An online report by TradingView highlighted that approximately 36% of crypto traders are using artificial intelligence to get assistance in trading. The same report reveals that 28% of traders are planning to use this technology for smart trading. This clearly shows that artificial intelligence is no longer just limited to automation of simple and routine tasks or providing data-backed insights.

AI has also entered crypto trading, which has become a part of our daily lives, with approximately 34% of users checking markets more than five times a day. AI crypto trading transforms the traditional way of trading by integrating smart bots that work all day long with the same efficiency and capability, and algorithms that don’t require human intervention to learn and adapt.

Curious to learn how? Let’s take the right approach and begin with the basics, and then move on to benefits, working, use cases, and everything else about how AI and blockchain are being used together for intelligent crypto trading.

What is AI Crypto Trading

Buying, selling, and exchanging cryptocurrency is crypto trading. When this is done by using AI and its other subsets like ML, NLP, and predictive analytics, it becomes AI crypto trading.

AI crypto trading facilitates smarter and data-backed decision-making. It requires minimal manual intervention. Moreover, it also eliminates the chances of emotion-based decision-making as AI algorithms are trained on related and relevant data to offer critical insights on the best time to trade, price movements, and more. In short, AI in crypto trading brings:

- Automation of routine trading tasks

- Prediction of market trend

- Reduction of risks via data-backed strategies

For example, an organization using an AI crypto trading bot can automate scanning of countless crypto pairs across different exchanges in real-time. Moreover, the bot can also detect trading signals and automatically execute profitable trades at a speed that no human can match.

Explore Similar: Complete Guide to Developing AI Crypto Tokens

Key Highlights

- AI in crypto trading enables buying, selling, and trading of cryptocurrencies with little or no manual intervention.

- Traders and trading firms can utilize AI crypto trading for risk management, arbitrage, market-making, and sentiment analysis.

- Enhanced trading capabilities, 24*7 trading, fairness, and data-driven trading strategy building are some of the advantages of using AI for cryptocurrency trading.

- High dependency on data quality, cybersecurity risks, and high cost are among the common challenges and risks associated with crypto trading powered by AI.

- The use of Generative AI, AI agents, and AI crypto trading platforms’ integration with DeFi platforms is among the future trends.

Crypto Trading Using AI: Market Stats

Before digging deeper into AI for crypto trading, let’s take a look at its market size and other interesting statistics. These statistics will also give you an idea of its popularity and growing demand.

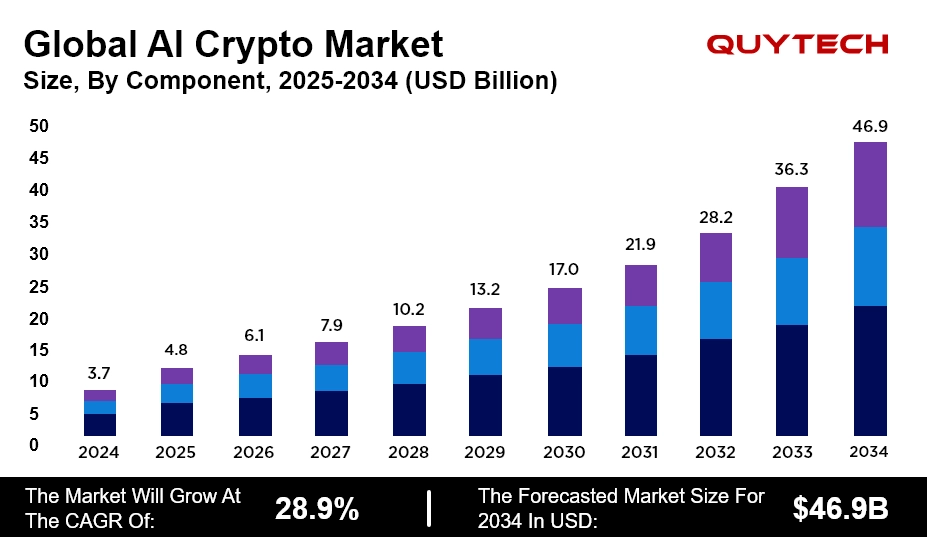

- The market size of AI in the crypto trading market is projected to reach USD 46.9 Billion By 2034. The size was USD 3.7 billion in 2024.

- The market is expected to grow at a whopping compound annual growth rate (CAGR) of 28.9% during this period.

- North America was the biggest player in the AI crypto trading market in 2024. It held a market share of 38.4%.

- The increasing demand for AI-powered crypto trading solutions and the rise of retail investors are the two biggest drivers fueling the growth of this market.

Traditional Vs. AI-Powered Crypto Trading

AI-powered crypto trading has totally changed the way traders and other people trade cryptocurrencies. You can know about this change or transformation only if you compare how things used to be (when traders were relying on traditional methods) and how they are now (after the arrival of AI in crypto trading).

The comparison given below will help you understand the difference between traditional and AI crypto trading:

| Feature / Aspect | Traditional Crypto Trading | AI Crypto Trading |

| Decision-making | Relies on human judgment and experience. | Uses Data-driven algorithms and AI models. |

| Speed | It’s slower as it completely depends on manual execution. | AI facilitates instant trade execution and 24/7 operation. |

| Data Handling | Limited to the analyzing capabilities of the trader. | AI can process massive datasets in real time. |

| Accuracy | Chances of emotional and cognitive biases are there. | Ensures a consistent accuracy based on patterns and predictions. |

| Risk Management | Depends on the trader’s experience. | AI models continuously monitor and adjust risk |

| Market Analysis | Depends on manual charting and technical indicators. | AI models continuously monitor and adjust risk. |

| Scalability | Managing multiple trades simultaneously is challenging. | AI crypto trading is capable of monitoring and trading across thousands of crypto pairs instantly. |

| Availability | Limited to the trader’s working hours | It can operate around the clock using AI crypto trading bots. |

| Cost | Time and effort intensive. | Reduces manual effort, increases operational efficiency. |

Explore Similar Blog: How to Build a Crypto Trading App like Coinbase

How AI Transforms Crypto Trading Strategies: 9 Key Use Cases

AI transforms crypto trading- it’s not just a vague statement. There are many areas or aspects of crypto trading that the technology revamps. This section covers nine unique use cases of AI in crypto trading:

1. Data-Powered Insights Extraction

AI solutions designed exclusively for crypto trading can process enormous amounts of data that traders or human analysts cannot do without spending days or months. Not just a particular type of data, AI crypto trading bots can process raw, structured, and semi-structured data to make sure you get insights, such as trading trends, evolving demands, and market opportunities, for real-time decision-making.

Traders can ensure their trading strategies are aligned with the upcoming trends to reap the maximum benefits in the minimum time possible.

2. Market Sentiment Analysis

Artificial intelligence models don’t require manual intervention to keep a tab on the latest news, social media trends, and forum discussions. AI crypto trading systems analyze them all to read positive and negative sentiments and further enable traders to plan before any market shift happens or the price chart fluctuations.

3. Predictive Modeling

The next big use case of AI for crypto trading is predicting possible price movements. AI, together with ML algorithms, can detect patterns from past or historical data. The data helps traders build forward-looking strategies and anticipate what the future price of cryptocurrencies will be. For example, traders can predict potential dips or rallies in ETH. Based on the prediction, they can optimize entry and exit points.

4. Automated Portfolio Management

With AI-enabled crypto trading systems, there is no need to monitor the performance of assets manually. The technology continuously does so based on real-time analysis. This not only minimizes the chances of errors but also guarantees that your portfolio and strategies are aligned. Apart from monitoring, AI also automatically reallocates assets for efficient risk management.

5. Adaptive Algorithms

AI systems designed for crypto trading can learn and improve from every trade. They can even modify strategies to ensure your crypto trading is profitable and can easily adapt to evolving market conditions. For learning or improving, AI-powered trading systems don’t require any manual effort.

6. Arbitrage Opportunities

AI bots for crypto trading can detect pricing differences across various crypto exchanges. They do this in real-time so that traders can make the most of such opportunities and secure risk-free profits. Doing the same manually is not possible or requires a highly experienced team of professionals to find these opportunities in time.

Take a look at: 7 Steps to Start a Cryptocurrency Exchange Business

7. Fraud Detection and Risk Management

Fraud detection and risk management are other critical use cases of AI in crypto trading. Using artificial intelligence, traders can know about unusual trading patterns and market manipulations that may happen in the future. They can reduce exposure to scams and, consequently, losses in volatile crypto trading markets.

Read Similar: How AI is Transforming Fraud Detection in Digital Transactions

8. Personalized Trading Recommendations

This is the most common use case of AI in almost every field, including cryptocurrency trading markets. Artificial intelligence technology can understand portfolios, trading history, and interests of each trader, and based on that, it can offer personalized trading strategies and recommendations that can make them earn maximum returns.

9. Integration with DeFi and Smart Contracts

With AI for crypto trading solutions, traders don’t need to put manual efforts into integrating with DeFi (decentralized finance) and smart contracts. The technology does this automatically. With AI, it is possible to automate the execution of trades on decentralized platforms by making the most of smart contracts.

You might also like: How AI is Being Used in Trading? AI in Stock Trading

5 Benefits of AI in Crypto Trading

Now that you know how AI transforms cryptocurrency trading, let’s understand the benefits that traders and users can get with this:

1. Enhanced Accuracy and Reduced Risk

Using AI in cryptocurrency trading eliminates human intervention and thereby reduces the chances of errors and bias. In fact, it encourages data-driven decision-making that maximizes returns. Traders can even identify high-risk traders early to avoid risks and losses.

2. 24/7 Trading Capability

Cryptocurrency markets run all day long. Human traders cannot work 24*7, but AI crypto trading bots can trade round-the-clock without compromising efficiency or accuracy. They can capture opportunities that a human eye might miss or happen when there is no human watching.

3. Faster Execution and Efficiency

With AI-powered crypto trading, trades can be executed in no time without missing any profitable signals. It reduces the time and effort required when the trading data is analyzed and trading strategies are made manually.

4. Fair Decisions

Unlike the traditional way of trading, AI crypto trading ensures emotion-free trading that results in a consistent outcome. This happens because AI uses advanced and well-trained algorithms to ensure every trading decision is made after thorough analysis of market conditions and available data.

5. Higher Profit Potential

Crypto trading powered by artificial intelligence ensures you get accurate predictions, faster trade execution, and efficient risk management. With all these benefits, traders can maximize returns and reduce losses.

Critical Insights: How to Develop a Stock Trading App: Step-by-Step Guide

Challenges and Risks of AI Crypto Trading

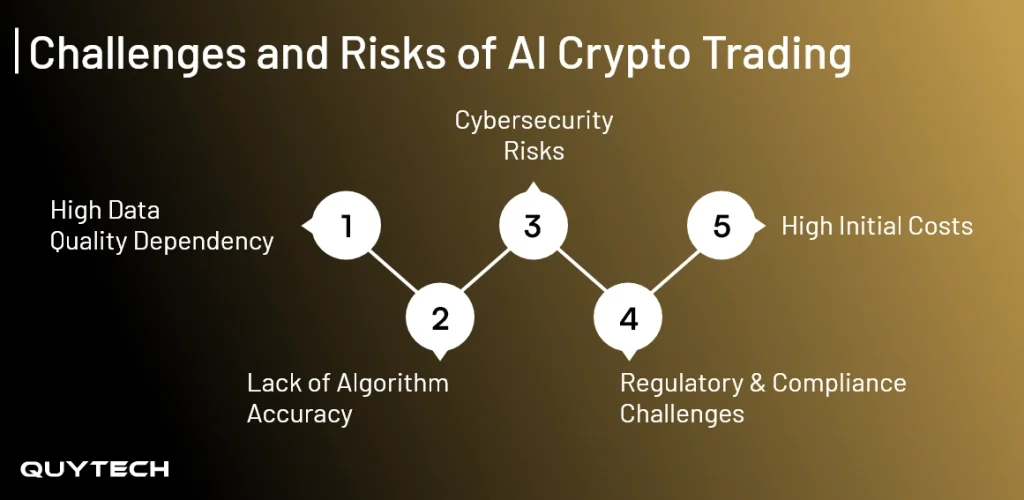

Till now, you have read about how AI in crypto trading can do wonders, but you should also be aware of the challenges and risks associated with it. This section covers them all:

1. High Data Quality Dependency

AI systems designed for cryptocurrency trading are highly dependent on the quality of the data. If the data quality is poor or the data is incomplete or irrelevant, you may get incorrect predictions. In some cases, it may also lead to losses.

2. Lack of Algorithm Accuracy

One of the biggest challenges of implementing AI in crypto trading is that the AI algorithms and models require continuous monitoring and fine-tuning on the evolving data. Without it, the algorithms may deliver inaccurate output or make mistakes in predictions.

3. Cybersecurity Risks

Crypto trading using AI may involve cybersecurity risks as the systems designed for the same are always on the hit list of cybercriminals. They may hack the systems to manipulate the market. Therefore, such systems must have strong security protocols.

You may want to read: AI in Cyber Threat Prediction and Defense: Strengthening Cybersecurity

4. Regulatory and Compliance Challenges

Crypto trading regulations are not the same across the globe. Therefore, traders using AI for crypto trading must ensure that their solution complies with defined regulatory requirements and compliance. This would otherwise lead to penalties and legal consequences.

5. High Initial Costs

The cost of implementing AI crypto trading bots or simply building an AI-powered trading solution might seem high to many, especially small investors.

Real-World Examples and Projects of AI for Crypto Trading

The world has already been reaping benefits from artificial intelligence in cryptocurrency trading. For example, there are many AI crypto trading bots and platforms platforms like Coinbase, Binance, and 3Commas are perfect examples that facilitate automatic buying, selling, and trading cryptocurrencies. Let’s delve deeper into the top 3 examples of AI in crypto trading:

1. Crypto.com

The company serves over 100 million users and utilizes Generative AI for sentiment and market-insight analysis. Traders across the globe can buy or sell Bitcoin, Ethereum, and more than 400 cryptocurrencies at this platform. The company also uses AI and LLM models to further improve trading experiences by generating localized market insights, analyzing news and social signals, and delivering more informed insights to users.

2. BingX

BingX is another example of AI in crypto trading. The company has over 20 million users. BingX has announced its AI Evolution and AI Master tool that combines strategy generation, execution management, and AI-driven backtesting for traders. Real-time market trending spotting, AI chat about token sentiments, and personalized trading analysis are a few areas where the company utilizes artificial intelligence.

3. XTX Markets

XTX Markets is an algorithmic trading company that uses machine learning and highly advanced forecasting technologies. The company makes the most of artificial intelligence technology for price forecasting and algorithmic trading.

You may want to read: How Stock Trading Apps like Robinhood are Disrupting The Financial Markets?

How Businesses Can Leverage AI in Crypto Trading: 5 Steps for Implementation

Traders and other businesses need to follow the right approach to make the most of AI crypto trading or successfully implement AI in crypto trading, or build/integrate AI trading bots

that can efficiently handle internal trading and client offerings. You can either try your hand at developing the same or collaborate with an experienced technology partner with experience in AI and blockchain solution development. Here is the stepwise process to implement AI in crypto trading:

1. Define Crypto Trading Goals

The first thing you need to decide is your goal. Whether you want to achieve profit, risk reduction, arbitrage, or automation. It is imperative to define because this will help you ensure that the AI model aligns with your business strategy.

2. Collect & Prepare Data

Collect data associated with historical prices, market indicators, order books, and sentiment. The more relevant and reliable the data is, the better the outcome delivered by AI models and algorithms.

3. Select the Right AI Model

Choose from LSTM, Reinforcement Learning, or Neural Networks based on the complexity of your trading strategy. The selection of the model directly impacts the output and performance of the model.

4. Train and Test the Model

The next step is to train the AI model on prepared data. Once trained, test it for performance, usability, output accuracy, and other key performance indicators.

5. Deployment and Monitoring

In this step, deploy or launch the trained AI-powered model or smart crypto trading bot onto existing systems via APIs. This will enable automated trading with minimal manual intervention. Continuously monitor the solution to keep it competitive.

Similar Read: How to Develop an AI Trading Assistant App Like Walbi?

The Future of AI for Crypto Trading: 2026 and Beyond

The future of crypto trading using AI is intelligent and automated. Let’s understand what we might witness in 2026 and the upcoming years:

- Increasing use of Generative AI to generate market insights.

- The rise of fully autonomous AI agents for crypto trading that can learn, adapt, and execute trade strategies on their own.

- DeFi and smart contract integration to open new possibilities for trustless, transparent, and highly efficient trading systems.

- Highly personalized trading strategies for smarter and data-driven strategy building.

- Merger of AI and blockchain to facilitate highly transparent decision-making and ensure every trading decision is traceable, auditable, and tamper-proof.

Take a look at: 10 Latest Crypto Market Trends To Watch

Leverage AI Crypto Trading with Quytech

To implement AI in crypto trading, it is a must to have experience in artificial intelligence, machine learning, AI agents, and other similar technologies. Moreover, it is also imperative to have knowledge of how the world of cryptocurrency trading works. With Quytech, you can assure both.

We are a reliable and highly experienced technology company that has built cryptocurrency platforms and trading applications powered by artificial intelligence. We have dedicated AI and ML experts, blockchain professionals with in-depth knowledge and hands-on experience in Ethereum, Solana, Binance Smart Chain, and other major blockchain networks.

From AI-powered crypto trading apps, crypto exchange platforms, to smart crypto trading bots, our experts can develop anything. Even if you already have a crypto trading application or platform, we can seamlessly back it up with artificial intelligence to enhance its capabilities and make it stand out from the competition.

No matter which type of AI crypto trading platform you want to build, commitment to data security, adherence to compliance, focus on customization and scalability, and post-launch support services are a few things that remain constant.

We have helped over a hundred trading firms, hedge funds, and individual investors to get maximum returns in trading and thrive in volatile crypto markets. We can help you too!

Conclusion

The world of crypto trading is evolving at an unprecedented pace. With an increasing user base of crypto trading, the need for implementing AI crypto trading is now more than ever. That’s because traditional ways of managing these trades are getting obsolete.

AI crypto trading bots and solutions are helping traders predict market fluctuations, pricing movements, upcoming trends, and a lot more to get maximum returns with effective and result-driven strategies.

Read this blog to explore risks, benefits, future, use cases, and everything else about AI in crypto trading. If you wish to build such a platform, connect with a reliable and experienced technology company.

FAQs

An AI crypto trading bot is an automated program that works on AI and ML algorithms to analyze market trends and data, identify trading opportunities, and autonomously trade cryptocurrencies.

AI trading bots can work around the clock to immediately respond to market signals and process massive amounts of data faster than humans. This leads to faster execution, reduced risk, and potentially higher returns in volatile crypto markets.

While AI cannot really guarantee perfect predictions or anticipations, it can predict probabilities based on which traders can make a decision. The technology analyzes price movements, news sentiment, social signals, historical patterns, and on-chain data to offer insights for informed decision-making.

Some of the popular tools for crypto trading AI are Binance Auto-Trading tools, Coinbase Advanced Trading, and 3Commas. All these tools combine algorithmic automation with real-time analytics.

Businesses can invest in different AI crypto trading solutions depending on their specific needs:

1. Predictive Price Forecasting Models

2. Automated Market-Making Bots

3. Arbitrage Trading Bots

4. Sentiment & News Analysis Engines

5. Portfolio Risk Balancing Systems

6. Reinforcement Learning-Based Strategy Bots