallets, let’s make your journey interesting with a comparison. Here’s a table highlighting the key differences between custodial wallets and non-custodial wallets:

| Aspect | Custodial Wallets | Non-Custodial Wallets |

| Control of Private Keys | The control of private keys lies in the hands of the custodian. | The control of private keys lies with the owner themself. |

| Ownership of Assets | The assets are owned by the user but are not controlled by them. | The assets are owned and controlled by the owner themself. |

| Security Responsibility | The responsibility for the security of crypto assets lies with the custodian. | The responsibility for the security of assets lies with the owner themself as there’s no third party involved. |

| Ease of Use | Custodial wallets are easy to use and beginner-friendly. Users can log in with credentials. | Non-custodial wallets are not very beginner-friendly, as users will have to handle wallets themselves. |

| Risk of Asset Loss | The risk is high with cyber threats in existence. | Risk of asset loss is high, as a loss of the seed phrase can result in loss of access to crypto assets. |

| Transaction Control | The transaction control is mainly in the hands of the custodian. The user can request transactions, but they take place only if the custodian approves. | The transaction control lies with the owner of the assets. They do not need the permission of a third party. |

| Privacy | Since the account is handled by a custodian, identity details are stored, resulting in less privacy. | High privacy is offered as the user directly connects to the blockchain, so they don’t need to reveal their identity details. |

| Recovery Options | Customer support is offered to aid users with recovery options. | There are no recovery options except backup to recover the wallet. |

| Ideal For | Ideal for beginners, traders who prefer centralized wallets. | Ideal for long-term users, experienced users, and traders who prefer privacy. |

You Might Also Like: 10 Latest Crypto Market Trends To Watch in 2025

Custodial vs. Non-Custodial: Which Wallet Should You Choose?

While different wallets offer different characteristics and benefits to users, it gets difficult to understand which wallet is right for you. Choosing the right wallet includes not just the preferences of a user, but also the durations they would like to trade. With multiple factors affecting the decision-making process, users might get confused. But not anymore!

Here are some factors that will assist you in choosing the right crypto wallet:

Beginner Users

For beginner users, handling complicated trading and wallets all by themself can be quite overwhelming. In such scenarios, users should opt for custodial wallets. This will help them stand steadily and explore trading without having to worry about the complexities.

Active Traders

Traders who wish to engage in crypto trading actively should opt for non-custodial wallets. This will help them explore and indulge in crypto trading without having to deal with custodian terms and conditions. It will offer them privacy and autonomy in handling their transactions.

Long-Term Investors

For people looking to invest in crypto for long-term durations, both custodial and non-custodial wallets are good options. However, for specific preferences like privacy and security, non-custodial wallets are a good option. If you prefer ease of use, go for custodial wallets.

Business/Institutional Investors

Business/institutional investors opting for wallets should go for custodial wallets. This is because with custodial wallets, the regulatory compliance requirements do not need to be handled by businesses themselves. The custodian takes care of all compliance complexities.

Read More: How to Develop an Algorithmic Trading App?

Future Trends in Crypto Wallets

With a growing market presence and investment opportunities, crypto wallets have a bright future ahead. As it continues to attract a large number of investors, the current wallets are expected to improve to cater to an even diverse user base. Here are some expected future trends in crypto wallets:

Improved Recovery Mechanisms

In the current scenario, crypto wallets offer very limited recovery options. This poses a negative impact on potential investors as they might be concerned about the complex losing their crypto assets. In the future, the recovery mechanisms will improve with advanced tech integrations.

Artificial Intelligence Integration

The future holds artificial intelligence integration for crypto wallets. This will contribute to enhancing security, detecting fraud, and preventing cyber attacks. Along with this, AI integrations will also contribute to enhancing the user experience.

Emphasis on User Education

With an increase in crypto adoption, the next wave of evolution will emphasize educating users, enhancing accessibility, and usability. This emphasis will pave the way for simpler trading experiences for new as well as existing users. The crypto world will no longer be limited to tech-savvy users.

Building the Future of Digital Asset Management with Quytech

With a strong inclination towards cryptocurrency trading, companies seeking to build solutions don’t have to search any further. Quytech is here to bring your idea of custodial and non-custodial wallets to life. Equipped with diverse industry-rich experience of over 14 years, we excel in delivering solutions that exceed your expectations.

Our dedicated team of developers pools in their talent and knowledge to develop a solution that caters to your requirements. Our successful solutions, like Hazel, Project10, and many more, reflect our dedication to building custom crypto solutions.

Wrapping Up

When it comes to centralized handling of crypto assets, the best a user could go for is a custodial wallet. Custodial wallets bring in benefits like ease of use, security, and 24/7 customer support. They introduce the perfect blend of convenience and guidance for beginners.

However, with increasing emphasis on privacy, non-custodial wallets check most of the boxes. They offer complete ownership over assets, permissionless access, and transaction control. All these add to the independence of users, without revealing their details to any third party.

While both wallets have their own pros and cons, the choice between them depends on the user. By comparing factors like trading experience, habits, and investment durations, users can find the right wallet for their needs.

FAQs

Beginners should opt for custodial wallets as handling wallets is very complex. Custodial wallets are handled by custodians, so users don’t have to worry about maintenance.

If you lose your private keys, then you lose access to your crypto assets. To prevent this, users can store their keys offline.

Non-custodial wallets offer more privacy as users don’t need to share their identity details with third parties.

Yes, you can get a custom-built crypto wallet tailored to your needs by hiring developers experienced in the field. You can also opt for a crypto exchange development company.